Aequim Alternative Investments LP raised its position in shares of Repay Holdings Co. (NASDAQ:RPAY - Free Report) by 640.7% in the third quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 578,484 shares of the company's stock after purchasing an additional 500,384 shares during the quarter. Aequim Alternative Investments LP owned 0.59% of Repay worth $4,720,000 at the end of the most recent quarter.

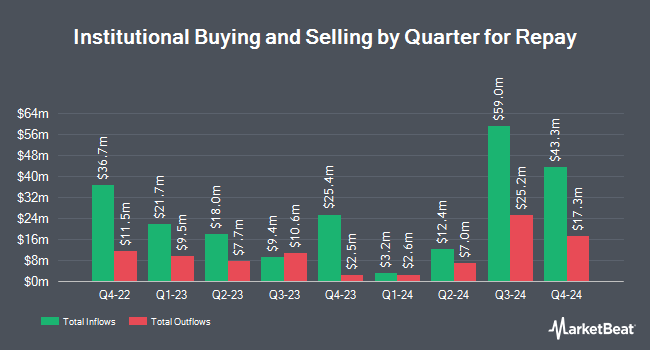

Several other large investors have also bought and sold shares of the company. Principal Financial Group Inc. bought a new position in shares of Repay during the third quarter valued at $1,122,000. Villanova Investment Management Co LLC lifted its stake in Repay by 71.7% during the 3rd quarter. Villanova Investment Management Co LLC now owns 281,439 shares of the company's stock valued at $2,297,000 after acquiring an additional 117,573 shares during the period. Millrace Asset Group Inc. lifted its stake in Repay by 216.7% during the 3rd quarter. Millrace Asset Group Inc. now owns 323,139 shares of the company's stock valued at $2,637,000 after acquiring an additional 221,102 shares during the period. Marshall Wace LLP purchased a new stake in shares of Repay during the 2nd quarter valued at about $1,365,000. Finally, Quantbot Technologies LP bought a new stake in shares of Repay in the third quarter worth approximately $601,000. 82.73% of the stock is owned by hedge funds and other institutional investors.

Repay Stock Performance

Shares of NASDAQ:RPAY traded down $0.11 during midday trading on Tuesday, hitting $7.94. The company had a trading volume of 1,110,475 shares, compared to its average volume of 829,139. The company has a market cap of $775.21 million, a price-to-earnings ratio of -9.20 and a beta of 1.42. The company has a debt-to-equity ratio of 0.64, a current ratio of 2.70 and a quick ratio of 2.70. The company has a fifty day moving average of $8.02 and a two-hundred day moving average of $8.82. Repay Holdings Co. has a 12-month low of $7.04 and a 12-month high of $11.27.

Repay (NASDAQ:RPAY - Get Free Report) last issued its quarterly earnings results on Tuesday, November 12th. The company reported $0.23 EPS for the quarter, hitting analysts' consensus estimates of $0.23. Repay had a positive return on equity of 8.73% and a negative net margin of 25.53%. The business had revenue of $79.15 million during the quarter, compared to analysts' expectations of $78.97 million. During the same quarter in the prior year, the business posted $0.16 earnings per share. The business's quarterly revenue was up 6.5% on a year-over-year basis. On average, equities research analysts expect that Repay Holdings Co. will post 0.72 EPS for the current fiscal year.

Insiders Place Their Bets

In other Repay news, EVP Jacob Hamilton Moore sold 51,694 shares of the stock in a transaction on Friday, September 13th. The stock was sold at an average price of $8.00, for a total value of $413,552.00. Following the completion of the sale, the executive vice president now owns 140,130 shares in the company, valued at approximately $1,121,040. This represents a 26.95 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. 11.00% of the stock is owned by company insiders.

Wall Street Analysts Forecast Growth

Several equities research analysts recently issued reports on RPAY shares. Barclays dropped their target price on shares of Repay from $12.00 to $11.00 and set an "overweight" rating on the stock in a report on Monday, August 12th. Canaccord Genuity Group restated a "buy" rating and issued a $13.00 price target on shares of Repay in a research note on Wednesday, November 13th. Finally, Benchmark reiterated a "buy" rating and set a $13.00 price objective on shares of Repay in a research report on Tuesday, August 13th. One research analyst has rated the stock with a hold rating and five have given a buy rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $12.83.

View Our Latest Research Report on RPAY

Repay Profile

(

Free Report)

Repay Holdings Corporation, payments technology company, provides integrated payment processing solutions to industry-oriented markets in the United States. It operates through two segments: Consumer Payments and Business Payments. The company's payment processing solutions enable consumers and businesses to make payments using electronic payment methods.

Recommended Stories

Before you consider Repay, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Repay wasn't on the list.

While Repay currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.