Aequim Alternative Investments LP bought a new position in Spotify Technology S.A. (NYSE:SPOT - Free Report) during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 10,700 shares of the company's stock, valued at approximately $3,943,000.

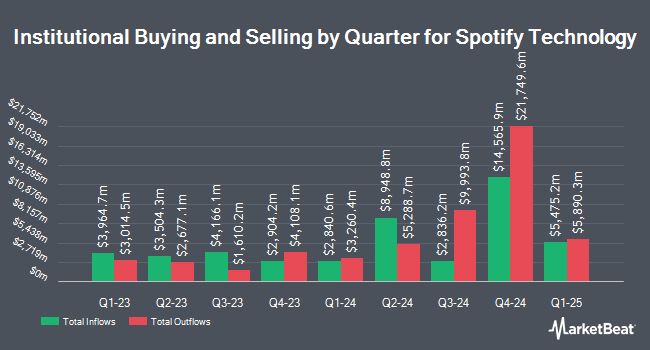

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in SPOT. RFG Advisory LLC raised its position in shares of Spotify Technology by 21.4% during the 2nd quarter. RFG Advisory LLC now owns 1,750 shares of the company's stock valued at $549,000 after buying an additional 308 shares in the last quarter. Park National Corp OH purchased a new position in shares of Spotify Technology in the 2nd quarter worth approximately $218,000. Sequoia Financial Advisors LLC increased its position in shares of Spotify Technology by 20.2% during the 2nd quarter. Sequoia Financial Advisors LLC now owns 1,037 shares of the company's stock valued at $325,000 after purchasing an additional 174 shares during the last quarter. Wedmont Private Capital raised its holdings in Spotify Technology by 29.5% during the 2nd quarter. Wedmont Private Capital now owns 965 shares of the company's stock valued at $292,000 after buying an additional 220 shares during the period. Finally, Wealth Enhancement Advisory Services LLC boosted its stake in Spotify Technology by 8.6% during the second quarter. Wealth Enhancement Advisory Services LLC now owns 4,683 shares of the company's stock worth $1,469,000 after buying an additional 372 shares during the period. 84.09% of the stock is owned by institutional investors.

Spotify Technology Stock Down 2.3 %

Shares of Spotify Technology stock traded down $10.94 during trading on Tuesday, reaching $471.58. The company's stock had a trading volume of 2,781,990 shares, compared to its average volume of 2,067,099. The company has a 50-day simple moving average of $418.31 and a two-hundred day simple moving average of $359.00. Spotify Technology S.A. has a 1-year low of $185.37 and a 1-year high of $506.47. The company has a market cap of $93.87 billion, a price-to-earnings ratio of 131.17 and a beta of 1.61.

Spotify Technology (NYSE:SPOT - Get Free Report) last posted its quarterly earnings data on Tuesday, November 12th. The company reported $1.45 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.75 by ($0.30). The company had revenue of $3.99 billion for the quarter, compared to analyst estimates of $4.03 billion. Spotify Technology had a net margin of 4.66% and a return on equity of 19.07%. The business's revenue was up 18.8% compared to the same quarter last year. During the same quarter last year, the company earned $0.36 EPS. As a group, analysts anticipate that Spotify Technology S.A. will post 6.02 earnings per share for the current year.

Wall Street Analyst Weigh In

Several brokerages have recently weighed in on SPOT. TD Cowen increased their target price on shares of Spotify Technology from $356.00 to $416.00 and gave the company a "hold" rating in a research note on Wednesday, November 13th. Morgan Stanley raised their price objective on shares of Spotify Technology from $430.00 to $460.00 and gave the stock an "overweight" rating in a research note on Wednesday, November 13th. KeyCorp upped their target price on Spotify Technology from $490.00 to $520.00 and gave the company an "overweight" rating in a research note on Wednesday, November 13th. Canaccord Genuity Group raised their price target on Spotify Technology from $525.00 to $560.00 and gave the stock a "buy" rating in a research note on Monday, December 2nd. Finally, The Goldman Sachs Group upped their price objective on Spotify Technology from $430.00 to $490.00 and gave the company a "buy" rating in a research report on Thursday, November 14th. One equities research analyst has rated the stock with a sell rating, five have assigned a hold rating and twenty-two have given a buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $429.96.

Read Our Latest Stock Report on SPOT

Spotify Technology Company Profile

(

Free Report)

Spotify Technology SA, together with its subsidiaries, provides audio streaming subscription services worldwide. It operates through two segments, Premium and Ad-Supported. The Premium segment offers unlimited online and offline streaming access to its catalog of music and podcasts without commercial breaks to its subscribers.

Recommended Stories

Before you consider Spotify Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spotify Technology wasn't on the list.

While Spotify Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.