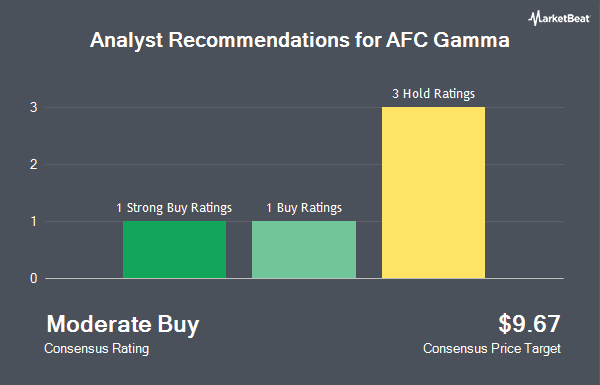

Shares of AFC Gamma, Inc. (NASDAQ:AFCG - Get Free Report) have been given an average recommendation of "Moderate Buy" by the five brokerages that are covering the firm, Marketbeat Ratings reports. Three equities research analysts have rated the stock with a hold rating, one has assigned a buy rating and one has given a strong buy rating to the company. The average twelve-month price objective among brokers that have updated their coverage on the stock in the last year is $9.67.

A number of analysts recently weighed in on the stock. Jefferies Financial Group lowered shares of AFC Gamma from a "buy" rating to a "hold" rating and lowered their price target for the company from $10.00 to $7.00 in a report on Friday, March 14th. Alliance Global Partners assumed coverage on AFC Gamma in a research note on Tuesday, December 17th. They set a "buy" rating and a $13.00 price target on the stock. Finally, JMP Securities reissued a "market perform" rating on shares of AFC Gamma in a report on Thursday, January 23rd.

Get Our Latest Research Report on AFC Gamma

AFC Gamma Price Performance

AFC Gamma stock traded down $0.38 on Wednesday, reaching $5.05. The company's stock had a trading volume of 323,669 shares, compared to its average volume of 176,852. AFC Gamma has a twelve month low of $4.97 and a twelve month high of $12.74. The company has a market cap of $114.11 million, a price-to-earnings ratio of 12.63 and a beta of 1.19. The company has a debt-to-equity ratio of 0.29, a quick ratio of 3.92 and a current ratio of 3.92. The business's fifty day moving average price is $7.64 and its 200 day moving average price is $8.81.

AFC Gamma Dividend Announcement

The company also recently disclosed a dividend, which will be paid on Tuesday, April 15th. Investors of record on Monday, March 31st will be issued a dividend of $0.23 per share. The ex-dividend date of this dividend is Monday, March 31st. AFC Gamma's dividend payout ratio is currently 115.00%.

Insiders Place Their Bets

In other AFC Gamma news, CEO Daniel Neville acquired 5,000 shares of the business's stock in a transaction dated Friday, March 28th. The shares were acquired at an average price of $6.15 per share, for a total transaction of $30,750.00. Following the acquisition, the chief executive officer now directly owns 187,261 shares of the company's stock, valued at approximately $1,151,655.15. This trade represents a 2.74 % increase in their position. The acquisition was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director Leonard M. Tannenbaum purchased 50,000 shares of the business's stock in a transaction on Monday, March 17th. The stock was bought at an average cost of $6.20 per share, for a total transaction of $310,000.00. Following the purchase, the director now owns 3,959,876 shares of the company's stock, valued at approximately $24,551,231.20. This represents a 1.28 % increase in their position. The disclosure for this purchase can be found here. Over the last three months, insiders have bought 146,606 shares of company stock worth $930,691. Company insiders own 26.20% of the company's stock.

Institutional Investors Weigh In On AFC Gamma

Several institutional investors have recently bought and sold shares of the company. Charles Schwab Investment Management Inc. boosted its holdings in AFC Gamma by 4.6% during the third quarter. Charles Schwab Investment Management Inc. now owns 50,403 shares of the company's stock worth $515,000 after purchasing an additional 2,200 shares during the last quarter. Centiva Capital LP bought a new position in AFC Gamma in the third quarter valued at approximately $193,000. State Street Corp increased its position in shares of AFC Gamma by 2.8% during the 3rd quarter. State Street Corp now owns 376,611 shares of the company's stock worth $3,968,000 after purchasing an additional 10,320 shares during the last quarter. Barclays PLC increased its position in shares of AFC Gamma by 257.0% during the 3rd quarter. Barclays PLC now owns 22,567 shares of the company's stock worth $231,000 after purchasing an additional 16,245 shares during the last quarter. Finally, Geode Capital Management LLC grew its stake in shares of AFC Gamma by 57.8% in the third quarter. Geode Capital Management LLC now owns 24,225 shares of the company's stock valued at $248,000 after buying an additional 8,877 shares in the last quarter. Institutional investors own 26.53% of the company's stock.

AFC Gamma Company Profile

(

Get Free ReportAFC Gamma, Inc originates, structures, underwrites, and invests in senior secured loans, and other various commercial real estate loans and debt securities for established companies operating in the cannabis industry. It primarily originates loans structured as senior loans secured by real estate, equipment, and licenses and/or other assets of the loan parties to the extent permitted by applicable laws and the regulations governing such loan parties.

Read More

Before you consider AFC Gamma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AFC Gamma wasn't on the list.

While AFC Gamma currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.