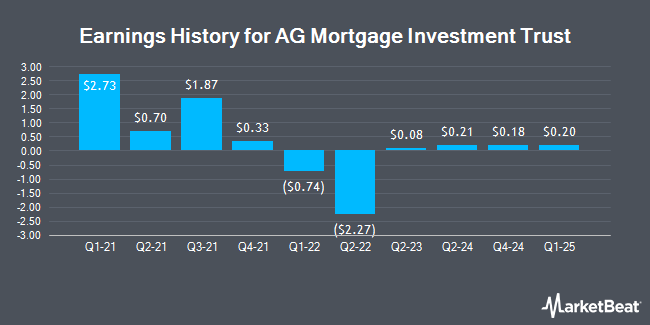

AG Mortgage Investment Trust (NYSE:MITT - Get Free Report) is anticipated to post its quarterly earnings results before the market opens on Thursday, February 27th. Analysts expect AG Mortgage Investment Trust to post earnings of $0.18 per share and revenue of $18.44 million for the quarter.

AG Mortgage Investment Trust Stock Performance

AG Mortgage Investment Trust stock traded up $0.07 on Friday, reaching $7.40. The company's stock had a trading volume of 192,200 shares, compared to its average volume of 178,993. The business's fifty day moving average price is $6.83 and its 200 day moving average price is $7.05. The company has a market cap of $218.49 million, a price-to-earnings ratio of 3.25 and a beta of 2.00. AG Mortgage Investment Trust has a twelve month low of $5.44 and a twelve month high of $7.95.

AG Mortgage Investment Trust Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, January 31st. Shareholders of record on Tuesday, December 31st were issued a dividend of $0.19 per share. This represents a $0.76 dividend on an annualized basis and a yield of 10.26%. The ex-dividend date of this dividend was Tuesday, December 31st. AG Mortgage Investment Trust's dividend payout ratio is currently 33.33%.

Analysts Set New Price Targets

A number of equities analysts have recently issued reports on the stock. JMP Securities reiterated a "market outperform" rating and set a $8.50 target price on shares of AG Mortgage Investment Trust in a research report on Thursday, January 23rd. StockNews.com downgraded AG Mortgage Investment Trust from a "buy" rating to a "hold" rating in a report on Saturday, November 2nd. Two analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $8.25.

View Our Latest Stock Report on MITT

About AG Mortgage Investment Trust

(

Get Free Report)

AG Mortgage Investment Trust, Inc operates as a residential mortgage real estate investment trust in the United States. Its investment portfolio includes residential investments, including non-agency loans, agency-eligible loans, re-and non-performing loans, and non-agency residential mortgage-backed securities, as well as commercial loans and commercial mortgage-backed securities.

See Also

Before you consider AG Mortgage Investment Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AG Mortgage Investment Trust wasn't on the list.

While AG Mortgage Investment Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.