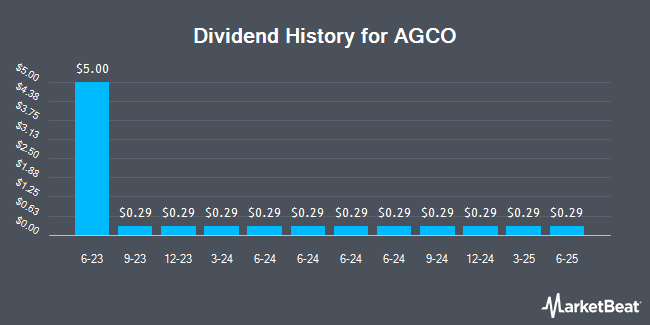

AGCO Co. (NYSE:AGCO - Get Free Report) announced a quarterly dividend on Thursday, January 16th,RTT News reports. Stockholders of record on Friday, February 14th will be paid a dividend of 0.29 per share by the industrial products company on Friday, March 14th. This represents a $1.16 dividend on an annualized basis and a dividend yield of 1.16%.

AGCO has increased its dividend payment by an average of 15.1% per year over the last three years and has raised its dividend annually for the last 12 consecutive years. AGCO has a payout ratio of 17.8% meaning its dividend is sufficiently covered by earnings. Equities research analysts expect AGCO to earn $4.22 per share next year, which means the company should continue to be able to cover its $1.16 annual dividend with an expected future payout ratio of 27.5%.

AGCO Stock Performance

Shares of AGCO stock traded up $2.64 during midday trading on Thursday, hitting $100.00. The company had a trading volume of 497,662 shares, compared to its average volume of 744,346. The company has a fifty day simple moving average of $95.15 and a 200 day simple moving average of $94.89. The stock has a market cap of $7.46 billion, a price-to-earnings ratio of 44.25, a PEG ratio of 0.90 and a beta of 1.25. The company has a quick ratio of 0.72, a current ratio of 1.53 and a debt-to-equity ratio of 0.87. AGCO has a 12-month low of $84.35 and a 12-month high of $130.26.

AGCO (NYSE:AGCO - Get Free Report) last posted its quarterly earnings results on Tuesday, November 5th. The industrial products company reported $0.68 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.08 by ($0.40). The company had revenue of $2.60 billion during the quarter, compared to analysts' expectations of $2.90 billion. AGCO had a return on equity of 15.79% and a net margin of 1.35%. The company's quarterly revenue was down 24.8% on a year-over-year basis. During the same period in the prior year, the business posted $3.97 EPS. As a group, analysts predict that AGCO will post 7.34 earnings per share for the current fiscal year.

Analyst Ratings Changes

AGCO has been the topic of several research analyst reports. Truist Financial boosted their price target on AGCO from $109.00 to $118.00 and gave the company a "buy" rating in a research note on Thursday. Citigroup dropped their target price on AGCO from $100.00 to $95.00 and set a "neutral" rating on the stock in a research report on Tuesday. JPMorgan Chase & Co. raised their price target on shares of AGCO from $102.00 to $111.00 and gave the stock an "overweight" rating in a research report on Wednesday. Oppenheimer dropped their price objective on shares of AGCO from $131.00 to $111.00 and set an "outperform" rating on the stock in a report on Wednesday, November 6th. Finally, Morgan Stanley assumed coverage on shares of AGCO in a report on Tuesday, December 3rd. They set an "equal weight" rating and a $101.00 target price for the company. Eight equities research analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. According to data from MarketBeat.com, AGCO currently has an average rating of "Hold" and a consensus price target of $107.40.

Read Our Latest Research Report on AGCO

About AGCO

(

Get Free Report)

AGCO Corporation manufactures and distributes agricultural equipment and related replacement parts worldwide. It offers horsepower tractors for row crop production, soil cultivation, planting, land leveling, seeding, and commercial hay operations; utility tractors for small- and medium-sized farms, as well as for dairy, livestock, orchards, and vineyards; and compact tractors for small farms, specialty agricultural industries, landscaping, equestrian, and residential uses.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AGCO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AGCO wasn't on the list.

While AGCO currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.