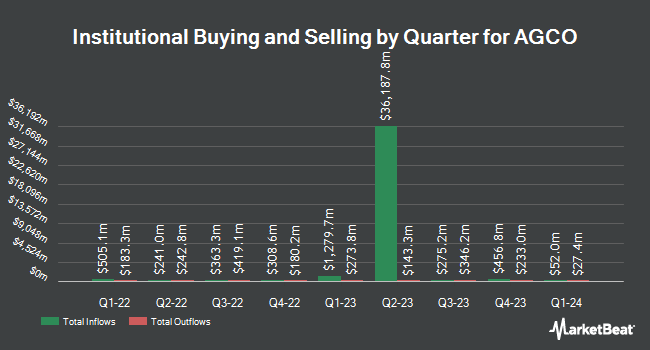

Jacobs Levy Equity Management Inc. cut its holdings in shares of AGCO Co. (NYSE:AGCO - Free Report) by 65.8% in the third quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 199,453 shares of the industrial products company's stock after selling 383,632 shares during the quarter. Jacobs Levy Equity Management Inc. owned 0.27% of AGCO worth $19,518,000 at the end of the most recent reporting period.

A number of other institutional investors also recently bought and sold shares of AGCO. Brooklyn Investment Group acquired a new stake in AGCO in the 3rd quarter valued at $29,000. LRI Investments LLC grew its stake in AGCO by 94.3% in the 2nd quarter. LRI Investments LLC now owns 340 shares of the industrial products company's stock valued at $33,000 after acquiring an additional 165 shares during the period. Blue Trust Inc. grew its stake in AGCO by 102.4% in the 2nd quarter. Blue Trust Inc. now owns 344 shares of the industrial products company's stock valued at $34,000 after acquiring an additional 174 shares during the period. Venturi Wealth Management LLC grew its stake in AGCO by 132.9% in the 3rd quarter. Venturi Wealth Management LLC now owns 368 shares of the industrial products company's stock valued at $36,000 after acquiring an additional 210 shares during the period. Finally, First Horizon Advisors Inc. grew its stake in AGCO by 69.0% in the 2nd quarter. First Horizon Advisors Inc. now owns 409 shares of the industrial products company's stock valued at $40,000 after acquiring an additional 167 shares during the period. 78.80% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently issued reports on the stock. Citigroup lifted their price target on shares of AGCO from $88.00 to $100.00 and gave the company a "neutral" rating in a research note on Wednesday, October 9th. The Goldman Sachs Group decreased their price objective on AGCO from $112.00 to $99.00 and set a "neutral" rating on the stock in a report on Wednesday, November 6th. StockNews.com lowered AGCO from a "hold" rating to a "sell" rating in a report on Thursday, November 28th. BMO Capital Markets initiated coverage on AGCO in a report on Friday, August 9th. They issued a "market perform" rating and a $96.00 price objective on the stock. Finally, Oppenheimer decreased their price objective on AGCO from $131.00 to $111.00 and set an "outperform" rating on the stock in a report on Wednesday, November 6th. One research analyst has rated the stock with a sell rating, seven have issued a hold rating and five have given a buy rating to the company's stock. According to data from MarketBeat, AGCO currently has a consensus rating of "Hold" and a consensus target price of $113.18.

Read Our Latest Report on AGCO

AGCO Trading Down 2.0 %

AGCO traded down $1.97 on Thursday, hitting $97.46. The company had a trading volume of 852,494 shares, compared to its average volume of 786,661. The firm has a market cap of $7.27 billion, a P/E ratio of 44.17, a PEG ratio of 0.57 and a beta of 1.24. AGCO Co. has a 1 year low of $84.35 and a 1 year high of $130.26. The company's fifty day moving average price is $97.54 and its 200 day moving average price is $96.83. The company has a current ratio of 1.53, a quick ratio of 0.72 and a debt-to-equity ratio of 0.87.

AGCO (NYSE:AGCO - Get Free Report) last issued its quarterly earnings data on Tuesday, November 5th. The industrial products company reported $0.68 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.08 by ($0.40). The company had revenue of $2.60 billion during the quarter, compared to analysts' expectations of $2.90 billion. AGCO had a net margin of 1.35% and a return on equity of 15.79%. The firm's quarterly revenue was down 24.8% on a year-over-year basis. During the same quarter last year, the firm posted $3.97 earnings per share. As a group, equities analysts expect that AGCO Co. will post 7.34 earnings per share for the current year.

AGCO Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Friday, November 15th will be issued a $0.29 dividend. The ex-dividend date of this dividend is Friday, November 15th. This represents a $1.16 annualized dividend and a yield of 1.19%. AGCO's dividend payout ratio (DPR) is currently 51.33%.

About AGCO

(

Free Report)

AGCO Corporation manufactures and distributes agricultural equipment and related replacement parts worldwide. It offers horsepower tractors for row crop production, soil cultivation, planting, land leveling, seeding, and commercial hay operations; utility tractors for small- and medium-sized farms, as well as for dairy, livestock, orchards, and vineyards; and compact tractors for small farms, specialty agricultural industries, landscaping, equestrian, and residential uses.

Read More

Before you consider AGCO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AGCO wasn't on the list.

While AGCO currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.