StockNews.com downgraded shares of AGCO (NYSE:AGCO - Free Report) from a hold rating to a sell rating in a report released on Wednesday.

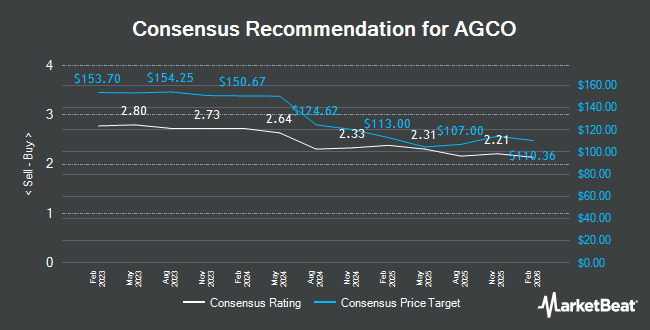

Several other brokerages also recently commented on AGCO. The Goldman Sachs Group dropped their price objective on AGCO from $112.00 to $99.00 and set a "neutral" rating on the stock in a research note on Wednesday, November 6th. Citigroup raised their price objective on AGCO from $95.00 to $100.00 and gave the stock a "neutral" rating in a research note on Monday. Oppenheimer dropped their price objective on AGCO from $131.00 to $111.00 and set an "outperform" rating on the stock in a research note on Wednesday, November 6th. Morgan Stanley assumed coverage on AGCO in a report on Tuesday, December 3rd. They set an "equal weight" rating and a $101.00 target price for the company. Finally, Truist Financial increased their target price on AGCO from $118.00 to $127.00 and gave the stock a "buy" rating in a report on Wednesday, October 9th. One equities research analyst has rated the stock with a sell rating, seven have assigned a hold rating and five have given a buy rating to the stock. According to data from MarketBeat.com, AGCO presently has a consensus rating of "Hold" and an average target price of $113.18.

Check Out Our Latest Research Report on AGCO

AGCO Stock Performance

AGCO traded up $0.60 on Wednesday, hitting $98.65. 951,078 shares of the stock traded hands, compared to its average volume of 790,142. The business has a fifty day moving average price of $97.55 and a two-hundred day moving average price of $96.48. AGCO has a 52 week low of $84.35 and a 52 week high of $130.26. The company has a current ratio of 1.53, a quick ratio of 0.72 and a debt-to-equity ratio of 0.87. The firm has a market capitalization of $7.36 billion, a PE ratio of 43.65, a P/E/G ratio of 0.55 and a beta of 1.24.

AGCO (NYSE:AGCO - Get Free Report) last posted its quarterly earnings results on Tuesday, November 5th. The industrial products company reported $0.68 earnings per share for the quarter, missing analysts' consensus estimates of $1.08 by ($0.40). The company had revenue of $2.60 billion during the quarter, compared to analyst estimates of $2.90 billion. AGCO had a net margin of 1.35% and a return on equity of 15.79%. The business's revenue for the quarter was down 24.8% compared to the same quarter last year. During the same period last year, the company earned $3.97 EPS. On average, research analysts predict that AGCO will post 7.36 EPS for the current fiscal year.

AGCO Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Friday, November 15th will be issued a dividend of $0.29 per share. This represents a $1.16 dividend on an annualized basis and a yield of 1.18%. The ex-dividend date is Friday, November 15th. AGCO's payout ratio is currently 51.33%.

Institutional Investors Weigh In On AGCO

Several hedge funds have recently bought and sold shares of the stock. Pacer Advisors Inc. raised its position in shares of AGCO by 103.5% in the second quarter. Pacer Advisors Inc. now owns 1,571,453 shares of the industrial products company's stock valued at $153,814,000 after buying an additional 799,429 shares in the last quarter. AQR Capital Management LLC raised its position in shares of AGCO by 53.0% in the second quarter. AQR Capital Management LLC now owns 1,747,954 shares of the industrial products company's stock valued at $171,090,000 after buying an additional 605,509 shares in the last quarter. Massachusetts Financial Services Co. MA raised its position in shares of AGCO by 28.0% in the second quarter. Massachusetts Financial Services Co. MA now owns 1,791,202 shares of the industrial products company's stock valued at $175,323,000 after buying an additional 391,591 shares in the last quarter. Dimensional Fund Advisors LP raised its position in shares of AGCO by 17.4% in the second quarter. Dimensional Fund Advisors LP now owns 2,259,699 shares of the industrial products company's stock valued at $221,187,000 after buying an additional 335,092 shares in the last quarter. Finally, Barclays PLC raised its position in shares of AGCO by 386.8% in the third quarter. Barclays PLC now owns 249,209 shares of the industrial products company's stock valued at $24,389,000 after buying an additional 198,014 shares in the last quarter. 78.80% of the stock is currently owned by institutional investors and hedge funds.

About AGCO

(

Get Free Report)

AGCO Corporation manufactures and distributes agricultural equipment and related replacement parts worldwide. It offers horsepower tractors for row crop production, soil cultivation, planting, land leveling, seeding, and commercial hay operations; utility tractors for small- and medium-sized farms, as well as for dairy, livestock, orchards, and vineyards; and compact tractors for small farms, specialty agricultural industries, landscaping, equestrian, and residential uses.

See Also

Before you consider AGCO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AGCO wasn't on the list.

While AGCO currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.