Agenus (NASDAQ:AGEN - Get Free Report) had its price objective reduced by stock analysts at HC Wainwright from $8.00 to $7.00 in a research report issued on Tuesday,Benzinga reports. The brokerage presently has a "neutral" rating on the biotechnology company's stock. HC Wainwright's price objective points to a potential upside of 125.44% from the stock's current price.

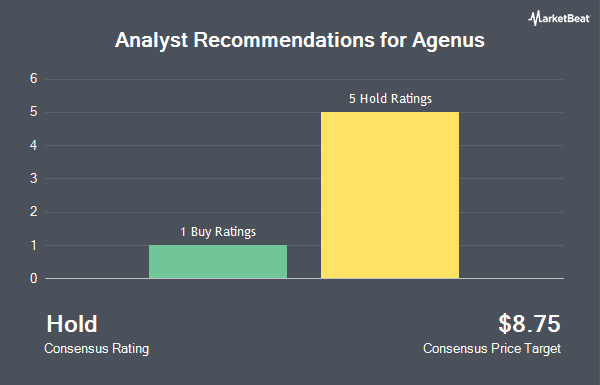

Several other research firms have also recently commented on AGEN. StockNews.com cut Agenus from a "hold" rating to a "sell" rating in a research note on Monday, August 12th. B. Riley cut their target price on shares of Agenus from $42.00 to $18.00 and set a "buy" rating on the stock in a research report on Wednesday, August 14th. Baird R W cut shares of Agenus from a "strong-buy" rating to a "hold" rating in a research report on Friday, July 19th. William Blair lowered shares of Agenus from an "outperform" rating to a "market perform" rating in a report on Thursday, July 18th. Finally, Robert W. Baird cut shares of Agenus from an "outperform" rating to a "neutral" rating and reduced their price objective for the company from $35.00 to $8.00 in a research note on Friday, July 19th. One equities research analyst has rated the stock with a sell rating, five have issued a hold rating and one has given a buy rating to the company. According to data from MarketBeat.com, Agenus has a consensus rating of "Hold" and a consensus price target of $10.00.

Get Our Latest Stock Report on Agenus

Agenus Price Performance

Shares of AGEN stock traded down $0.80 during trading hours on Tuesday, reaching $3.11. 2,106,710 shares of the company were exchanged, compared to its average volume of 646,332. Agenus has a fifty-two week low of $2.98 and a fifty-two week high of $19.69. The stock's fifty day moving average is $4.86 and its two-hundred day moving average is $8.91. The company has a market cap of $66.98 million, a price-to-earnings ratio of -0.29 and a beta of 1.39.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently added to or reduced their stakes in AGEN. Vanguard Group Inc. boosted its holdings in shares of Agenus by 13.7% in the first quarter. Vanguard Group Inc. now owns 34,401,122 shares of the biotechnology company's stock valued at $19,953,000 after buying an additional 4,134,232 shares during the period. Acadian Asset Management LLC lifted its holdings in shares of Agenus by 1,959.9% in the first quarter. Acadian Asset Management LLC now owns 757,397 shares of the biotechnology company's stock valued at $439,000 after purchasing an additional 720,629 shares in the last quarter. Price T Rowe Associates Inc. MD boosted its position in shares of Agenus by 52.4% during the first quarter. Price T Rowe Associates Inc. MD now owns 357,915 shares of the biotechnology company's stock worth $208,000 after buying an additional 123,058 shares during the period. Federated Hermes Inc. bought a new position in shares of Agenus during the second quarter worth about $1,921,000. Finally, BNP Paribas Financial Markets raised its position in Agenus by 81.3% in the 1st quarter. BNP Paribas Financial Markets now owns 188,414 shares of the biotechnology company's stock valued at $109,000 after buying an additional 84,477 shares during the last quarter. 61.46% of the stock is currently owned by institutional investors.

Agenus Company Profile

(

Get Free Report)

Agenus Inc, a clinical-stage biotechnology company, discovers and develops immuno-oncology products in the United States and internationally. The company offers Retrocyte Display, an antibody expression platform for the identification of fully human and humanized monoclonal antibodies; and display technologies.

Featured Stories

Before you consider Agenus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agenus wasn't on the list.

While Agenus currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.