AGF Management Ltd. decreased its stake in Costco Wholesale Co. (NASDAQ:COST - Free Report) by 24.4% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 38,208 shares of the retailer's stock after selling 12,337 shares during the period. AGF Management Ltd.'s holdings in Costco Wholesale were worth $35,009,000 at the end of the most recent quarter.

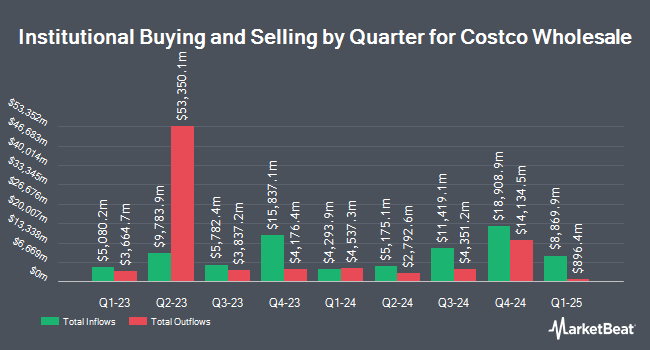

Other hedge funds also recently modified their holdings of the company. Geode Capital Management LLC lifted its position in Costco Wholesale by 1.7% during the third quarter. Geode Capital Management LLC now owns 9,487,057 shares of the retailer's stock worth $8,380,648,000 after acquiring an additional 162,191 shares during the last quarter. FMR LLC raised its position in shares of Costco Wholesale by 3.6% in the third quarter. FMR LLC now owns 9,308,615 shares of the retailer's stock valued at $8,252,274,000 after buying an additional 324,973 shares in the last quarter. Jennison Associates LLC raised its position in shares of Costco Wholesale by 3.8% in the third quarter. Jennison Associates LLC now owns 3,399,127 shares of the retailer's stock valued at $3,013,394,000 after buying an additional 125,444 shares in the last quarter. Fisher Asset Management LLC raised its position in shares of Costco Wholesale by 1.4% in the fourth quarter. Fisher Asset Management LLC now owns 3,077,905 shares of the retailer's stock valued at $2,820,193,000 after buying an additional 43,414 shares in the last quarter. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its position in shares of Costco Wholesale by 2.3% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 3,075,065 shares of the retailer's stock valued at $2,726,107,000 after buying an additional 70,561 shares in the last quarter. Institutional investors own 68.48% of the company's stock.

Wall Street Analyst Weigh In

COST has been the subject of a number of analyst reports. Wells Fargo & Company lifted their price target on shares of Costco Wholesale from $950.00 to $1,000.00 and gave the company an "equal weight" rating in a research report on Friday, December 13th. Stifel Nicolaus boosted their price objective on shares of Costco Wholesale from $1,000.00 to $1,075.00 and gave the company a "buy" rating in a research report on Thursday, February 6th. Truist Financial boosted their price objective on shares of Costco Wholesale from $935.00 to $995.00 and gave the company a "hold" rating in a research report on Friday, March 7th. Roth Mkm boosted their price objective on shares of Costco Wholesale from $755.00 to $907.00 and gave the company a "neutral" rating in a research report on Friday, December 13th. Finally, BMO Capital Markets boosted their price objective on shares of Costco Wholesale from $1,075.00 to $1,175.00 and gave the company an "outperform" rating in a research report on Friday, December 13th. Nine equities research analysts have rated the stock with a hold rating and twenty-one have given a buy rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $1,030.43.

Read Our Latest Stock Report on COST

Costco Wholesale Stock Performance

Shares of Costco Wholesale stock opened at $930.49 on Wednesday. The stock has a market cap of $413.04 billion, a price-to-earnings ratio of 54.64, a P/E/G ratio of 6.15 and a beta of 0.81. The company has a quick ratio of 0.43, a current ratio of 0.98 and a debt-to-equity ratio of 0.23. Costco Wholesale Co. has a twelve month low of $697.27 and a twelve month high of $1,078.24. The company's fifty day moving average is $990.22 and its 200 day moving average is $944.64.

Costco Wholesale (NASDAQ:COST - Get Free Report) last released its earnings results on Thursday, March 6th. The retailer reported $4.02 earnings per share (EPS) for the quarter, missing the consensus estimate of $4.09 by ($0.07). The firm had revenue of $63.72 billion during the quarter, compared to analyst estimates of $63.02 billion. Costco Wholesale had a net margin of 2.93% and a return on equity of 32.31%. Sell-side analysts forecast that Costco Wholesale Co. will post 18.03 EPS for the current year.

Costco Wholesale Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, February 21st. Investors of record on Friday, February 7th were issued a $1.16 dividend. The ex-dividend date was Friday, February 7th. This represents a $4.64 annualized dividend and a yield of 0.50%. Costco Wholesale's payout ratio is 27.09%.

Costco Wholesale Profile

(

Free Report)

Costco Wholesale Corporation, together with its subsidiaries, engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden. The company offers branded and private-label products in a range of merchandise categories.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Costco Wholesale, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Costco Wholesale wasn't on the list.

While Costco Wholesale currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.