JMP Securities cut shares of agilon health (NYSE:AGL - Free Report) from an outperform rating to a market perform rating in a research note published on Monday, MarketBeat.com reports.

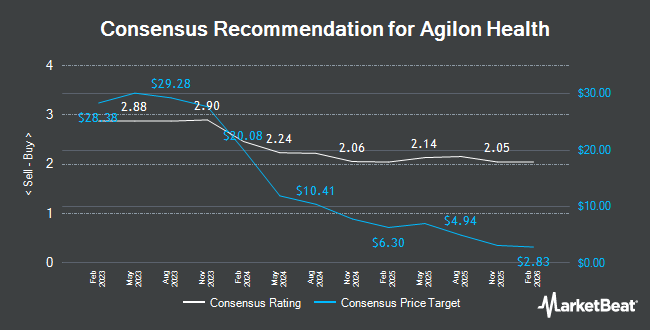

Several other research firms also recently commented on AGL. Benchmark reaffirmed a "buy" rating and issued a $9.00 price target on shares of agilon health in a research note on Thursday, August 8th. Evercore ISI reduced their target price on shares of agilon health from $7.00 to $4.00 and set an "in-line" rating on the stock in a research report on Tuesday, October 8th. Royal Bank of Canada reiterated an "outperform" rating and issued a $8.00 price target on shares of agilon health in a report on Wednesday, August 7th. William Blair downgraded agilon health from an "outperform" rating to a "market perform" rating in a report on Friday. Finally, Deutsche Bank Aktiengesellschaft decreased their target price on agilon health from $5.00 to $4.00 and set a "hold" rating for the company in a research report on Friday, August 9th. Three analysts have rated the stock with a sell rating, fifteen have given a hold rating and three have assigned a buy rating to the company. Based on data from MarketBeat, the company has an average rating of "Hold" and an average target price of $7.34.

View Our Latest Stock Report on agilon health

agilon health Trading Up 16.8 %

AGL traded up $0.31 during trading hours on Monday, reaching $2.15. 5,999,258 shares of the company's stock traded hands, compared to its average volume of 4,949,941. The firm has a 50-day moving average price of $3.26 and a 200 day moving average price of $4.97. The firm has a market capitalization of $884.69 million, a PE ratio of -2.17 and a beta of 0.60. The company has a quick ratio of 1.36, a current ratio of 1.36 and a debt-to-equity ratio of 0.04. agilon health has a 52-week low of $1.80 and a 52-week high of $13.76.

Insiders Place Their Bets

In other agilon health news, CEO Steven Sell acquired 20,000 shares of the firm's stock in a transaction dated Thursday, September 12th. The stock was purchased at an average price of $3.36 per share, for a total transaction of $67,200.00. Following the acquisition, the chief executive officer now owns 67,590 shares in the company, valued at approximately $227,102.40. This trade represents a 0.00 % increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Corporate insiders own 3.20% of the company's stock.

Institutional Trading of agilon health

Several large investors have recently bought and sold shares of the stock. J.Safra Asset Management Corp lifted its stake in shares of agilon health by 626.1% during the second quarter. J.Safra Asset Management Corp now owns 4,204 shares of the company's stock worth $27,000 after buying an additional 3,625 shares during the period. CWM LLC increased its holdings in shares of agilon health by 406.5% in the second quarter. CWM LLC now owns 9,081 shares of the company's stock valued at $59,000 after purchasing an additional 7,288 shares during the period. Nisa Investment Advisors LLC acquired a new position in shares of agilon health in the second quarter valued at about $60,000. Bleakley Financial Group LLC purchased a new position in shares of agilon health in the first quarter worth about $65,000. Finally, Allspring Global Investments Holdings LLC lifted its holdings in shares of agilon health by 17,790.0% during the second quarter. Allspring Global Investments Holdings LLC now owns 10,734 shares of the company's stock worth $70,000 after purchasing an additional 10,674 shares during the period.

agilon health Company Profile

(

Get Free Report)

agilon health, inc. provides healthcare services for seniors through primary care physicians in the communities of the United States. It offers a platform that manages the total healthcare needs of the patients by subscription-like per-member per-month. The company was formerly known as Agilon Health Topco, Inc and changed its name to agilon health, inc.

Featured Stories

Before you consider agilon health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and agilon health wasn't on the list.

While agilon health currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.