agilon health (NYSE:AGL - Free Report) had its target price cut by Barclays from $5.00 to $2.00 in a research report report published on Monday morning,Benzinga reports. They currently have an underweight rating on the stock.

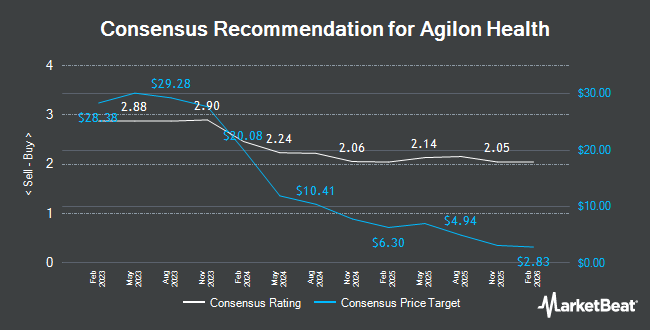

Other research analysts also recently issued reports about the company. Evercore ISI cut their target price on agilon health from $7.00 to $4.00 and set an "in-line" rating on the stock in a report on Tuesday, October 8th. Royal Bank of Canada reissued an "outperform" rating and set a $8.00 target price on shares of agilon health in a research report on Wednesday, August 7th. JMP Securities downgraded shares of agilon health from an "outperform" rating to a "market perform" rating in a research report on Monday. Citigroup reiterated a "sell" rating and set a $2.50 price objective (down from $7.00) on shares of agilon health in a research report on Tuesday, October 29th. Finally, Deutsche Bank Aktiengesellschaft dropped their target price on shares of agilon health from $5.00 to $4.00 and set a "hold" rating on the stock in a report on Friday, August 9th. Three analysts have rated the stock with a sell rating, fifteen have assigned a hold rating and three have assigned a buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus target price of $7.34.

Check Out Our Latest Stock Analysis on agilon health

agilon health Trading Up 17.4 %

agilon health stock traded up $0.32 during trading hours on Monday, hitting $2.16. The stock had a trading volume of 9,241,375 shares, compared to its average volume of 4,964,813. The business's 50 day simple moving average is $3.26 and its 200-day simple moving average is $4.97. agilon health has a one year low of $1.80 and a one year high of $13.76. The stock has a market cap of $888.80 million, a price-to-earnings ratio of -2.17 and a beta of 0.60. The company has a quick ratio of 1.36, a current ratio of 1.36 and a debt-to-equity ratio of 0.04.

Insiders Place Their Bets

In related news, CEO Steven Sell acquired 20,000 shares of the company's stock in a transaction on Thursday, September 12th. The shares were acquired at an average cost of $3.36 per share, for a total transaction of $67,200.00. Following the purchase, the chief executive officer now owns 67,590 shares in the company, valued at approximately $227,102.40. The trade was a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which can be accessed through the SEC website. Corporate insiders own 3.20% of the company's stock.

Institutional Investors Weigh In On agilon health

A number of hedge funds have recently made changes to their positions in AGL. Intech Investment Management LLC purchased a new stake in shares of agilon health during the 3rd quarter worth approximately $228,000. Simplify Asset Management Inc. boosted its holdings in agilon health by 67.5% in the 3rd quarter. Simplify Asset Management Inc. now owns 168,696 shares of the company's stock valued at $663,000 after purchasing an additional 67,968 shares during the period. Aigen Investment Management LP bought a new stake in agilon health during the third quarter valued at $79,000. Los Angeles Capital Management LLC purchased a new position in shares of agilon health during the third quarter worth about $513,000. Finally, City State Bank purchased a new position in shares of agilon health during the third quarter worth about $52,000.

About agilon health

(

Get Free Report)

agilon health, inc. provides healthcare services for seniors through primary care physicians in the communities of the United States. It offers a platform that manages the total healthcare needs of the patients by subscription-like per-member per-month. The company was formerly known as Agilon Health Topco, Inc and changed its name to agilon health, inc.

Further Reading

Before you consider agilon health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and agilon health wasn't on the list.

While agilon health currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.