Oppenheimer & Co. Inc. reduced its position in shares of Agnico Eagle Mines Limited (NYSE:AEM - Free Report) TSE: AEM by 32.2% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 37,701 shares of the mining company's stock after selling 17,904 shares during the quarter. Oppenheimer & Co. Inc.'s holdings in Agnico Eagle Mines were worth $3,037,000 as of its most recent SEC filing.

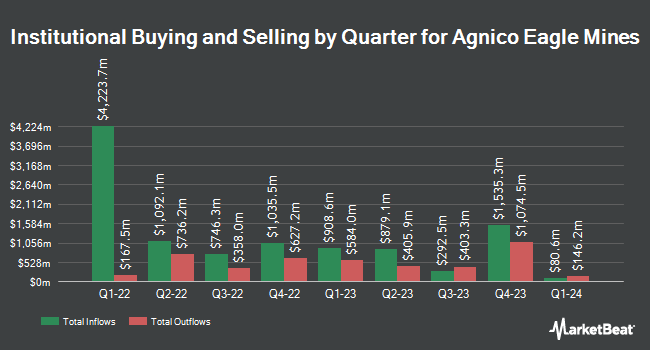

Other hedge funds have also modified their holdings of the company. Van ECK Associates Corp increased its holdings in Agnico Eagle Mines by 0.3% in the 2nd quarter. Van ECK Associates Corp now owns 22,320,085 shares of the mining company's stock worth $1,459,741,000 after acquiring an additional 58,681 shares in the last quarter. Massachusetts Financial Services Co. MA increased its stake in shares of Agnico Eagle Mines by 1.0% during the second quarter. Massachusetts Financial Services Co. MA now owns 13,281,926 shares of the mining company's stock worth $868,638,000 after purchasing an additional 134,872 shares in the last quarter. Capital World Investors raised its position in shares of Agnico Eagle Mines by 0.8% during the 1st quarter. Capital World Investors now owns 9,769,275 shares of the mining company's stock worth $582,529,000 after purchasing an additional 79,275 shares during the last quarter. CIBC Asset Management Inc lifted its stake in Agnico Eagle Mines by 4.1% in the 2nd quarter. CIBC Asset Management Inc now owns 6,083,606 shares of the mining company's stock valued at $397,657,000 after buying an additional 237,347 shares in the last quarter. Finally, TD Asset Management Inc lifted its stake in Agnico Eagle Mines by 10.3% in the 2nd quarter. TD Asset Management Inc now owns 5,852,648 shares of the mining company's stock valued at $382,720,000 after buying an additional 546,542 shares in the last quarter. 68.34% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

AEM has been the subject of several research reports. UBS Group started coverage on Agnico Eagle Mines in a research note on Tuesday, September 17th. They set a "buy" rating and a $95.00 price objective for the company. Jefferies Financial Group increased their price objective on Agnico Eagle Mines from $68.00 to $85.00 and gave the company a "hold" rating in a research note on Friday, October 4th. TD Securities lifted their target price on shares of Agnico Eagle Mines from $90.00 to $91.00 and gave the stock a "buy" rating in a research note on Friday, August 2nd. Royal Bank of Canada increased their target price on shares of Agnico Eagle Mines from $80.00 to $87.00 and gave the company an "outperform" rating in a research report on Tuesday, September 10th. Finally, Scotiabank raised their price target on shares of Agnico Eagle Mines from $81.00 to $94.00 and gave the stock a "sector outperform" rating in a research note on Monday, August 19th. One investment analyst has rated the stock with a hold rating and eight have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus price target of $86.78.

Check Out Our Latest Report on Agnico Eagle Mines

Agnico Eagle Mines Trading Down 1.1 %

NYSE:AEM traded down $0.88 on Friday, hitting $76.76. The stock had a trading volume of 1,663,802 shares, compared to its average volume of 2,672,932. The company has a fifty day moving average price of $82.43 and a two-hundred day moving average price of $75.42. Agnico Eagle Mines Limited has a 1-year low of $44.37 and a 1-year high of $89.00. The company has a quick ratio of 0.83, a current ratio of 1.75 and a debt-to-equity ratio of 0.06. The stock has a market cap of $38.51 billion, a price-to-earnings ratio of 38.38, a PEG ratio of 0.66 and a beta of 1.09.

Agnico Eagle Mines Company Profile

(

Free Report)

Agnico Eagle Mines Limited, a gold mining company, exploration, development, and production of precious metals. It explores for gold. The company's mines are located in Canada, Australia, Finland and Mexico, with exploration and development activities in Canada, Australia, Europe, Latin America, and the United States.

See Also

Before you consider Agnico Eagle Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agnico Eagle Mines wasn't on the list.

While Agnico Eagle Mines currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.