Vestcor Inc decreased its position in shares of Agnico Eagle Mines Limited (NYSE:AEM - Free Report) TSE: AEM by 15.6% during the 3rd quarter, according to its most recent disclosure with the SEC. The firm owned 35,215 shares of the mining company's stock after selling 6,500 shares during the period. Vestcor Inc's holdings in Agnico Eagle Mines were worth $2,837,000 as of its most recent SEC filing.

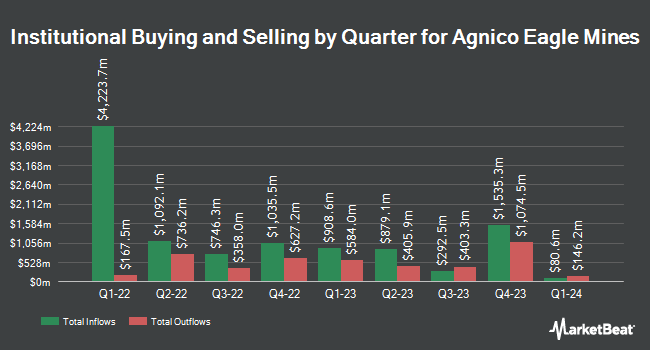

A number of other hedge funds have also recently bought and sold shares of the company. Groupama Asset Managment boosted its stake in Agnico Eagle Mines by 9.3% in the 3rd quarter. Groupama Asset Managment now owns 844,467 shares of the mining company's stock worth $68,000 after buying an additional 72,042 shares during the last quarter. Y Intercept Hong Kong Ltd purchased a new position in shares of Agnico Eagle Mines during the 3rd quarter worth about $358,000. MML Investors Services LLC acquired a new stake in shares of Agnico Eagle Mines in the third quarter worth approximately $252,000. Delos Wealth Advisors LLC grew its holdings in Agnico Eagle Mines by 5.2% in the third quarter. Delos Wealth Advisors LLC now owns 40,593 shares of the mining company's stock valued at $3,270,000 after purchasing an additional 2,004 shares during the period. Finally, National Bank of Canada FI increased its position in Agnico Eagle Mines by 7.4% during the third quarter. National Bank of Canada FI now owns 4,155,349 shares of the mining company's stock worth $334,749,000 after purchasing an additional 285,565 shares during the last quarter. Institutional investors and hedge funds own 68.34% of the company's stock.

Agnico Eagle Mines Stock Up 3.6 %

NYSE:AEM traded up $3.05 during trading hours on Wednesday, hitting $87.36. The stock had a trading volume of 1,733,779 shares, compared to its average volume of 2,600,569. The company has a market cap of $43.86 billion, a PE ratio of 43.68, a price-to-earnings-growth ratio of 0.65 and a beta of 1.07. The business has a 50 day simple moving average of $83.17 and a two-hundred day simple moving average of $77.46. Agnico Eagle Mines Limited has a 1-year low of $44.37 and a 1-year high of $89.00. The company has a current ratio of 1.75, a quick ratio of 0.83 and a debt-to-equity ratio of 0.06.

Analysts Set New Price Targets

A number of equities analysts have weighed in on the stock. Royal Bank of Canada lifted their price target on shares of Agnico Eagle Mines from $80.00 to $87.00 and gave the company an "outperform" rating in a report on Tuesday, September 10th. UBS Group initiated coverage on Agnico Eagle Mines in a research report on Tuesday, September 17th. They set a "buy" rating and a $95.00 price target for the company. Jefferies Financial Group raised their price objective on Agnico Eagle Mines from $68.00 to $85.00 and gave the stock a "hold" rating in a report on Friday, October 4th. Finally, Scotiabank lifted their price objective on Agnico Eagle Mines from $81.00 to $94.00 and gave the company a "sector outperform" rating in a research note on Monday, August 19th. One equities research analyst has rated the stock with a hold rating and eight have given a buy rating to the company. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $86.78.

Read Our Latest Analysis on Agnico Eagle Mines

Agnico Eagle Mines Profile

(

Free Report)

Agnico Eagle Mines Limited, a gold mining company, exploration, development, and production of precious metals. It explores for gold. The company's mines are located in Canada, Australia, Finland and Mexico, with exploration and development activities in Canada, Australia, Europe, Latin America, and the United States.

Read More

Before you consider Agnico Eagle Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agnico Eagle Mines wasn't on the list.

While Agnico Eagle Mines currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.