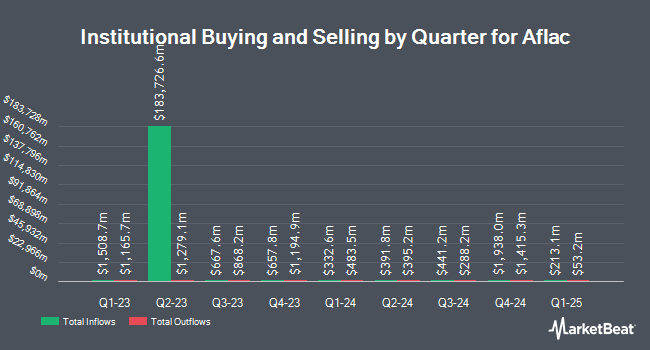

AGP Franklin LLC bought a new position in shares of Aflac Incorporated (NYSE:AFL - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 9,592 shares of the financial services provider's stock, valued at approximately $992,000.

A number of other large investors have also recently made changes to their positions in the stock. Whipplewood Advisors LLC purchased a new position in Aflac during the 4th quarter valued at about $26,000. BankPlus Trust Department purchased a new stake in Aflac in the 4th quarter worth approximately $34,000. Curio Wealth LLC bought a new position in Aflac in the 4th quarter valued at $36,000. OFI Invest Asset Management purchased a new position in shares of Aflac during the 4th quarter valued at $38,000. Finally, Rialto Wealth Management LLC bought a new position in shares of Aflac in the fourth quarter worth $41,000. 67.44% of the stock is owned by institutional investors.

Insider Buying and Selling

In other Aflac news, Director Charles D. Lake II sold 29,802 shares of the stock in a transaction that occurred on Monday, March 10th. The shares were sold at an average price of $107.29, for a total value of $3,197,456.58. Following the transaction, the director now directly owns 49,962 shares in the company, valued at approximately $5,360,422.98. This trade represents a 37.36 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, Director Joseph L. Moskowitz sold 1,000 shares of the company's stock in a transaction on Friday, March 7th. The stock was sold at an average price of $107.63, for a total value of $107,630.00. Following the completion of the sale, the director now owns 25,393 shares of the company's stock, valued at $2,733,048.59. This trade represents a 3.79 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.90% of the stock is currently owned by insiders.

Analyst Ratings Changes

A number of brokerages have weighed in on AFL. Keefe, Bruyette & Woods decreased their target price on Aflac from $107.00 to $104.00 and set a "market perform" rating on the stock in a research note on Wednesday, February 12th. Morgan Stanley dropped their target price on Aflac from $105.00 to $100.00 and set an "equal weight" rating for the company in a research report on Thursday, April 10th. Wells Fargo & Company lowered their price objective on shares of Aflac from $104.00 to $102.00 and set an "equal weight" rating for the company in a report on Wednesday, February 19th. BMO Capital Markets started coverage on shares of Aflac in a research note on Thursday, January 23rd. They issued a "market perform" rating and a $111.00 price target for the company. Finally, StockNews.com upgraded shares of Aflac from a "sell" rating to a "hold" rating in a research note on Friday, February 14th. Two equities research analysts have rated the stock with a sell rating, eleven have given a hold rating and two have given a buy rating to the stock. According to data from MarketBeat, the company has an average rating of "Hold" and a consensus price target of $103.93.

Get Our Latest Research Report on Aflac

Aflac Stock Performance

Aflac stock traded up $0.01 during midday trading on Friday, reaching $107.35. 2,294,639 shares of the company traded hands, compared to its average volume of 2,143,187. The company has a debt-to-equity ratio of 0.29, a current ratio of 0.10 and a quick ratio of 0.08. Aflac Incorporated has a 12 month low of $80.59 and a 12 month high of $115.50. The firm has a market capitalization of $58.59 billion, a price-to-earnings ratio of 11.18, a price-to-earnings-growth ratio of 3.24 and a beta of 0.81. The business has a 50 day moving average of $106.72 and a two-hundred day moving average of $107.33.

Aflac (NYSE:AFL - Get Free Report) last released its quarterly earnings results on Wednesday, February 5th. The financial services provider reported $1.56 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.63 by ($0.07). Aflac had a return on equity of 16.20% and a net margin of 28.76%. As a group, research analysts predict that Aflac Incorporated will post 6.88 earnings per share for the current year.

Aflac Profile

(

Free Report)

Aflac Incorporated, through its subsidiaries, provides supplemental health and life insurance products. The company operates through Aflac Japan and Aflac U.S. segments. The Aflac Japan segment offers cancer, medical, nursing care, work leave, GIFT, and whole and term life insurance products, as well as WAYS and child endowment plans under saving type insurance products in Japan.

Read More

Before you consider Aflac, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aflac wasn't on the list.

While Aflac currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.