Agree Realty (NYSE:ADC - Get Free Report) was downgraded by analysts at JMP Securities from an "outperform" rating to a "market perform" rating in a note issued to investors on Tuesday, Marketbeat Ratings reports.

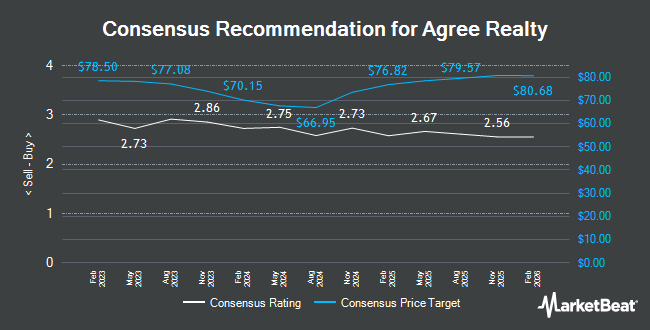

ADC has been the subject of a number of other reports. Robert W. Baird lifted their price objective on shares of Agree Realty from $67.00 to $76.00 and gave the company an "outperform" rating in a report on Tuesday, October 29th. Royal Bank of Canada boosted their price objective on Agree Realty from $79.00 to $80.00 and gave the stock an "outperform" rating in a report on Thursday, October 24th. Mizuho raised their target price on Agree Realty from $75.00 to $80.00 and gave the company a "neutral" rating in a report on Thursday, November 14th. Wells Fargo & Company cut their target price on Agree Realty from $80.00 to $79.00 and set an "overweight" rating on the stock in a research report on Monday, November 4th. Finally, Raymond James increased their price target on Agree Realty from $70.00 to $81.00 and gave the company a "strong-buy" rating in a research report on Wednesday, August 21st. One equities research analyst has rated the stock with a sell rating, four have assigned a hold rating, ten have issued a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $78.03.

Check Out Our Latest Stock Report on Agree Realty

Agree Realty Stock Down 1.0 %

NYSE:ADC traded down $0.76 on Tuesday, hitting $73.29. The stock had a trading volume of 1,129,630 shares, compared to its average volume of 941,898. The company has a quick ratio of 0.66, a current ratio of 0.66 and a debt-to-equity ratio of 0.52. Agree Realty has a 52 week low of $54.28 and a 52 week high of $78.39. The business's fifty day moving average is $75.25 and its 200 day moving average is $71.02. The company has a market cap of $7.59 billion, a PE ratio of 40.97, a P/E/G ratio of 3.66 and a beta of 0.62.

Agree Realty (NYSE:ADC - Get Free Report) last issued its earnings results on Tuesday, October 22nd. The real estate investment trust reported $0.42 earnings per share for the quarter, missing analysts' consensus estimates of $1.03 by ($0.61). Agree Realty had a return on equity of 3.77% and a net margin of 31.62%. The firm had revenue of $154.33 million for the quarter, compared to analyst estimates of $152.83 million. During the same period in the previous year, the company earned $1.00 earnings per share. Agree Realty's revenue for the quarter was up 12.8% compared to the same quarter last year. On average, equities research analysts expect that Agree Realty will post 4.12 EPS for the current fiscal year.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently modified their holdings of the stock. Daiwa Securities Group Inc. lifted its stake in Agree Realty by 29.4% in the third quarter. Daiwa Securities Group Inc. now owns 2,350,056 shares of the real estate investment trust's stock valued at $177,030,000 after purchasing an additional 534,545 shares during the last quarter. FMR LLC raised its stake in shares of Agree Realty by 729.3% in the third quarter. FMR LLC now owns 2,238,784 shares of the real estate investment trust's stock valued at $168,648,000 after buying an additional 1,968,811 shares during the period. Geode Capital Management LLC lifted its position in shares of Agree Realty by 1.5% during the 3rd quarter. Geode Capital Management LLC now owns 2,074,760 shares of the real estate investment trust's stock valued at $156,327,000 after buying an additional 30,377 shares during the last quarter. Charles Schwab Investment Management Inc. grew its stake in shares of Agree Realty by 3.7% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,588,355 shares of the real estate investment trust's stock worth $119,651,000 after acquiring an additional 57,354 shares during the period. Finally, Dimensional Fund Advisors LP increased its holdings in Agree Realty by 5.3% in the 2nd quarter. Dimensional Fund Advisors LP now owns 1,522,014 shares of the real estate investment trust's stock worth $94,273,000 after acquiring an additional 76,818 shares during the last quarter. 97.83% of the stock is owned by institutional investors.

Agree Realty Company Profile

(

Get Free Report)

Agree Realty Corporation is a publicly traded real estate investment trust that is RETHINKING RETAIL through the acquisition and development of properties net leased to industry-leading, omni-channel retail tenants. As of December 31, 2023, the Company owned and operated a portfolio of 2,135 properties, located in 49 states and containing approximately 44.2 million square feet of gross leasable area.

Featured Articles

Before you consider Agree Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agree Realty wasn't on the list.

While Agree Realty currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.