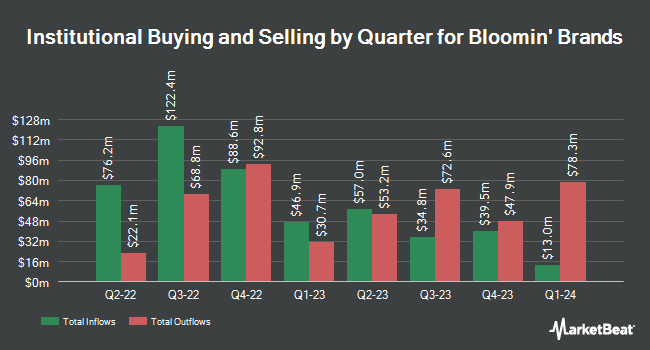

A&I Financial Services LLC bought a new stake in Bloomin' Brands, Inc. (NASDAQ:BLMN - Free Report) during the fourth quarter, according to its most recent 13F filing with the SEC. The institutional investor bought 28,085 shares of the restaurant operator's stock, valued at approximately $343,000.

Several other hedge funds also recently modified their holdings of the company. Gladius Capital Management LP purchased a new stake in shares of Bloomin' Brands in the third quarter valued at $26,000. KBC Group NV grew its holdings in Bloomin' Brands by 79.1% in the third quarter. KBC Group NV now owns 3,371 shares of the restaurant operator's stock valued at $56,000 after purchasing an additional 1,489 shares during the period. GAMMA Investing LLC boosted its holdings in shares of Bloomin' Brands by 606.6% in the 4th quarter. GAMMA Investing LLC now owns 4,890 shares of the restaurant operator's stock valued at $60,000 after purchasing an additional 4,198 shares during the last quarter. Entropy Technologies LP purchased a new stake in shares of Bloomin' Brands during the 4th quarter valued at $140,000. Finally, Olympiad Research LP acquired a new stake in shares of Bloomin' Brands during the 3rd quarter worth $202,000.

Bloomin' Brands Stock Down 10.0 %

Shares of NASDAQ BLMN traded down $0.94 during midday trading on Monday, reaching $8.44. 4,167,392 shares of the company's stock were exchanged, compared to its average volume of 1,668,216. The stock has a market capitalization of $716.82 million, a PE ratio of -76.72 and a beta of 1.97. Bloomin' Brands, Inc. has a 52-week low of $8.38 and a 52-week high of $30.13. The company has a debt-to-equity ratio of 4.46, a quick ratio of 0.22 and a current ratio of 0.31. The business's fifty day moving average price is $11.85 and its two-hundred day moving average price is $14.20.

Bloomin' Brands Cuts Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, March 26th. Investors of record on Tuesday, March 11th will be paid a $0.15 dividend. The ex-dividend date of this dividend is Tuesday, March 11th. This represents a $0.60 dividend on an annualized basis and a dividend yield of 7.11%. Bloomin' Brands's dividend payout ratio (DPR) is presently -40.27%.

Analysts Set New Price Targets

A number of equities research analysts have issued reports on BLMN shares. BMO Capital Markets lowered their price target on Bloomin' Brands from $16.00 to $12.00 and set a "market perform" rating for the company in a research report on Thursday. Piper Sandler dropped their target price on shares of Bloomin' Brands from $20.00 to $16.00 and set a "neutral" rating for the company in a research report on Monday, November 11th. Raymond James cut shares of Bloomin' Brands from an "outperform" rating to a "market perform" rating in a research report on Monday, November 11th. JPMorgan Chase & Co. decreased their price objective on shares of Bloomin' Brands from $19.00 to $14.00 and set a "neutral" rating for the company in a research note on Tuesday, November 12th. Finally, Barclays set a $11.00 target price on shares of Bloomin' Brands and gave the company an "equal weight" rating in a research note on Thursday. Two investment analysts have rated the stock with a sell rating and ten have issued a hold rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Hold" and an average target price of $15.00.

Read Our Latest Research Report on BLMN

Bloomin' Brands Company Profile

(

Free Report)

Bloomin' Brands, Inc engages in the acquisition, operation, design, and development of restaurant concepts. It operates through the U.S. and International geographical segments. The U.S. segment operates in the USA and Puerto Rico. The International segment operates in Brazil, South Korea, Hong Kong, and China.

Featured Articles

Before you consider Bloomin' Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bloomin' Brands wasn't on the list.

While Bloomin' Brands currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.