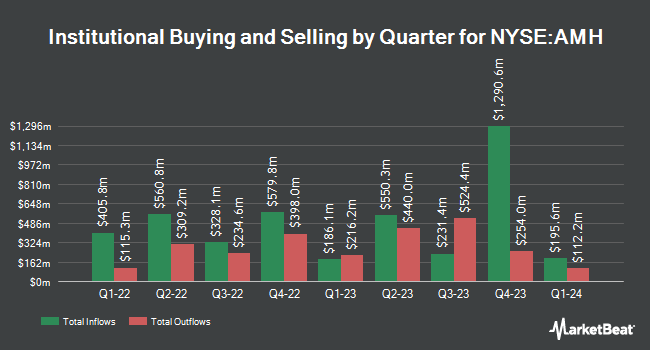

Aigen Investment Management LP acquired a new stake in American Homes 4 Rent (NYSE:AMH - Free Report) during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The firm acquired 14,366 shares of the real estate investment trust's stock, valued at approximately $552,000.

Other institutional investors have also made changes to their positions in the company. Mirae Asset Global Investments Co. Ltd. acquired a new position in shares of American Homes 4 Rent during the 1st quarter worth about $524,000. SG Americas Securities LLC raised its stake in shares of American Homes 4 Rent by 17.5% during the 1st quarter. SG Americas Securities LLC now owns 47,738 shares of the real estate investment trust's stock worth $1,756,000 after purchasing an additional 7,106 shares in the last quarter. ProShare Advisors LLC acquired a new stake in shares of American Homes 4 Rent in the 1st quarter valued at approximately $571,000. State Board of Administration of Florida Retirement System grew its stake in shares of American Homes 4 Rent by 2.7% in the first quarter. State Board of Administration of Florida Retirement System now owns 290,334 shares of the real estate investment trust's stock valued at $10,678,000 after buying an additional 7,572 shares in the last quarter. Finally, Mitsubishi UFJ Asset Management Co. Ltd. increased its holdings in American Homes 4 Rent by 8.7% during the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 371,928 shares of the real estate investment trust's stock worth $13,680,000 after buying an additional 29,727 shares during the last quarter. Institutional investors own 91.87% of the company's stock.

American Homes 4 Rent Stock Down 0.8 %

American Homes 4 Rent stock traded down $0.32 on Thursday, hitting $37.64. 895,450 shares of the stock traded hands, compared to its average volume of 2,562,473. The firm has a market cap of $13.91 billion, a P/E ratio of 39.26, a price-to-earnings-growth ratio of 3.22 and a beta of 0.77. The company has a current ratio of 0.58, a quick ratio of 0.58 and a debt-to-equity ratio of 0.59. American Homes 4 Rent has a 1 year low of $33.75 and a 1 year high of $41.41. The business's fifty day simple moving average is $38.25 and its 200 day simple moving average is $37.35.

American Homes 4 Rent (NYSE:AMH - Get Free Report) last announced its quarterly earnings results on Tuesday, October 29th. The real estate investment trust reported $0.20 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.43 by ($0.23). American Homes 4 Rent had a return on equity of 4.76% and a net margin of 21.51%. The firm had revenue of $445.06 million during the quarter, compared to the consensus estimate of $443.81 million. During the same quarter in the previous year, the firm earned $0.41 EPS. The business's revenue for the quarter was up 5.5% on a year-over-year basis. As a group, sell-side analysts forecast that American Homes 4 Rent will post 1.77 earnings per share for the current year.

American Homes 4 Rent Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Friday, December 13th will be given a $0.26 dividend. The ex-dividend date of this dividend is Friday, December 13th. This represents a $1.04 dividend on an annualized basis and a yield of 2.76%. American Homes 4 Rent's dividend payout ratio is presently 108.33%.

Analyst Upgrades and Downgrades

A number of equities analysts have recently weighed in on AMH shares. Wells Fargo & Company upgraded American Homes 4 Rent from an "equal weight" rating to an "overweight" rating and increased their target price for the stock from $36.00 to $42.00 in a research note on Monday, August 26th. JPMorgan Chase & Co. boosted their price target on American Homes 4 Rent from $38.00 to $43.00 and gave the company a "neutral" rating in a research note on Monday, September 16th. StockNews.com cut shares of American Homes 4 Rent from a "hold" rating to a "sell" rating in a research report on Thursday, October 24th. Mizuho boosted their target price on American Homes 4 Rent from $39.00 to $40.00 and gave the company an "outperform" rating in a research report on Thursday, October 10th. Finally, UBS Group boosted their price objective on American Homes 4 Rent from $37.00 to $40.00 and gave the company a "neutral" rating in a report on Friday, August 16th. One equities research analyst has rated the stock with a sell rating, three have given a hold rating and twelve have assigned a buy rating to the company. According to MarketBeat, American Homes 4 Rent currently has an average rating of "Moderate Buy" and a consensus price target of $41.60.

Check Out Our Latest Report on American Homes 4 Rent

American Homes 4 Rent Profile

(

Free Report)

AMH NYSE: AMH is a leading large-scale integrated owner, operator and developer of single-family rental homes. We're an internally managed Maryland real estate investment trust (REIT) focused on acquiring, developing, renovating, leasing and managing homes as rental properties. Our goal is to simplify the experience of leasing a home and deliver peace of mind to households across the country.

Further Reading

Before you consider American Homes 4 Rent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Homes 4 Rent wasn't on the list.

While American Homes 4 Rent currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.