Aigen Investment Management LP purchased a new position in Twilio Inc. (NYSE:TWLO - Free Report) in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 6,358 shares of the technology company's stock, valued at approximately $415,000.

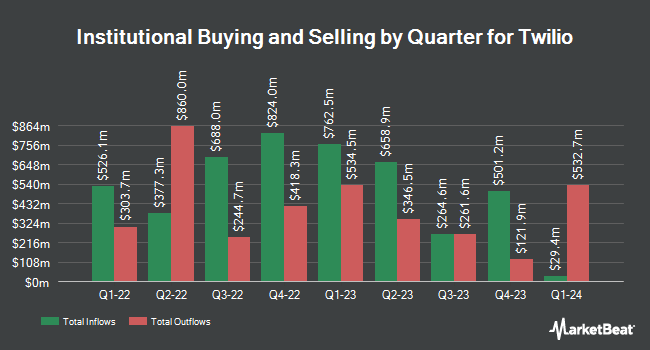

Several other hedge funds and other institutional investors have also recently bought and sold shares of the stock. Covestor Ltd lifted its holdings in shares of Twilio by 16.7% in the third quarter. Covestor Ltd now owns 1,033 shares of the technology company's stock valued at $67,000 after purchasing an additional 148 shares in the last quarter. Tidal Investments LLC lifted its position in Twilio by 2.3% in the 1st quarter. Tidal Investments LLC now owns 7,295 shares of the technology company's stock worth $446,000 after buying an additional 166 shares in the last quarter. Arizona State Retirement System increased its stake in shares of Twilio by 0.4% in the second quarter. Arizona State Retirement System now owns 47,511 shares of the technology company's stock worth $2,699,000 after acquiring an additional 205 shares during the last quarter. US Bancorp DE grew its stake in Twilio by 4.7% in the third quarter. US Bancorp DE now owns 4,787 shares of the technology company's stock valued at $312,000 after purchasing an additional 217 shares in the last quarter. Finally, Royal London Asset Management Ltd. increased its position in Twilio by 0.4% in the 2nd quarter. Royal London Asset Management Ltd. now owns 60,074 shares of the technology company's stock worth $3,413,000 after purchasing an additional 220 shares during the last quarter. 84.27% of the stock is owned by institutional investors.

Analysts Set New Price Targets

A number of equities research analysts recently issued reports on the stock. Sanford C. Bernstein upped their price objective on shares of Twilio from $68.00 to $70.00 and gave the stock a "market perform" rating in a report on Tuesday, August 27th. JPMorgan Chase & Co. upped their price target on shares of Twilio from $78.00 to $83.00 and gave the company an "overweight" rating in a report on Thursday, October 31st. StockNews.com upgraded Twilio from a "hold" rating to a "buy" rating in a report on Friday, September 13th. Oppenheimer increased their price target on shares of Twilio from $85.00 to $90.00 and gave the company an "outperform" rating in a report on Thursday, October 31st. Finally, Barclays increased their target price on shares of Twilio from $65.00 to $80.00 and gave the company an "equal weight" rating in a research note on Friday, November 1st. Two equities research analysts have rated the stock with a sell rating, eleven have given a hold rating and eleven have assigned a buy rating to the stock. According to data from MarketBeat.com, the company presently has an average rating of "Hold" and an average price target of $83.70.

View Our Latest Research Report on TWLO

Twilio Stock Down 0.6 %

Shares of NYSE:TWLO traded down $0.59 during midday trading on Friday, hitting $96.54. 3,158,289 shares of the company's stock were exchanged, compared to its average volume of 2,704,369. Twilio Inc. has a 12 month low of $52.51 and a 12 month high of $101.00. The company has a market cap of $14.81 billion, a PE ratio of -37.56, a price-to-earnings-growth ratio of 2.89 and a beta of 1.32. The stock has a 50 day moving average price of $71.47 and a 200-day moving average price of $63.23. The company has a debt-to-equity ratio of 0.12, a current ratio of 5.06 and a quick ratio of 5.06.

Insider Buying and Selling

In related news, CFO Aidan Viggiano sold 1,931 shares of the stock in a transaction on Tuesday, August 20th. The stock was sold at an average price of $61.67, for a total value of $119,084.77. Following the transaction, the chief financial officer now owns 184,570 shares of the company's stock, valued at $11,382,431.90. This represents a 1.04 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO Khozema Shipchandler sold 11,073 shares of Twilio stock in a transaction dated Monday, September 30th. The stock was sold at an average price of $65.03, for a total value of $720,077.19. Following the completion of the transaction, the chief executive officer now owns 278,134 shares in the company, valued at approximately $18,087,054.02. This represents a 3.83 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 52,468 shares of company stock valued at $3,509,830. 4.50% of the stock is owned by insiders.

Twilio Company Profile

(

Free Report)

Twilio Inc, together with its subsidiaries, provides customer engagement platform solutions in the United States and internationally. It operates through two segments, Twilio Communications and Twilio Segment. The company provides various application programming interfaces and software solutions for communications between customers and end users, including messaging, voice, email, flex, marketing campaigns, and user identity and authentication.

Featured Stories

Before you consider Twilio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Twilio wasn't on the list.

While Twilio currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.