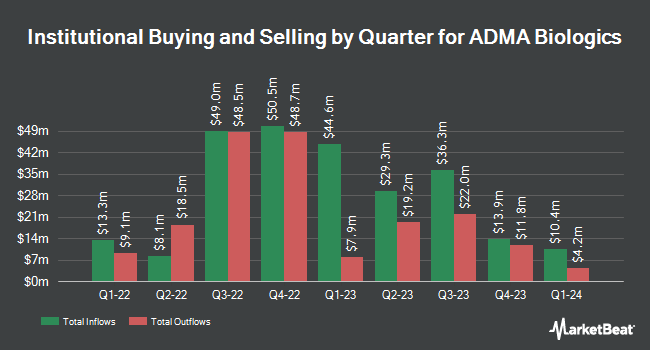

Aigen Investment Management LP bought a new position in shares of ADMA Biologics, Inc. (NASDAQ:ADMA - Free Report) during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm bought 29,143 shares of the biotechnology company's stock, valued at approximately $583,000.

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Quest Partners LLC acquired a new position in ADMA Biologics during the second quarter worth approximately $29,000. Hollencrest Capital Management purchased a new position in shares of ADMA Biologics in the 3rd quarter worth $30,000. EntryPoint Capital LLC acquired a new position in ADMA Biologics in the first quarter valued at $31,000. CWM LLC boosted its holdings in ADMA Biologics by 114.2% in the second quarter. CWM LLC now owns 8,192 shares of the biotechnology company's stock valued at $92,000 after acquiring an additional 4,367 shares during the last quarter. Finally, Acadian Asset Management LLC acquired a new stake in ADMA Biologics during the second quarter worth about $93,000. 75.68% of the stock is owned by hedge funds and other institutional investors.

ADMA Biologics Stock Down 4.8 %

NASDAQ ADMA traded down $1.02 on Thursday, reaching $20.45. The company had a trading volume of 2,073,757 shares, compared to its average volume of 3,662,076. The company has a debt-to-equity ratio of 0.48, a current ratio of 7.09 and a quick ratio of 3.26. ADMA Biologics, Inc. has a 1 year low of $3.60 and a 1 year high of $23.64. The firm has a 50-day moving average of $18.42 and a 200-day moving average of $14.22. The firm has a market capitalization of $4.77 billion, a PE ratio of 73.18 and a beta of 0.64.

ADMA Biologics (NASDAQ:ADMA - Get Free Report) last released its quarterly earnings results on Thursday, November 7th. The biotechnology company reported $0.15 earnings per share for the quarter, beating analysts' consensus estimates of $0.13 by $0.02. ADMA Biologics had a net margin of 17.80% and a return on equity of 53.20%. The business had revenue of $119.84 million during the quarter, compared to analyst estimates of $107.25 million. During the same period last year, the business earned $0.01 EPS. On average, equities research analysts anticipate that ADMA Biologics, Inc. will post 0.52 EPS for the current fiscal year.

Insider Buying and Selling

In other ADMA Biologics news, Director Lawrence P. Guiheen sold 9,000 shares of the firm's stock in a transaction that occurred on Monday, September 9th. The stock was sold at an average price of $18.47, for a total transaction of $166,230.00. Following the completion of the sale, the director now owns 153,941 shares in the company, valued at $2,843,290.27. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. In other news, Director Lawrence P. Guiheen sold 9,000 shares of the business's stock in a transaction dated Monday, September 9th. The shares were sold at an average price of $18.47, for a total value of $166,230.00. Following the completion of the sale, the director now owns 153,941 shares of the company's stock, valued at approximately $2,843,290.27. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Adam S. Grossman sold 236,889 shares of the stock in a transaction dated Monday, August 26th. The stock was sold at an average price of $17.69, for a total transaction of $4,190,566.41. Following the transaction, the chief executive officer now directly owns 2,059,726 shares in the company, valued at $36,436,552.94. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 466,900 shares of company stock worth $8,224,121. 3.70% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

Several equities analysts have recently weighed in on the company. Raymond James lifted their price objective on ADMA Biologics from $18.00 to $25.00 and gave the company a "strong-buy" rating in a research note on Friday, November 8th. Cantor Fitzgerald reiterated an "overweight" rating and set a $20.00 price objective on shares of ADMA Biologics in a research note on Friday, September 20th. Finally, HC Wainwright increased their price objective on shares of ADMA Biologics from $18.00 to $26.00 and gave the stock a "buy" rating in a research report on Friday, November 8th.

Check Out Our Latest Report on ADMA Biologics

ADMA Biologics Company Profile

(

Free Report)

ADMA Biologics, Inc, a biopharmaceutical company, engages in developing, manufacturing, and marketing specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally. The company offers BIVIGAM, an intravenous immune globulin (IVIG) product indicated for the treatment of primary humoral immunodeficiency (PI); ASCENIV, an IVIG product for the treatment of PI; and Nabi-HB for the treatment of acute exposure to blood containing Hepatitis B surface antigen and other listed exposures to Hepatitis B.

Featured Articles

Before you consider ADMA Biologics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ADMA Biologics wasn't on the list.

While ADMA Biologics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.