Aigen Investment Management LP decreased its position in Workiva Inc. (NYSE:WK - Free Report) by 69.8% in the 4th quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 4,320 shares of the software maker's stock after selling 10,003 shares during the quarter. Aigen Investment Management LP's holdings in Workiva were worth $473,000 as of its most recent filing with the SEC.

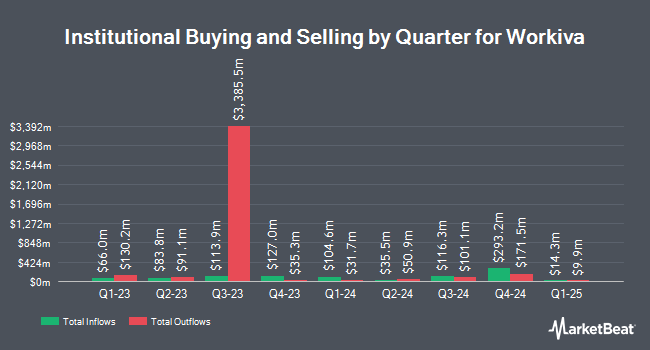

A number of other hedge funds have also recently added to or reduced their stakes in the company. Versor Investments LP acquired a new stake in shares of Workiva in the third quarter worth about $1,217,000. SG Americas Securities LLC boosted its position in Workiva by 141.6% during the fourth quarter. SG Americas Securities LLC now owns 9,341 shares of the software maker's stock worth $1,023,000 after purchasing an additional 5,475 shares during the period. TimesSquare Capital Management LLC grew its holdings in Workiva by 4.3% during the third quarter. TimesSquare Capital Management LLC now owns 467,769 shares of the software maker's stock valued at $37,010,000 after purchasing an additional 19,095 shares during the last quarter. Mutual of America Capital Management LLC raised its position in shares of Workiva by 138.8% in the third quarter. Mutual of America Capital Management LLC now owns 54,059 shares of the software maker's stock valued at $4,277,000 after purchasing an additional 31,421 shares during the period. Finally, Nordea Investment Management AB acquired a new stake in shares of Workiva in the fourth quarter worth $59,894,000. Institutional investors and hedge funds own 92.21% of the company's stock.

Workiva Stock Down 0.1 %

Workiva stock traded down $0.05 on Tuesday, hitting $85.06. The company's stock had a trading volume of 451,745 shares, compared to its average volume of 419,985. The company has a fifty day moving average price of $98.88 and a 200-day moving average price of $91.42. The firm has a market cap of $4.71 billion, a P/E ratio of -92.45 and a beta of 1.09. Workiva Inc. has a one year low of $65.47 and a one year high of $116.83.

Wall Street Analysts Forecast Growth

Several brokerages have recently issued reports on WK. Stifel Nicolaus lowered their price target on Workiva from $130.00 to $120.00 and set a "buy" rating on the stock in a research report on Wednesday, February 26th. Robert W. Baird raised their target price on Workiva from $110.00 to $130.00 and gave the company an "outperform" rating in a report on Friday, December 13th. The Goldman Sachs Group lifted their price target on Workiva from $120.00 to $133.00 and gave the stock a "buy" rating in a research report on Tuesday, January 14th. BMO Capital Markets lowered their price objective on shares of Workiva from $120.00 to $108.00 and set an "outperform" rating on the stock in a research note on Wednesday, February 26th. Finally, Raymond James upgraded shares of Workiva from a "market perform" rating to an "outperform" rating and set a $135.00 target price for the company in a research note on Friday, January 3rd. One investment analyst has rated the stock with a hold rating and eight have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $121.57.

View Our Latest Report on Workiva

Insider Buying and Selling

In related news, CAO Brandon Ziegler sold 4,115 shares of Workiva stock in a transaction dated Friday, March 7th. The shares were sold at an average price of $85.72, for a total transaction of $352,737.80. Following the completion of the transaction, the chief accounting officer now directly owns 103,509 shares of the company's stock, valued at $8,872,791.48. This trade represents a 3.82 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, EVP Michael D. Hawkins sold 10,421 shares of the company's stock in a transaction dated Friday, March 7th. The stock was sold at an average price of $85.43, for a total transaction of $890,266.03. Following the sale, the executive vice president now directly owns 61,298 shares in the company, valued at $5,236,688.14. This represents a 14.53 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 20,129 shares of company stock worth $1,718,633 in the last 90 days. 3.86% of the stock is owned by company insiders.

About Workiva

(

Free Report)

Workiva Inc, together with its subsidiaries, provides cloud-based reporting solutions in the United States and internationally. The company offers Workiva platform, a multi-tenant cloud software that provides data linking capabilities; audit trail services; administrators access management; and allows customers to connect data from multiple enterprise resource planning, human capital management, and customer relationship management systems, as well as other third-party cloud and on-premise applications.

Featured Stories

Before you consider Workiva, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Workiva wasn't on the list.

While Workiva currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.