Aigen Investment Management LP bought a new position in shares of MSCI Inc. (NYSE:MSCI - Free Report) during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor bought 2,097 shares of the technology company's stock, valued at approximately $1,222,000.

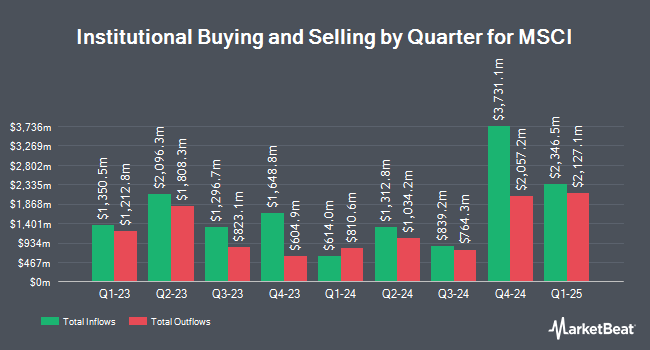

A number of other institutional investors also recently modified their holdings of MSCI. Frank Rimerman Advisors LLC raised its stake in shares of MSCI by 0.9% in the third quarter. Frank Rimerman Advisors LLC now owns 1,968 shares of the technology company's stock valued at $1,147,000 after acquiring an additional 17 shares in the last quarter. Conning Inc. increased its holdings in MSCI by 4.1% in the second quarter. Conning Inc. now owns 479 shares of the technology company's stock valued at $231,000 after buying an additional 19 shares during the last quarter. Capital Advisors Ltd. LLC increased its holdings in MSCI by 3.8% in the second quarter. Capital Advisors Ltd. LLC now owns 542 shares of the technology company's stock valued at $261,000 after buying an additional 20 shares during the last quarter. Concurrent Investment Advisors LLC increased its holdings in MSCI by 5.0% in the second quarter. Concurrent Investment Advisors LLC now owns 423 shares of the technology company's stock valued at $204,000 after buying an additional 20 shares during the last quarter. Finally, Commerzbank Aktiengesellschaft FI increased its holdings in MSCI by 3.5% in the second quarter. Commerzbank Aktiengesellschaft FI now owns 618 shares of the technology company's stock valued at $298,000 after buying an additional 21 shares during the last quarter. 89.97% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several equities analysts have issued reports on MSCI shares. Morgan Stanley raised their price objective on MSCI from $640.00 to $662.00 and gave the stock an "overweight" rating in a report on Wednesday, October 30th. Royal Bank of Canada restated an "outperform" rating and issued a $638.00 price objective on shares of MSCI in a research report on Wednesday, October 30th. Evercore ISI initiated coverage on shares of MSCI in a research report on Wednesday, October 2nd. They issued an "outperform" rating and a $690.00 price objective for the company. The Goldman Sachs Group lifted their price target on shares of MSCI from $526.00 to $590.00 and gave the company a "neutral" rating in a research report on Wednesday, July 24th. Finally, UBS Group reduced their price target on shares of MSCI from $695.00 to $680.00 and set a "buy" rating for the company in a research report on Wednesday, October 30th. Seven analysts have rated the stock with a hold rating and nine have issued a buy rating to the company's stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $631.83.

Read Our Latest Research Report on MSCI

MSCI Price Performance

MSCI stock traded up $7.89 during midday trading on Wednesday, hitting $610.53. The stock had a trading volume of 554,959 shares, compared to its average volume of 543,348. The firm has a market cap of $47.85 billion, a PE ratio of 40.50, a price-to-earnings-growth ratio of 3.13 and a beta of 1.11. MSCI Inc. has a 12-month low of $439.95 and a 12-month high of $631.70. The company's 50-day moving average price is $581.48 and its 200 day moving average price is $535.52.

MSCI (NYSE:MSCI - Get Free Report) last announced its quarterly earnings data on Tuesday, October 29th. The technology company reported $3.86 earnings per share (EPS) for the quarter, beating the consensus estimate of $3.77 by $0.09. MSCI had a net margin of 43.06% and a negative return on equity of 162.06%. The company had revenue of $724.70 million during the quarter, compared to analysts' expectations of $716.15 million. During the same period in the previous year, the company earned $3.45 EPS. The business's quarterly revenue was up 15.9% compared to the same quarter last year. As a group, sell-side analysts anticipate that MSCI Inc. will post 14.98 EPS for the current year.

MSCI Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Friday, November 29th. Shareholders of record on Friday, November 15th will be issued a $1.60 dividend. The ex-dividend date is Friday, November 15th. This represents a $6.40 dividend on an annualized basis and a yield of 1.05%. MSCI's dividend payout ratio is currently 42.02%.

About MSCI

(

Free Report)

MSCI Inc, together with its subsidiaries, provides critical decision support tools and solutions for the investment community to manage investment processes worldwide. The Index segment provides indexes for use in various areas of the investment process, including indexed financial product, such as ETFs, mutual funds, annuities, futures, options, structured products, and over-the-counter derivatives; performance benchmarking; portfolio construction and rebalancing; and asset allocation, as well as licenses GICS and GICS Direct.

See Also

Before you consider MSCI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MSCI wasn't on the list.

While MSCI currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.