Aigen Investment Management LP purchased a new stake in State Street Co. (NYSE:STT - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor purchased 27,154 shares of the asset manager's stock, valued at approximately $2,402,000.

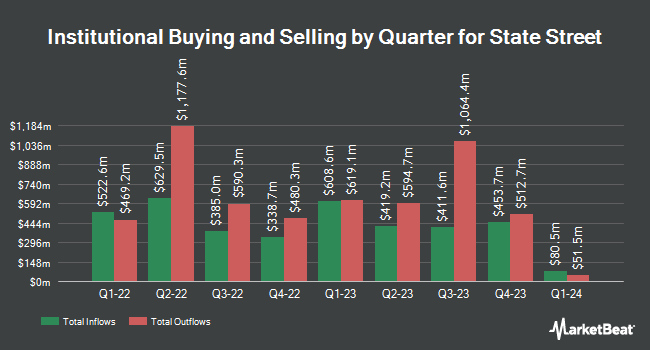

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in STT. Benjamin F. Edwards & Company Inc. increased its holdings in State Street by 5.4% during the 2nd quarter. Benjamin F. Edwards & Company Inc. now owns 2,514 shares of the asset manager's stock worth $186,000 after purchasing an additional 129 shares during the period. Massmutual Trust Co. FSB ADV lifted its position in shares of State Street by 9.3% during the 2nd quarter. Massmutual Trust Co. FSB ADV now owns 1,739 shares of the asset manager's stock valued at $129,000 after acquiring an additional 148 shares during the period. Rockland Trust Co. boosted its position in shares of State Street by 1.8% in the third quarter. Rockland Trust Co. now owns 8,332 shares of the asset manager's stock worth $737,000 after acquiring an additional 150 shares during the last quarter. Mather Group LLC. lifted its stake in shares of State Street by 10.9% during the second quarter. Mather Group LLC. now owns 1,613 shares of the asset manager's stock worth $125,000 after purchasing an additional 158 shares in the last quarter. Finally, Covestor Ltd grew its position in shares of State Street by 13.0% in the 1st quarter. Covestor Ltd now owns 1,539 shares of the asset manager's stock worth $119,000 after acquiring an additional 177 shares in the last quarter. 87.44% of the stock is owned by institutional investors.

Insider Transactions at State Street

In other State Street news, EVP John Plansky sold 13,859 shares of the company's stock in a transaction dated Friday, October 18th. The shares were sold at an average price of $91.32, for a total value of $1,265,603.88. Following the completion of the sale, the executive vice president now directly owns 55,108 shares of the company's stock, valued at approximately $5,032,462.56. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through the SEC website. 0.31% of the stock is owned by company insiders.

State Street Price Performance

State Street stock traded down $1.34 during midday trading on Tuesday, hitting $95.21. The company's stock had a trading volume of 1,938,799 shares, compared to its average volume of 2,223,303. State Street Co. has a 12 month low of $66.86 and a 12 month high of $98.45. The company has a quick ratio of 0.56, a current ratio of 0.56 and a debt-to-equity ratio of 0.91. The company has a market capitalization of $27.91 billion, a PE ratio of 15.04, a price-to-earnings-growth ratio of 1.21 and a beta of 1.46. The stock's 50-day moving average price is $89.21 and its 200-day moving average price is $81.65.

State Street (NYSE:STT - Get Free Report) last announced its quarterly earnings results on Tuesday, October 15th. The asset manager reported $2.26 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.12 by $0.14. State Street had a return on equity of 12.02% and a net margin of 9.87%. The company had revenue of $3.26 billion during the quarter, compared to the consensus estimate of $3.19 billion. During the same period in the prior year, the company earned $1.93 earnings per share. The company's revenue for the quarter was up 21.1% compared to the same quarter last year. Analysts anticipate that State Street Co. will post 8.38 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Several research analysts have weighed in on STT shares. Barclays upped their target price on State Street from $103.00 to $108.00 and gave the stock an "overweight" rating in a research report on Wednesday, October 16th. Royal Bank of Canada increased their price objective on State Street from $85.00 to $91.00 and gave the company a "sector perform" rating in a report on Wednesday, July 17th. Citigroup boosted their target price on shares of State Street from $85.00 to $90.00 and gave the company a "neutral" rating in a research note on Monday, July 22nd. Deutsche Bank Aktiengesellschaft increased their price objective on State Street from $90.00 to $95.00 and gave the company a "hold" rating in a research note on Monday. Finally, Morgan Stanley lifted their target price on shares of State Street from $100.00 to $102.00 and gave the stock an "equal weight" rating in a research report on Wednesday, October 16th. Two investment analysts have rated the stock with a sell rating, six have issued a hold rating and six have issued a buy rating to the company. Based on data from MarketBeat, State Street presently has an average rating of "Hold" and a consensus price target of $91.96.

View Our Latest Research Report on State Street

About State Street

(

Free Report)

State Street Corporation, through its subsidiaries, provides a range of financial products and services to institutional investors worldwide. The company offers investment servicing products and services, including custody, accounting, regulatory reporting, investor, and performance and analytics; middle office products, such as IBOR, transaction management, loans, cash, derivatives and collateral, record keeping, and client reporting and investment analytics; finance leasing; foreign exchange, and brokerage and other trading services; securities finance and enhanced custody products; deposit and short-term investment facilities; investment manager and alternative investment manager operations outsourcing; performance, risk, and compliance analytics; and financial data management to support institutional investors.

Read More

Before you consider State Street, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and State Street wasn't on the list.

While State Street currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.