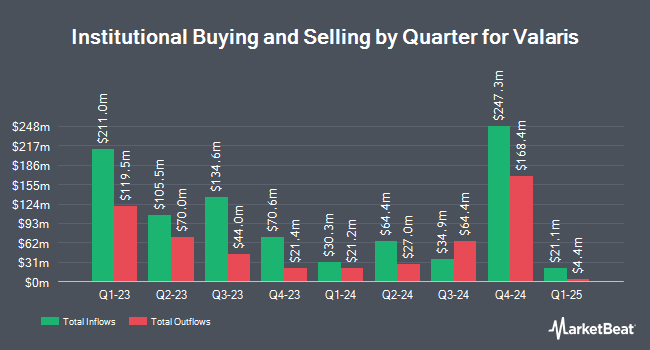

Aigen Investment Management LP bought a new stake in shares of Valaris Limited (NYSE:VAL - Free Report) in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 13,807 shares of the company's stock, valued at approximately $611,000.

A number of other hedge funds and other institutional investors also recently bought and sold shares of VAL. Quarry LP purchased a new stake in Valaris during the third quarter valued at approximately $25,000. Blue Trust Inc. lifted its position in Valaris by 41.0% during the fourth quarter. Blue Trust Inc. now owns 1,758 shares of the company's stock valued at $78,000 after acquiring an additional 511 shares during the last quarter. KBC Group NV lifted its position in Valaris by 63.3% during the fourth quarter. KBC Group NV now owns 2,929 shares of the company's stock valued at $130,000 after acquiring an additional 1,135 shares during the last quarter. Spire Wealth Management lifted its position in Valaris by 24.3% during the fourth quarter. Spire Wealth Management now owns 4,206 shares of the company's stock valued at $186,000 after acquiring an additional 821 shares during the last quarter. Finally, Loring Wolcott & Coolidge Fiduciary Advisors LLP MA acquired a new position in Valaris during the 4th quarter valued at approximately $243,000. Hedge funds and other institutional investors own 96.74% of the company's stock.

Analyst Ratings Changes

A number of research firms have recently weighed in on VAL. Evercore ISI lowered shares of Valaris from an "outperform" rating to an "in-line" rating and cut their price objective for the stock from $87.00 to $59.00 in a research note on Wednesday, January 15th. StockNews.com raised shares of Valaris to a "sell" rating in a report on Thursday, February 20th. JPMorgan Chase & Co. started coverage on shares of Valaris in a report on Friday, December 6th. They set an "underweight" rating and a $40.00 price objective on the stock. Barclays decreased their price target on shares of Valaris from $49.00 to $46.00 and set an "equal weight" rating on the stock in a research note on Tuesday, February 25th. Finally, Citigroup raised their price objective on shares of Valaris from $47.00 to $48.00 and gave the stock a "neutral" rating in a research report on Thursday, January 30th. Two research analysts have rated the stock with a sell rating and six have issued a hold rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Hold" and an average price target of $55.00.

Check Out Our Latest Analysis on Valaris

Valaris Stock Performance

Valaris stock traded up $2.55 during trading hours on Friday, reaching $37.38. 3,492,917 shares of the stock were exchanged, compared to its average volume of 1,284,066. The stock has a market cap of $2.65 billion, a P/E ratio of 7.27 and a beta of 1.16. The company has a debt-to-equity ratio of 0.48, a quick ratio of 1.61 and a current ratio of 1.59. Valaris Limited has a 52-week low of $31.15 and a 52-week high of $84.20. The firm's 50 day moving average is $44.36 and its 200 day moving average is $48.70.

Valaris (NYSE:VAL - Get Free Report) last announced its quarterly earnings results on Wednesday, February 19th. The company reported $1.88 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.20 by $0.68. The business had revenue of $584.40 million during the quarter, compared to the consensus estimate of $578.01 million. Valaris had a net margin of 15.81% and a return on equity of 17.40%. Analysts predict that Valaris Limited will post 3.96 EPS for the current fiscal year.

Valaris Company Profile

(

Free Report)

Valaris Limited, together with its subsidiaries, provides offshore contract drilling services Gulf of Mexico, South America, North Sea, the Middle East, Africa, and the Asia Pacific. The company operates through four segments: Floaters, Jackups, ARO, and Other. It owns an offshore drilling rig fleet, which include drillships, dynamically positioned semisubmersible rigs, moored semisubmersible rig, and jackup rigs.

See Also

Before you consider Valaris, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Valaris wasn't on the list.

While Valaris currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.