Aigen Investment Management LP bought a new stake in Vishay Intertechnology, Inc. (NYSE:VSH - Free Report) during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor bought 35,336 shares of the semiconductor company's stock, valued at approximately $668,000.

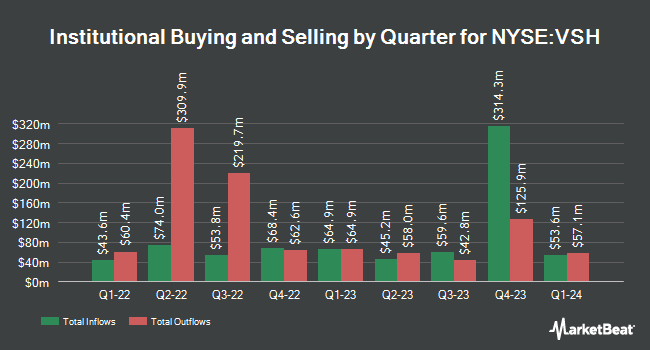

A number of other institutional investors also recently modified their holdings of VSH. Headlands Technologies LLC increased its stake in Vishay Intertechnology by 95.7% in the first quarter. Headlands Technologies LLC now owns 1,583 shares of the semiconductor company's stock valued at $36,000 after purchasing an additional 774 shares in the last quarter. Russell Investments Group Ltd. raised its position in shares of Vishay Intertechnology by 403.6% during the first quarter. Russell Investments Group Ltd. now owns 346,017 shares of the semiconductor company's stock worth $7,848,000 after purchasing an additional 277,311 shares during the period. State Board of Administration of Florida Retirement System grew its position in Vishay Intertechnology by 31.7% in the 1st quarter. State Board of Administration of Florida Retirement System now owns 129,201 shares of the semiconductor company's stock valued at $2,923,000 after purchasing an additional 31,115 shares during the period. M&G Plc acquired a new position in Vishay Intertechnology during the first quarter worth $6,016,000. Finally, Mizuho Markets Americas LLC grew its holdings in shares of Vishay Intertechnology by 8.0% during the first quarter. Mizuho Markets Americas LLC now owns 1,019,508 shares of the semiconductor company's stock valued at $23,122,000 after buying an additional 75,100 shares during the last quarter. 93.66% of the stock is owned by institutional investors.

Vishay Intertechnology Stock Down 2.1 %

NYSE:VSH traded down $0.35 on Thursday, hitting $15.98. The stock had a trading volume of 732,509 shares, compared to its average volume of 1,222,835. Vishay Intertechnology, Inc. has a 1 year low of $15.98 and a 1 year high of $24.72. The firm's fifty day simple moving average is $17.97 and its two-hundred day simple moving average is $20.82. The stock has a market cap of $2.19 billion, a P/E ratio of 26.34 and a beta of 1.09. The company has a debt-to-equity ratio of 0.38, a quick ratio of 1.85 and a current ratio of 2.81.

Vishay Intertechnology (NYSE:VSH - Get Free Report) last posted its quarterly earnings data on Wednesday, November 6th. The semiconductor company reported $0.08 earnings per share for the quarter, missing the consensus estimate of $0.14 by ($0.06). Vishay Intertechnology had a return on equity of 5.35% and a net margin of 2.88%. The business had revenue of $735.35 million during the quarter, compared to analysts' expectations of $748.84 million. The firm's revenue for the quarter was down 13.9% on a year-over-year basis. During the same period in the prior year, the firm posted $0.60 EPS. Analysts predict that Vishay Intertechnology, Inc. will post 0.55 earnings per share for the current year.

Vishay Intertechnology Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Thursday, December 12th. Shareholders of record on Tuesday, December 3rd will be paid a $0.10 dividend. This represents a $0.40 dividend on an annualized basis and a yield of 2.50%. The ex-dividend date of this dividend is Tuesday, December 3rd. Vishay Intertechnology's payout ratio is 64.52%.

Analysts Set New Price Targets

A number of equities analysts have issued reports on VSH shares. StockNews.com downgraded Vishay Intertechnology from a "hold" rating to a "sell" rating in a research note on Monday. TD Cowen lowered their price target on Vishay Intertechnology from $24.00 to $22.00 and set a "hold" rating for the company in a research report on Thursday, August 8th.

View Our Latest Report on Vishay Intertechnology

Vishay Intertechnology Company Profile

(

Free Report)

Vishay Intertechnology, Inc manufactures and sells discrete semiconductors and passive electronic components in Asia, Europe, and the Americas. The company operates through Metal Oxide Semiconductor Field Effect Transistors (MOSFETs), Diodes, Optoelectronic Components, Resistors, Inductors, and Capacitors segments.

Read More

Before you consider Vishay Intertechnology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vishay Intertechnology wasn't on the list.

While Vishay Intertechnology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.