Aigen Investment Management LP purchased a new stake in Dropbox, Inc. (NASDAQ:DBX - Free Report) in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor purchased 18,952 shares of the company's stock, valued at approximately $482,000.

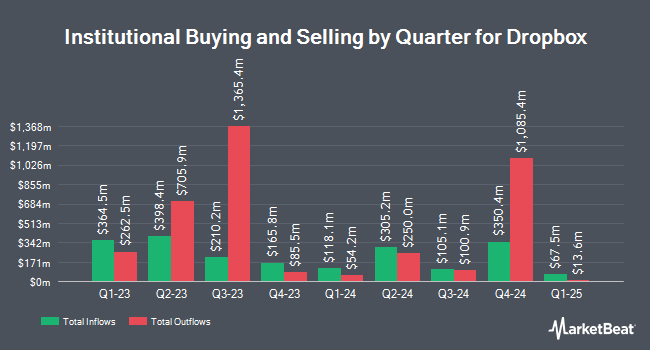

Several other hedge funds have also made changes to their positions in DBX. Capital Performance Advisors LLP acquired a new position in shares of Dropbox in the 3rd quarter valued at about $28,000. V Square Quantitative Management LLC acquired a new position in Dropbox in the 3rd quarter valued at approximately $31,000. GAMMA Investing LLC lifted its position in Dropbox by 274.0% in the 2nd quarter. GAMMA Investing LLC now owns 1,238 shares of the company's stock worth $28,000 after buying an additional 907 shares in the last quarter. Fifth Third Bancorp boosted its stake in shares of Dropbox by 548.8% during the 2nd quarter. Fifth Third Bancorp now owns 1,382 shares of the company's stock valued at $31,000 after buying an additional 1,169 shares during the period. Finally, UMB Bank n.a. grew its holdings in shares of Dropbox by 2,479.4% during the 3rd quarter. UMB Bank n.a. now owns 1,754 shares of the company's stock valued at $45,000 after acquiring an additional 1,686 shares in the last quarter. Hedge funds and other institutional investors own 94.84% of the company's stock.

Wall Street Analyst Weigh In

Separately, UBS Group cut their price objective on Dropbox from $30.00 to $28.00 and set a "buy" rating for the company in a report on Friday, August 9th. Two equities research analysts have rated the stock with a sell rating, three have issued a hold rating and two have assigned a buy rating to the company's stock. According to data from MarketBeat, Dropbox presently has an average rating of "Hold" and a consensus price target of $28.67.

View Our Latest Report on DBX

Dropbox Price Performance

Shares of DBX stock traded down $0.61 on Friday, hitting $27.06. The company's stock had a trading volume of 2,286,528 shares, compared to its average volume of 3,688,146. The stock has a market capitalization of $8.81 billion, a price-to-earnings ratio of 15.64, a P/E/G ratio of 1.78 and a beta of 0.61. Dropbox, Inc. has a fifty-two week low of $20.68 and a fifty-two week high of $33.43. The firm's fifty day moving average price is $25.67 and its 200-day moving average price is $23.86.

Insiders Place Their Bets

In other Dropbox news, CFO Timothy Regan sold 3,177 shares of the company's stock in a transaction dated Thursday, September 19th. The shares were sold at an average price of $25.00, for a total transaction of $79,425.00. Following the completion of the sale, the chief financial officer now directly owns 481,747 shares in the company, valued at $12,043,675. This represents a 0.66 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Andrew Houston sold 3,493 shares of the firm's stock in a transaction dated Thursday, September 19th. The shares were sold at an average price of $25.00, for a total value of $87,325.00. Following the completion of the sale, the chief executive officer now directly owns 8,266,666 shares in the company, valued at approximately $206,666,650. This represents a 0.04 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 459,952 shares of company stock valued at $11,544,337 over the last quarter. Insiders own 26.40% of the company's stock.

Dropbox Company Profile

(

Free Report)

Dropbox, Inc provides a content collaboration platform worldwide. The company's platform allows individuals, families, teams, and organizations to collaborate and sign up for free through its website or app, as well as upgrade to a paid subscription plan for premium features. It serves customers in professional services, technology, media, education, industrial, consumer and retail, and financial services industries.

Featured Stories

Before you consider Dropbox, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dropbox wasn't on the list.

While Dropbox currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.