Aigen Investment Management LP bought a new position in Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm bought 723 shares of the biopharmaceutical company's stock, valued at approximately $760,000.

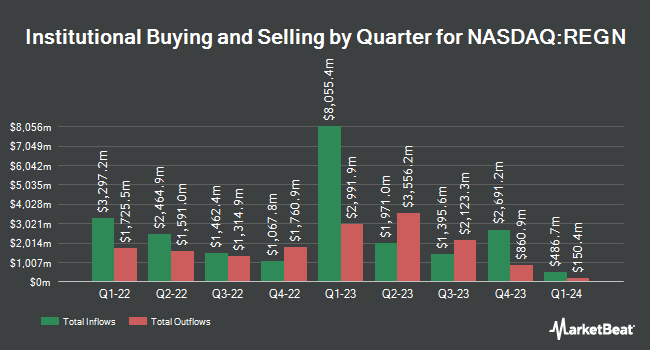

A number of other large investors have also bought and sold shares of the company. International Assets Investment Management LLC boosted its stake in Regeneron Pharmaceuticals by 86,013.3% during the third quarter. International Assets Investment Management LLC now owns 880,939 shares of the biopharmaceutical company's stock valued at $926,078,000 after buying an additional 879,916 shares during the period. Capital International Investors boosted its stake in Regeneron Pharmaceuticals by 7.3% during the first quarter. Capital International Investors now owns 3,129,010 shares of the biopharmaceutical company's stock valued at $3,011,640,000 after buying an additional 213,038 shares during the period. Price T Rowe Associates Inc. MD boosted its stake in Regeneron Pharmaceuticals by 25.7% during the first quarter. Price T Rowe Associates Inc. MD now owns 902,613 shares of the biopharmaceutical company's stock valued at $868,757,000 after buying an additional 184,561 shares during the period. Swedbank AB bought a new stake in Regeneron Pharmaceuticals during the first quarter valued at $129,257,000. Finally, Epoch Investment Partners Inc. bought a new stake in Regeneron Pharmaceuticals during the first quarter valued at $99,667,000. 83.31% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other Regeneron Pharmaceuticals news, CFO Christopher R. Fenimore sold 5,680 shares of the company's stock in a transaction that occurred on Wednesday, August 28th. The stock was sold at an average price of $1,205.33, for a total transaction of $6,846,274.40. Following the transaction, the chief financial officer now owns 15,305 shares in the company, valued at approximately $18,447,575.65. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Company insiders own 7.48% of the company's stock.

Regeneron Pharmaceuticals Trading Down 2.0 %

REGN traded down $16.67 during midday trading on Wednesday, reaching $804.33. 589,526 shares of the company's stock traded hands, compared to its average volume of 524,091. The firm has a fifty day moving average of $1,007.57 and a two-hundred day moving average of $1,037.30. The stock has a market capitalization of $88.39 billion, a price-to-earnings ratio of 19.90, a P/E/G ratio of 3.10 and a beta of 0.15. The company has a debt-to-equity ratio of 0.09, a current ratio of 5.28 and a quick ratio of 4.46. Regeneron Pharmaceuticals, Inc. has a 52 week low of $784.96 and a 52 week high of $1,211.20.

Analysts Set New Price Targets

REGN has been the topic of a number of research reports. Evercore ISI lowered their price target on Regeneron Pharmaceuticals from $1,250.00 to $1,175.00 and set an "outperform" rating on the stock in a research report on Thursday, October 24th. Morgan Stanley lowered their price target on Regeneron Pharmaceuticals from $1,235.00 to $1,184.00 and set an "overweight" rating on the stock in a research report on Friday, November 1st. Piper Sandler lowered their price target on Regeneron Pharmaceuticals from $1,242.00 to $1,195.00 and set an "overweight" rating on the stock in a research report on Friday, November 1st. Cantor Fitzgerald restated a "neutral" rating and set a $1,015.00 price target on shares of Regeneron Pharmaceuticals in a research report on Wednesday, October 23rd. Finally, Leerink Partners restated a "market perform" rating and set a $1,077.00 price target (down previously from $1,175.00) on shares of Regeneron Pharmaceuticals in a research report on Tuesday, September 24th. One investment analyst has rated the stock with a sell rating, three have issued a hold rating and eighteen have assigned a buy rating to the company. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $1,107.25.

Get Our Latest Research Report on Regeneron Pharmaceuticals

Regeneron Pharmaceuticals Company Profile

(

Free Report)

Regeneron Pharmaceuticals, Inc discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide. The company's products include EYLEA injection to treat wet age-related macular degeneration and diabetic macular edema; myopic choroidal neovascularization; diabetic retinopathy; neovascular glaucoma; and retinopathy of prematurity.

Featured Stories

Before you consider Regeneron Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regeneron Pharmaceuticals wasn't on the list.

While Regeneron Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.