Amalgamated Bank lessened its position in Air Lease Co. (NYSE:AL - Free Report) by 30.0% in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 32,468 shares of the transportation company's stock after selling 13,930 shares during the quarter. Amalgamated Bank's holdings in Air Lease were worth $1,470,000 as of its most recent filing with the Securities & Exchange Commission.

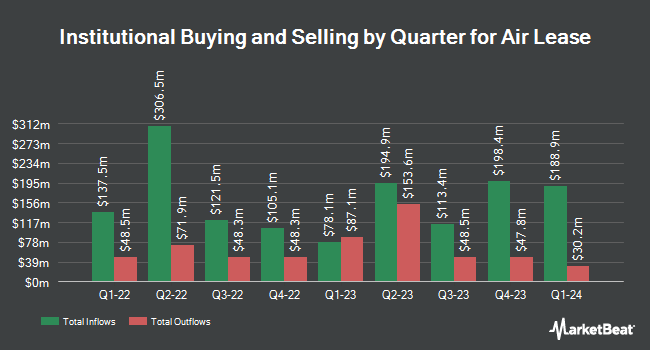

Several other hedge funds also recently made changes to their positions in AL. Vanguard Group Inc. boosted its stake in Air Lease by 23.6% during the 1st quarter. Vanguard Group Inc. now owns 12,578,106 shares of the transportation company's stock valued at $647,018,000 after purchasing an additional 2,404,649 shares during the last quarter. Artemis Investment Management LLP purchased a new stake in Air Lease in the second quarter worth approximately $22,339,000. Earnest Partners LLC grew its position in Air Lease by 19.4% in the 1st quarter. Earnest Partners LLC now owns 2,113,615 shares of the transportation company's stock worth $108,724,000 after purchasing an additional 343,360 shares during the period. Principal Financial Group Inc. grew its holdings in shares of Air Lease by 42.6% in the second quarter. Principal Financial Group Inc. now owns 760,160 shares of the transportation company's stock worth $36,130,000 after acquiring an additional 227,274 shares during the period. Finally, Boston Partners grew its holdings in shares of Air Lease by 239.9% in the first quarter. Boston Partners now owns 307,657 shares of the transportation company's stock worth $15,827,000 after acquiring an additional 217,153 shares during the period. 94.59% of the stock is currently owned by institutional investors.

Air Lease Price Performance

AL stock traded up $0.92 during trading on Wednesday, reaching $49.26. The company's stock had a trading volume of 245,665 shares, compared to its average volume of 966,246. The company's fifty day moving average is $44.51 and its 200-day moving average is $46.18. Air Lease Co. has a 1 year low of $37.29 and a 1 year high of $52.31. The company has a market capitalization of $5.49 billion, a P/E ratio of 11.02, a price-to-earnings-growth ratio of 1.44 and a beta of 1.59. The company has a quick ratio of 0.43, a current ratio of 0.43 and a debt-to-equity ratio of 2.63.

Air Lease Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Thursday, January 9th. Investors of record on Thursday, December 12th will be issued a $0.22 dividend. The ex-dividend date of this dividend is Thursday, December 12th. This is a boost from Air Lease's previous quarterly dividend of $0.21. This represents a $0.88 dividend on an annualized basis and a yield of 1.79%. Air Lease's payout ratio is currently 19.13%.

Analysts Set New Price Targets

Several analysts recently commented on AL shares. TD Cowen started coverage on Air Lease in a report on Monday, July 29th. They issued a "buy" rating and a $58.00 price objective for the company. Barclays reduced their price target on Air Lease from $55.00 to $54.00 and set an "overweight" rating for the company in a research report on Friday, August 2nd. Finally, JPMorgan Chase & Co. boosted their price objective on Air Lease from $52.00 to $56.00 and gave the company an "overweight" rating in a research note on Tuesday. One investment analyst has rated the stock with a hold rating and four have issued a buy rating to the company's stock. According to MarketBeat.com, Air Lease has an average rating of "Moderate Buy" and a consensus price target of $55.75.

View Our Latest Stock Report on Air Lease

Air Lease Company Profile

(

Free Report)

Air Lease Corporation, an aircraft leasing company, engages in the purchase and leasing of commercial jet aircraft to airlines worldwide. It sells aircraft from its fleet to third parties, including other leasing companies, financial services companies, airlines, and other investors. The company provides fleet management services to investors and owners of aircraft portfolios.

Featured Articles

Before you consider Air Lease, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Air Lease wasn't on the list.

While Air Lease currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.