Air Products and Chemicals (NYSE:APD - Get Free Report) was upgraded by stock analysts at UBS Group from a "neutral" rating to a "buy" rating in a research report issued on Monday, Marketbeat Ratings reports. The firm currently has a $375.00 price target on the basic materials company's stock. UBS Group's price objective indicates a potential upside of 14.37% from the stock's previous close.

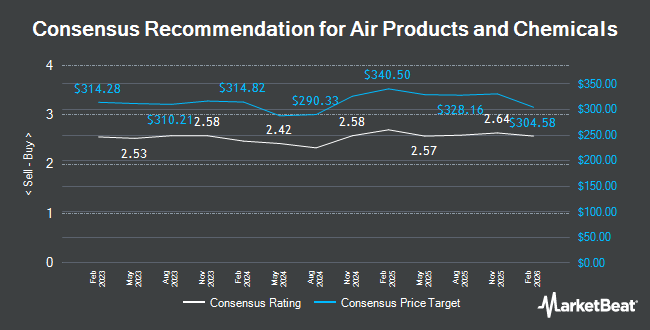

A number of other equities research analysts also recently commented on the company. Citigroup raised their target price on Air Products and Chemicals from $345.00 to $365.00 and gave the company a "buy" rating in a report on Monday, November 11th. JPMorgan Chase & Co. decreased their price objective on shares of Air Products and Chemicals from $350.00 to $345.00 and set an "overweight" rating on the stock in a report on Friday, November 8th. Jefferies Financial Group raised shares of Air Products and Chemicals from a "hold" rating to a "buy" rating and increased their target price for the company from $295.00 to $364.00 in a report on Monday, October 7th. The Goldman Sachs Group raised their target price on shares of Air Products and Chemicals from $291.00 to $330.00 and gave the company a "buy" rating in a report on Monday, August 5th. Finally, Redburn Atlantic upgraded Air Products and Chemicals from a "sell" rating to a "neutral" rating and set a $330.00 price target for the company in a report on Friday, October 25th. Eight research analysts have rated the stock with a hold rating and twelve have issued a buy rating to the company's stock. According to MarketBeat, Air Products and Chemicals presently has an average rating of "Moderate Buy" and an average price target of $331.53.

View Our Latest Stock Report on APD

Air Products and Chemicals Stock Performance

Shares of Air Products and Chemicals stock traded up $10.79 on Monday, reaching $327.89. 1,896,266 shares of the stock were exchanged, compared to its average volume of 1,611,334. The company has a current ratio of 1.52, a quick ratio of 1.34 and a debt-to-equity ratio of 0.72. The firm has a market capitalization of $72.89 billion, a PE ratio of 18.46, a PEG ratio of 3.18 and a beta of 0.81. Air Products and Chemicals has a 1-year low of $212.24 and a 1-year high of $332.42. The business has a fifty day moving average price of $305.56 and a two-hundred day moving average price of $280.26.

Hedge Funds Weigh In On Air Products and Chemicals

A number of large investors have recently bought and sold shares of APD. Town & Country Bank & Trust CO dba First Bankers Trust CO grew its position in Air Products and Chemicals by 0.3% in the 3rd quarter. Town & Country Bank & Trust CO dba First Bankers Trust CO now owns 11,593 shares of the basic materials company's stock worth $3,452,000 after purchasing an additional 34 shares during the last quarter. CX Institutional lifted its stake in shares of Air Products and Chemicals by 2.6% in the 3rd quarter. CX Institutional now owns 1,343 shares of the basic materials company's stock valued at $400,000 after purchasing an additional 34 shares during the last quarter. Bank of Stockton increased its position in Air Products and Chemicals by 1.9% during the third quarter. Bank of Stockton now owns 1,813 shares of the basic materials company's stock worth $540,000 after buying an additional 34 shares during the last quarter. Cape Investment Advisory Inc. lifted its position in shares of Air Products and Chemicals by 1.0% in the first quarter. Cape Investment Advisory Inc. now owns 3,740 shares of the basic materials company's stock worth $906,000 after buying an additional 37 shares during the last quarter. Finally, Exchange Traded Concepts LLC boosted its stake in shares of Air Products and Chemicals by 22.3% during the 3rd quarter. Exchange Traded Concepts LLC now owns 203 shares of the basic materials company's stock worth $60,000 after acquiring an additional 37 shares in the last quarter. Institutional investors own 81.66% of the company's stock.

About Air Products and Chemicals

(

Get Free Report)

Air Products and Chemicals, Inc provides atmospheric gases, process and specialty gases, equipment, and related services in the Americas, Asia, Europe, the Middle East, India, and internationally. The company produces atmospheric gases, including oxygen, nitrogen, and argon; process gases, such as hydrogen, helium, carbon dioxide, carbon monoxide, and syngas; and specialty gases for customers in various industries, including refining, chemical, manufacturing, electronics, energy production, medical, food, and metals.

Featured Stories

Before you consider Air Products and Chemicals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Air Products and Chemicals wasn't on the list.

While Air Products and Chemicals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.