Josh Arnold Investment Consultant LLC reduced its holdings in shares of Airbnb, Inc. (NASDAQ:ABNB - Free Report) by 29.4% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 9,465 shares of the company's stock after selling 3,950 shares during the quarter. Airbnb makes up 1.0% of Josh Arnold Investment Consultant LLC's investment portfolio, making the stock its 6th largest position. Josh Arnold Investment Consultant LLC's holdings in Airbnb were worth $1,200,000 as of its most recent SEC filing.

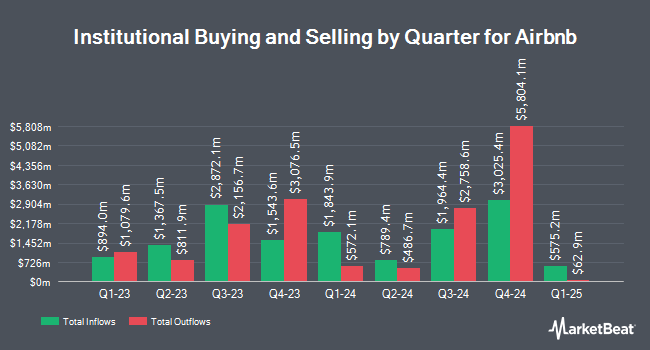

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. True Wealth Design LLC raised its holdings in shares of Airbnb by 11,660.0% in the third quarter. True Wealth Design LLC now owns 588 shares of the company's stock worth $75,000 after acquiring an additional 583 shares during the last quarter. Edgestream Partners L.P. purchased a new stake in Airbnb during the 3rd quarter worth about $899,000. Caisse DE Depot ET Placement DU Quebec raised its stake in Airbnb by 120.8% in the 3rd quarter. Caisse DE Depot ET Placement DU Quebec now owns 626,351 shares of the company's stock valued at $79,428,000 after purchasing an additional 342,667 shares during the last quarter. Infusive Asset Management Inc. purchased a new position in Airbnb in the 3rd quarter valued at about $1,769,000. Finally, Crawford Fund Management LLC acquired a new stake in shares of Airbnb during the 3rd quarter worth about $3,012,000. Institutional investors and hedge funds own 80.76% of the company's stock.

Insider Buying and Selling

In related news, CTO Aristotle N. Balogh sold 600 shares of the business's stock in a transaction dated Tuesday, September 17th. The stock was sold at an average price of $120.00, for a total value of $72,000.00. Following the completion of the sale, the chief technology officer now directly owns 195,844 shares of the company's stock, valued at $23,501,280. The trade was a 0.31 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, insider Nathan Blecharczyk sold 9,603 shares of the stock in a transaction that occurred on Wednesday, November 20th. The stock was sold at an average price of $130.22, for a total value of $1,250,502.66. Following the transaction, the insider now directly owns 164,850 shares in the company, valued at approximately $21,466,767. This represents a 5.50 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 718,017 shares of company stock worth $91,842,052. Insiders own 27.83% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts have recently weighed in on the stock. Robert W. Baird boosted their price objective on shares of Airbnb from $120.00 to $140.00 and gave the company a "neutral" rating in a research report on Friday, November 8th. Deutsche Bank Aktiengesellschaft reduced their price target on Airbnb from $143.00 to $90.00 and set a "hold" rating on the stock in a research note on Wednesday, August 7th. BMO Capital Markets lowered their price objective on Airbnb from $151.00 to $130.00 and set a "market perform" rating for the company in a research report on Wednesday, August 7th. JPMorgan Chase & Co. upped their target price on Airbnb from $121.00 to $142.00 and gave the company a "neutral" rating in a research note on Friday, November 8th. Finally, Truist Financial decreased their price target on Airbnb from $134.00 to $124.00 and set a "hold" rating on the stock in a research note on Wednesday, September 4th. Six investment analysts have rated the stock with a sell rating, eighteen have given a hold rating and eight have given a buy rating to the company's stock. Based on data from MarketBeat.com, Airbnb currently has an average rating of "Hold" and a consensus price target of $138.97.

Check Out Our Latest Report on Airbnb

Airbnb Stock Down 1.6 %

NASDAQ:ABNB traded down $2.17 on Friday, reaching $136.11. The stock had a trading volume of 2,664,219 shares, compared to its average volume of 5,739,123. Airbnb, Inc. has a 12-month low of $110.38 and a 12-month high of $170.10. The stock has a market cap of $86.29 billion, a P/E ratio of 47.76, a price-to-earnings-growth ratio of 1.93 and a beta of 1.15. The company has a current ratio of 1.62, a quick ratio of 1.62 and a debt-to-equity ratio of 0.23. The company has a 50-day moving average of $134.15 and a 200 day moving average of $135.32.

Airbnb (NASDAQ:ABNB - Get Free Report) last issued its quarterly earnings data on Thursday, November 7th. The company reported $2.13 earnings per share for the quarter, missing analysts' consensus estimates of $2.17 by ($0.04). Airbnb had a net margin of 16.96% and a return on equity of 32.88%. The business had revenue of $3.73 billion for the quarter, compared to analyst estimates of $3.72 billion. During the same quarter last year, the business earned $2.39 EPS. On average, research analysts predict that Airbnb, Inc. will post 4.02 earnings per share for the current year.

Airbnb Company Profile

(

Free Report)

Airbnb, Inc, together with its subsidiaries, operates a platform that enables hosts to offer stays and experiences to guests worldwide. The company's marketplace connects hosts and guests online or through mobile devices to book spaces and experiences. It primarily offers private rooms, primary homes, and vacation homes.

Recommended Stories

Before you consider Airbnb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Airbnb wasn't on the list.

While Airbnb currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.