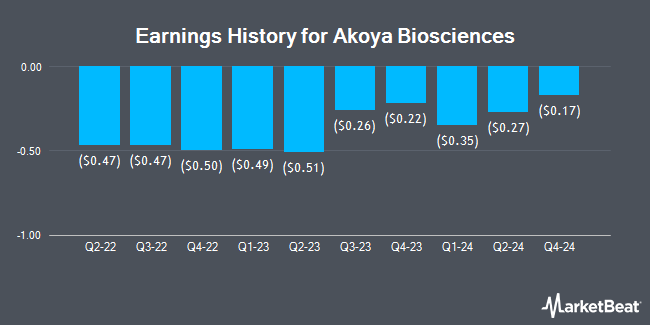

Akoya Biosciences (NASDAQ:AKYA - Get Free Report) released its earnings results on Monday. The company reported ($0.17) EPS for the quarter, missing the consensus estimate of ($0.15) by ($0.02), Zacks reports. Akoya Biosciences had a negative net margin of 66.77% and a negative return on equity of 162.99%. The firm had revenue of $21.34 million during the quarter, compared to the consensus estimate of $21.34 million.

Akoya Biosciences Price Performance

Shares of Akoya Biosciences stock traded up $0.06 during midday trading on Friday, hitting $1.74. 73,441 shares of the company traded hands, compared to its average volume of 345,480. The stock has a market cap of $86.43 million, a price-to-earnings ratio of -1.47 and a beta of 1.32. The company has a debt-to-equity ratio of 5.62, a quick ratio of 1.85 and a current ratio of 2.75. The firm's fifty day moving average price is $2.26 and its 200-day moving average price is $2.51. Akoya Biosciences has a 12 month low of $1.39 and a 12 month high of $5.16.

Institutional Investors Weigh In On Akoya Biosciences

An institutional investor recently raised its position in Akoya Biosciences stock. Bank of America Corp DE increased its holdings in shares of Akoya Biosciences, Inc. (NASDAQ:AKYA - Free Report) by 39.6% during the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 29,092 shares of the company's stock after buying an additional 8,258 shares during the period. Bank of America Corp DE owned about 0.06% of Akoya Biosciences worth $67,000 at the end of the most recent quarter. Institutional investors and hedge funds own 79.42% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts have commented on the stock. Canaccord Genuity Group lowered shares of Akoya Biosciences from a "strong-buy" rating to a "hold" rating in a report on Monday, January 13th. Piper Sandler lowered shares of Akoya Biosciences from an "overweight" rating to a "neutral" rating and set a $2.40 target price on the stock. in a report on Wednesday, March 5th. Finally, Stephens reissued an "overweight" rating and issued a $3.50 target price on shares of Akoya Biosciences in a report on Tuesday. Six equities research analysts have rated the stock with a hold rating and one has assigned a buy rating to the company's stock. According to data from MarketBeat, Akoya Biosciences presently has an average rating of "Hold" and an average target price of $3.90.

View Our Latest Research Report on AKYA

Akoya Biosciences Company Profile

(

Get Free Report)

Akoya Biosciences, Inc, a life sciences technology company, provides spatial biology solutions focused on transforming discovery and clinical research in North America, the Asia Pacific, Europe, the Middle East, and Africa. The company offers PhenoCycler instrument, a compact bench-top fluidics system that integrates with a companion microscope to automate image acquisition; and PhenoImager platform that enables researchers to visualize, analyze, quantify, and phenotype cells in situ, in fresh frozen or FFPE tissue sections, and tissue microarrays utilizing an automated and high-throughput workflow.

Featured Stories

Before you consider Akoya Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Akoya Biosciences wasn't on the list.

While Akoya Biosciences currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.