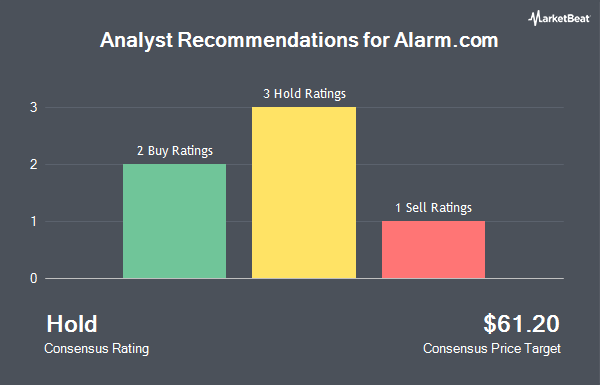

Alarm.com Holdings, Inc. (NASDAQ:ALRM - Get Free Report) has been assigned a consensus rating of "Hold" from the six ratings firms that are presently covering the firm, MarketBeat Ratings reports. One investment analyst has rated the stock with a sell rating, three have given a hold rating and two have issued a buy rating on the company. The average twelve-month price objective among brokers that have updated their coverage on the stock in the last year is $64.40.

Several analysts have recently issued reports on ALRM shares. Barclays increased their target price on Alarm.com from $60.00 to $67.00 and gave the stock an "equal weight" rating in a report on Friday, November 8th. Roth Mkm reduced their target price on Alarm.com from $78.00 to $73.00 and set a "buy" rating on the stock in a report on Wednesday, October 9th. Jefferies Financial Group started coverage on Alarm.com in a research report on Tuesday, November 5th. They set a "buy" rating and a $65.00 price objective for the company. StockNews.com downgraded Alarm.com from a "buy" rating to a "hold" rating in a research report on Monday. Finally, JPMorgan Chase & Co. reiterated an "underweight" rating and issued a $50.00 target price (down from $65.00) on shares of Alarm.com in a research report on Monday.

Get Our Latest Stock Report on Alarm.com

Insiders Place Their Bets

In other Alarm.com news, CFO Steve Valenzuela sold 7,400 shares of the company's stock in a transaction on Thursday, August 22nd. The shares were sold at an average price of $60.27, for a total value of $445,998.00. Following the completion of the transaction, the chief financial officer now directly owns 37,500 shares in the company, valued at approximately $2,260,125. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. In other news, insider Daniel Ramos sold 9,476 shares of the company's stock in a transaction dated Friday, August 23rd. The shares were sold at an average price of $61.81, for a total value of $585,711.56. Following the sale, the insider now directly owns 41,100 shares of the company's stock, valued at $2,540,391. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CFO Steve Valenzuela sold 7,400 shares of the company's stock in a transaction dated Thursday, August 22nd. The stock was sold at an average price of $60.27, for a total transaction of $445,998.00. Following the completion of the sale, the chief financial officer now directly owns 37,500 shares in the company, valued at $2,260,125. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 5.60% of the company's stock.

Institutional Trading of Alarm.com

Hedge funds and other institutional investors have recently modified their holdings of the business. Assenagon Asset Management S.A. grew its position in Alarm.com by 230.6% during the 3rd quarter. Assenagon Asset Management S.A. now owns 381,277 shares of the software maker's stock valued at $20,844,000 after purchasing an additional 265,936 shares during the last quarter. Bank of Montreal Can boosted its stake in Alarm.com by 2,394.6% during the second quarter. Bank of Montreal Can now owns 273,730 shares of the software maker's stock worth $17,406,000 after buying an additional 262,757 shares during the period. M&G PLC bought a new position in Alarm.com in the third quarter worth about $9,583,000. Disciplined Growth Investors Inc. MN raised its holdings in Alarm.com by 6.2% in the second quarter. Disciplined Growth Investors Inc. MN now owns 2,710,998 shares of the software maker's stock worth $172,257,000 after purchasing an additional 158,465 shares in the last quarter. Finally, Federated Hermes Inc. grew its stake in shares of Alarm.com by 1,729.4% during the second quarter. Federated Hermes Inc. now owns 118,231 shares of the software maker's stock worth $7,512,000 after acquiring an additional 111,768 shares during the last quarter. 91.74% of the stock is owned by hedge funds and other institutional investors.

Alarm.com Stock Performance

Shares of ALRM stock traded up $0.45 during trading on Wednesday, reaching $60.95. 599,130 shares of the company's stock were exchanged, compared to its average volume of 373,852. The company has a quick ratio of 8.20, a current ratio of 8.66 and a debt-to-equity ratio of 1.42. The firm's fifty day moving average price is $54.90 and its 200-day moving average price is $61.25. Alarm.com has a twelve month low of $51.87 and a twelve month high of $77.29. The stock has a market capitalization of $3.01 billion, a PE ratio of 26.46, a PEG ratio of 4.24 and a beta of 0.90.

Alarm.com Company Profile

(

Get Free ReportAlarm.com Holdings, Inc provides various Internet of Things (IoT) and solutions for residential, multi-family, small business, and enterprise commercial markets in North America and internationally. The company operates through two segments, Alarm.com and Other. It offers solutions to control and monitor security systems, as well as to IoT devices, including door locks, garage doors, thermostats, and video cameras; and video monitoring and analytics solutions, such as video analytics, escalated events, video doorbells, intelligent integration, live streaming, secure cloud storage, and video alerts.

Featured Stories

Before you consider Alarm.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alarm.com wasn't on the list.

While Alarm.com currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.