Sei Investments Co. lifted its holdings in shares of Albany International Corp. (NYSE:AIN - Free Report) by 7.0% in the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 729,377 shares of the textile maker's stock after buying an additional 47,936 shares during the period. Sei Investments Co. owned 2.33% of Albany International worth $58,328,000 at the end of the most recent reporting period.

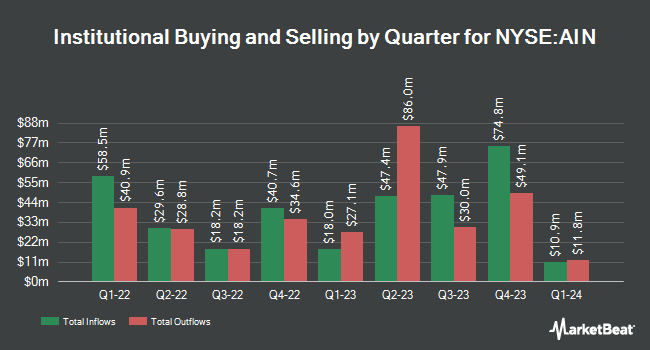

Several other institutional investors and hedge funds have also recently bought and sold shares of AIN. Quarry LP increased its position in Albany International by 515.4% in the third quarter. Quarry LP now owns 480 shares of the textile maker's stock worth $43,000 after buying an additional 402 shares during the period. Smartleaf Asset Management LLC grew its position in shares of Albany International by 306.7% during the fourth quarter. Smartleaf Asset Management LLC now owns 667 shares of the textile maker's stock worth $53,000 after acquiring an additional 503 shares during the last quarter. Vestcor Inc acquired a new stake in shares of Albany International in the 4th quarter worth about $70,000. KBC Group NV lifted its position in Albany International by 41.3% in the 4th quarter. KBC Group NV now owns 1,495 shares of the textile maker's stock valued at $120,000 after purchasing an additional 437 shares during the last quarter. Finally, Central Pacific Bank Trust Division boosted its stake in Albany International by 16.1% during the 4th quarter. Central Pacific Bank Trust Division now owns 2,305 shares of the textile maker's stock valued at $184,000 after purchasing an additional 320 shares during the period. Institutional investors and hedge funds own 97.37% of the company's stock.

Albany International Price Performance

AIN traded down $1.27 during trading on Thursday, reaching $72.15. The stock had a trading volume of 159,187 shares, compared to its average volume of 185,049. The stock has a 50 day moving average of $77.88 and a two-hundred day moving average of $79.35. The company has a quick ratio of 2.94, a current ratio of 3.68 and a debt-to-equity ratio of 0.36. The firm has a market capitalization of $2.23 billion, a price-to-earnings ratio of 22.55 and a beta of 1.37. Albany International Corp. has a 1-year low of $67.39 and a 1-year high of $96.49.

Albany International (NYSE:AIN - Get Free Report) last announced its quarterly earnings data on Wednesday, February 26th. The textile maker reported $0.58 earnings per share for the quarter, missing the consensus estimate of $0.63 by ($0.05). Albany International had a net margin of 7.92% and a return on equity of 12.20%. The firm had revenue of $286.91 million during the quarter, compared to analyst estimates of $299.52 million. As a group, equities analysts anticipate that Albany International Corp. will post 3.23 EPS for the current fiscal year.

Albany International Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, April 7th. Stockholders of record on Friday, March 21st will be given a dividend of $0.27 per share. The ex-dividend date is Friday, March 21st. This represents a $1.08 annualized dividend and a dividend yield of 1.50%. Albany International's dividend payout ratio (DPR) is 38.71%.

Analyst Ratings Changes

AIN has been the topic of several analyst reports. Truist Financial raised their price target on shares of Albany International from $85.00 to $88.00 and gave the company a "buy" rating in a research note on Tuesday, January 14th. JPMorgan Chase & Co. lowered their target price on Albany International from $75.00 to $74.00 and set a "neutral" rating on the stock in a research report on Wednesday, January 15th. Bank of America reduced their price target on Albany International from $80.00 to $75.00 and set an "underperform" rating for the company in a research report on Tuesday. StockNews.com cut Albany International from a "buy" rating to a "hold" rating in a research note on Friday, February 28th. Finally, Robert W. Baird cut their price objective on shares of Albany International from $104.00 to $92.00 and set an "outperform" rating on the stock in a research note on Friday, February 28th. One research analyst has rated the stock with a sell rating, two have assigned a hold rating, two have issued a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $82.00.

View Our Latest Stock Report on Albany International

About Albany International

(

Free Report)

Albany International Corp., together with its subsidiaries, engages in the machine clothing and engineered composites businesses. The company operates in two segments, Machine Clothing (MC) and Albany Engineered Composites (AEC). The MC segment designs, manufactures, and markets paper machine clothing for use in the manufacturing of papers, paperboards, tissues, towels, pulps, nonwovens, building products, tannery, and textiles, as well as fiber cement and several other industrial applications.

Further Reading

Before you consider Albany International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Albany International wasn't on the list.

While Albany International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.