Charles Schwab Investment Management Inc. increased its position in Albemarle Co. (NYSE:ALB - Free Report) by 38.2% in the 3rd quarter, according to its most recent 13F filing with the SEC. The firm owned 1,020,590 shares of the specialty chemicals company's stock after buying an additional 282,194 shares during the period. Charles Schwab Investment Management Inc. owned about 0.87% of Albemarle worth $96,660,000 at the end of the most recent quarter.

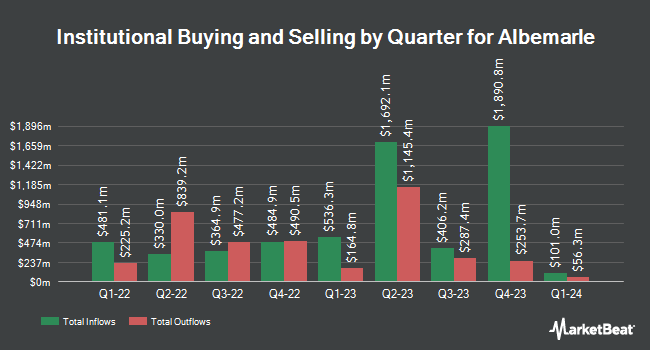

Several other hedge funds also recently bought and sold shares of the company. O Shaughnessy Asset Management LLC boosted its holdings in shares of Albemarle by 40.6% during the 1st quarter. O Shaughnessy Asset Management LLC now owns 1,973 shares of the specialty chemicals company's stock valued at $260,000 after purchasing an additional 570 shares during the last quarter. Price T Rowe Associates Inc. MD boosted its holdings in shares of Albemarle by 1.4% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 162,386 shares of the specialty chemicals company's stock valued at $21,394,000 after purchasing an additional 2,309 shares during the last quarter. SVB Wealth LLC bought a new position in shares of Albemarle during the 1st quarter valued at about $396,000. Silvercrest Asset Management Group LLC boosted its holdings in shares of Albemarle by 10.0% during the 1st quarter. Silvercrest Asset Management Group LLC now owns 6,514 shares of the specialty chemicals company's stock valued at $858,000 after purchasing an additional 593 shares during the last quarter. Finally, Janus Henderson Group PLC lifted its holdings in shares of Albemarle by 206.9% in the 1st quarter. Janus Henderson Group PLC now owns 55,508 shares of the specialty chemicals company's stock valued at $7,312,000 after acquiring an additional 37,423 shares during the last quarter. Institutional investors own 92.87% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts recently commented on the stock. Royal Bank of Canada increased their price target on shares of Albemarle from $108.00 to $133.00 and gave the company an "outperform" rating in a report on Tuesday, November 12th. Berenberg Bank downgraded shares of Albemarle from a "buy" rating to a "hold" rating and lowered their price target for the company from $160.00 to $83.00 in a report on Wednesday, July 31st. Scotiabank lowered their price target on shares of Albemarle from $135.00 to $85.00 and set a "sector perform" rating for the company in a report on Tuesday, August 6th. Robert W. Baird lowered their price target on shares of Albemarle from $85.00 to $79.00 and set a "neutral" rating for the company in a report on Friday, October 25th. Finally, Bank of America reduced their price objective on shares of Albemarle from $135.00 to $126.00 and set a "buy" rating on the stock in a research report on Friday, August 2nd. One investment analyst has rated the stock with a sell rating, fifteen have issued a hold rating and six have assigned a buy rating to the company. According to data from MarketBeat, the company has an average rating of "Hold" and an average target price of $114.47.

Check Out Our Latest Stock Report on Albemarle

Albemarle Stock Up 1.1 %

ALB stock traded up $1.16 during trading on Wednesday, hitting $107.95. 1,071,860 shares of the company's stock traded hands, compared to its average volume of 2,931,197. The firm has a market capitalization of $12.69 billion, a P/E ratio of -6.40 and a beta of 1.55. The business has a fifty day simple moving average of $98.58 and a two-hundred day simple moving average of $98.69. The company has a quick ratio of 1.58, a current ratio of 2.44 and a debt-to-equity ratio of 0.43. Albemarle Co. has a 1 year low of $71.97 and a 1 year high of $153.54.

Albemarle Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Thursday, January 2nd. Shareholders of record on Friday, December 13th will be paid a $0.405 dividend. The ex-dividend date is Friday, December 13th. This represents a $1.62 annualized dividend and a yield of 1.50%. Albemarle's dividend payout ratio (DPR) is -9.67%.

About Albemarle

(

Free Report)

Albemarle Corporation develops, manufactures, and markets engineered specialty chemicals worldwide. It operates through three segments: Energy Storage, Specialties and Ketjen. The Energy Storage segment offers lithium compounds, including lithium carbonate, lithium hydroxide, and lithium chloride; technical services for the handling and use of reactive lithium products; and lithium-containing by-products recycling services.

Further Reading

Before you consider Albemarle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Albemarle wasn't on the list.

While Albemarle currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.