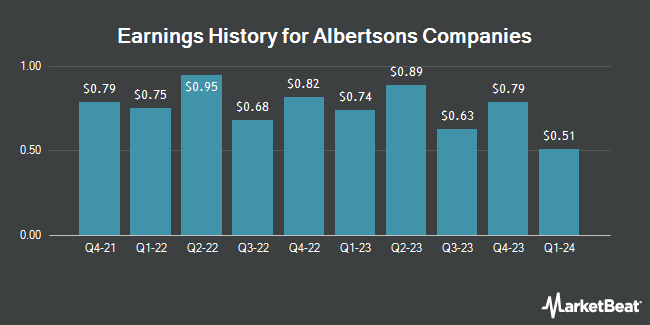

Albertsons Companies (NYSE:ACI - Get Free Report) issued its earnings results on Tuesday. The company reported $0.46 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.40 by $0.06, RTT News reports. Albertsons Companies had a return on equity of 44.70% and a net margin of 1.30%. The company had revenue of $18.80 billion during the quarter, compared to analyst estimates of $18.78 billion. During the same quarter last year, the business posted $0.54 EPS. Albertsons Companies updated its FY 2025 guidance to 2.030-2.160 EPS.

Albertsons Companies Stock Performance

NYSE:ACI traded up $0.51 during midday trading on Friday, reaching $21.66. 10,042,907 shares of the company traded hands, compared to its average volume of 4,307,437. Albertsons Companies has a twelve month low of $17.00 and a twelve month high of $23.20. The company has a debt-to-equity ratio of 2.31, a current ratio of 0.93 and a quick ratio of 0.21. The company has a fifty day moving average price of $21.19 and a 200 day moving average price of $19.97. The firm has a market capitalization of $12.55 billion, a price-to-earnings ratio of 12.17, a price-to-earnings-growth ratio of 1.92 and a beta of 0.47.

Albertsons Companies Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, May 9th. Stockholders of record on Friday, April 25th will be given a dividend of $0.15 per share. This represents a $0.60 dividend on an annualized basis and a dividend yield of 2.77%. The ex-dividend date is Friday, April 25th. Albertsons Companies's payout ratio is 36.59%.

Wall Street Analyst Weigh In

Several analysts have recently issued reports on ACI shares. Royal Bank of Canada reiterated an "outperform" rating and issued a $23.00 target price on shares of Albertsons Companies in a research report on Wednesday. Telsey Advisory Group reaffirmed an "outperform" rating and issued a $26.00 target price on shares of Albertsons Companies in a research report on Friday, April 11th. The Goldman Sachs Group reaffirmed a "buy" rating and issued a $26.00 price objective on shares of Albertsons Companies in a research note on Tuesday, February 4th. Evercore ISI cut their price objective on Albertsons Companies from $23.00 to $22.00 and set an "in-line" rating on the stock in a research report on Thursday. Finally, UBS Group decreased their price target on shares of Albertsons Companies from $24.00 to $22.00 and set a "neutral" rating for the company in a research note on Wednesday. Six equities research analysts have rated the stock with a hold rating and nine have given a buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $23.36.

View Our Latest Report on Albertsons Companies

About Albertsons Companies

(

Get Free Report)

Albertsons Companies, Inc, through its subsidiaries, engages in the operation of food and drug stores in the United States. The company's food and drug retail stores offer grocery products, general merchandise, health and beauty care products, pharmacy, fuel, and other items and services. It also manufactures and processes food products for sale in stores.

Further Reading

Before you consider Albertsons Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Albertsons Companies wasn't on the list.

While Albertsons Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.