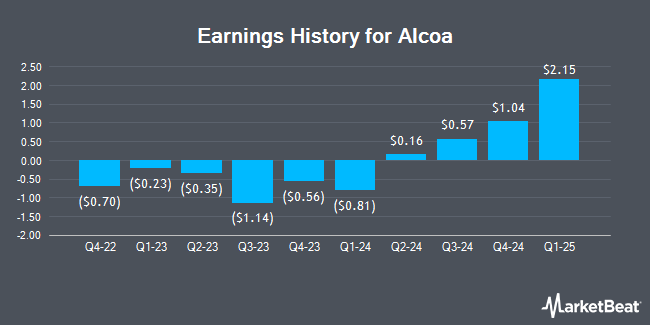

Alcoa (NYSE:AA - Get Free Report) announced its quarterly earnings results on Wednesday. The industrial products company reported $1.04 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.91 by $0.13, Zacks reports. Alcoa had a negative net margin of 2.65% and a negative return on equity of 1.45%.

Alcoa Stock Up 0.4 %

AA stock traded up $0.17 during trading on Wednesday, reaching $38.78. 8,760,064 shares of the stock were exchanged, compared to its average volume of 4,771,510. The firm's 50 day moving average is $40.58 and its 200 day moving average is $37.69. The firm has a market cap of $10.02 billion, a P/E ratio of -22.03, a price-to-earnings-growth ratio of 0.17 and a beta of 2.47. The company has a current ratio of 1.41, a quick ratio of 0.80 and a debt-to-equity ratio of 0.47. Alcoa has a twelve month low of $24.86 and a twelve month high of $47.77.

Wall Street Analysts Forecast Growth

Several brokerages recently issued reports on AA. Argus raised Alcoa from a "hold" rating to a "buy" rating and set a $48.00 target price for the company in a research report on Wednesday, October 23rd. JPMorgan Chase & Co. upped their target price on Alcoa from $38.00 to $40.00 and gave the company a "neutral" rating in a report on Thursday, January 16th. Bank of America boosted their price target on shares of Alcoa to $58.00 and gave the stock a "buy" rating in a research report on Thursday, November 28th. StockNews.com upgraded shares of Alcoa from a "sell" rating to a "hold" rating in a research report on Thursday, October 17th. Finally, UBS Group boosted their target price on shares of Alcoa from $40.00 to $50.00 and gave the company a "buy" rating in a report on Tuesday, October 15th. Four equities research analysts have rated the stock with a hold rating and eight have issued a buy rating to the company. According to data from MarketBeat.com, Alcoa currently has a consensus rating of "Moderate Buy" and a consensus price target of $46.36.

Read Our Latest Analysis on AA

Alcoa Company Profile

(

Get Free Report)

Alcoa Corporation, together with its subsidiaries, produces and sells bauxite, alumina, and aluminum products in the United States, Spain, Australia, Iceland, Norway, Brazil, Canada, and internationally. The company operates through two segments, Alumina and Aluminum. It engages in bauxite mining operations; and processes bauxite into alumina and sells it to customers who process it into industrial chemical products, as well as aluminum smelting and casting businesses.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alcoa, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alcoa wasn't on the list.

While Alcoa currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.