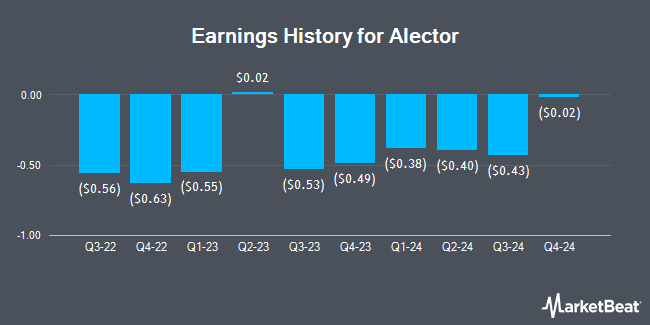

Alector (NASDAQ:ALEC - Get Free Report) released its quarterly earnings data on Wednesday. The company reported ($0.43) earnings per share for the quarter, beating the consensus estimate of ($0.53) by $0.10, Zacks reports. The firm had revenue of $15.34 million during the quarter, compared to the consensus estimate of $16.33 million. Alector had a negative return on equity of 102.63% and a negative net margin of 290.66%.

Alector Trading Up 2.0 %

Shares of ALEC traded up $0.11 during mid-day trading on Friday, reaching $5.75. The company had a trading volume of 634,576 shares, compared to its average volume of 621,828. The stock has a market cap of $559.59 million, a price-to-earnings ratio of -3.19 and a beta of 0.66. The firm has a fifty day simple moving average of $5.07 and a 200-day simple moving average of $5.12. Alector has a fifty-two week low of $3.66 and a fifty-two week high of $8.90.

Insider Activity at Alector

In other news, CFO Marc Grasso sold 7,297 shares of Alector stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $4.88, for a total value of $35,609.36. Following the transaction, the chief financial officer now directly owns 130,740 shares of the company's stock, valued at $638,011.20. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this link. In other Alector news, CFO Marc Grasso sold 7,297 shares of Alector stock in a transaction that occurred on Tuesday, September 3rd. The shares were sold at an average price of $4.88, for a total transaction of $35,609.36. Following the transaction, the chief financial officer now directly owns 130,740 shares of the company's stock, valued at $638,011.20. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, insider Sara Kenkare-Mitra sold 13,926 shares of the firm's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $4.88, for a total transaction of $67,958.88. Following the completion of the transaction, the insider now directly owns 291,715 shares in the company, valued at approximately $1,423,569.20. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 58,222 shares of company stock worth $286,013. 9.10% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

ALEC has been the topic of a number of analyst reports. HC Wainwright reiterated a "buy" rating and set a $35.00 target price on shares of Alector in a report on Thursday. Cantor Fitzgerald reiterated an "overweight" rating on shares of Alector in a research report on Tuesday, September 17th. Five analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, the stock currently has a consensus rating of "Buy" and a consensus target price of $17.75.

View Our Latest Stock Report on Alector

Alector Company Profile

(

Get Free Report)

Alector, Inc, a clinical stage biopharmaceutical company, develops therapies for the treatment of neurodegeneration diseases. Its products include AL001, an immune activity in the brain with genetic links to multiple neurodegenerative disorders, which is in Phase III clinical trial for the treatment of frontotemporal dementia, Alzheimer's, Parkinson's, and amyotrophic lateral sclerosis diseases; and AL101 that is in Phase I clinical trial for the treatment of neurodegenerative diseases, including Alzheimer's and Parkinson's diseases.

Read More

Before you consider Alector, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alector wasn't on the list.

While Alector currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.