Algert Global LLC increased its holdings in Avis Budget Group, Inc. (NASDAQ:CAR - Free Report) by 123.8% in the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 22,745 shares of the business services provider's stock after purchasing an additional 12,580 shares during the period. Algert Global LLC owned approximately 0.06% of Avis Budget Group worth $1,992,000 as of its most recent SEC filing.

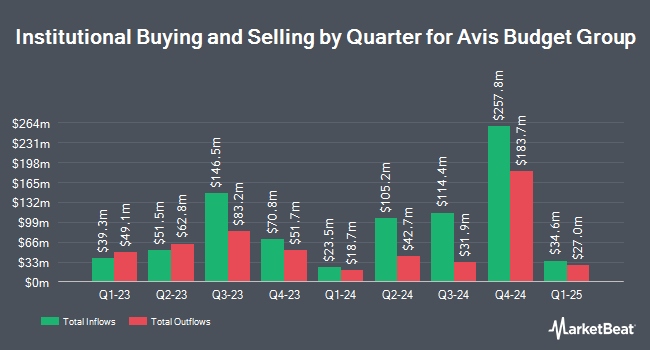

Several other institutional investors and hedge funds also recently made changes to their positions in CAR. Rubric Capital Management LP lifted its stake in Avis Budget Group by 220.9% in the second quarter. Rubric Capital Management LP now owns 690,273 shares of the business services provider's stock worth $72,147,000 after purchasing an additional 475,181 shares during the last quarter. Massachusetts Financial Services Co. MA lifted its stake in shares of Avis Budget Group by 0.4% in the 3rd quarter. Massachusetts Financial Services Co. MA now owns 592,341 shares of the business services provider's stock valued at $51,883,000 after acquiring an additional 2,561 shares during the last quarter. International Assets Investment Management LLC boosted its holdings in Avis Budget Group by 19,203.5% during the 3rd quarter. International Assets Investment Management LLC now owns 481,044 shares of the business services provider's stock valued at $421,350,000 after acquiring an additional 478,552 shares during the period. Assenagon Asset Management S.A. bought a new position in Avis Budget Group during the 2nd quarter worth approximately $19,978,000. Finally, Charles Schwab Investment Management Inc. increased its stake in Avis Budget Group by 10.5% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 185,801 shares of the business services provider's stock worth $16,274,000 after purchasing an additional 17,666 shares during the period. Institutional investors own 96.35% of the company's stock.

Avis Budget Group Price Performance

CAR stock traded up $1.47 during trading on Thursday, reaching $108.84. The company had a trading volume of 328,838 shares, compared to its average volume of 719,169. The business has a 50 day moving average of $90.56 and a 200 day moving average of $95.77. The company has a market cap of $3.82 billion, a P/E ratio of 9.94 and a beta of 2.14. Avis Budget Group, Inc. has a 52 week low of $65.73 and a 52 week high of $204.77.

Avis Budget Group (NASDAQ:CAR - Get Free Report) last released its earnings results on Thursday, October 31st. The business services provider reported $6.65 EPS for the quarter, missing analysts' consensus estimates of $8.55 by ($1.90). The firm had revenue of $3.48 billion during the quarter, compared to analysts' expectations of $3.53 billion. Avis Budget Group had a net margin of 3.34% and a negative return on equity of 101.41%. The company's revenue for the quarter was down 2.4% compared to the same quarter last year. During the same quarter in the previous year, the business earned $16.78 EPS. Research analysts expect that Avis Budget Group, Inc. will post 3.59 earnings per share for the current year.

Analyst Ratings Changes

CAR has been the topic of several recent analyst reports. Susquehanna cut their target price on shares of Avis Budget Group from $120.00 to $95.00 and set a "neutral" rating on the stock in a report on Friday, August 9th. Northcoast Research lowered shares of Avis Budget Group from a "buy" rating to a "neutral" rating in a report on Monday, November 18th. JPMorgan Chase & Co. lowered their price objective on shares of Avis Budget Group from $175.00 to $150.00 and set an "overweight" rating for the company in a research note on Monday, November 4th. The Goldman Sachs Group cut their target price on Avis Budget Group from $105.00 to $90.00 and set a "neutral" rating on the stock in a research note on Friday, October 11th. Finally, Barclays began coverage on Avis Budget Group in a report on Thursday, September 19th. They set an "equal weight" rating and a $105.00 price target on the stock. Five equities research analysts have rated the stock with a hold rating and four have given a buy rating to the company's stock. According to data from MarketBeat, the company has an average rating of "Hold" and a consensus price target of $133.13.

Check Out Our Latest Stock Report on Avis Budget Group

About Avis Budget Group

(

Free Report)

Avis Budget Group, Inc, together with its subsidiaries, provides car and truck rentals, car sharing, and ancillary products and services to businesses and consumers in the Americas, Europe, the Middle East and Africa, Asia, and Australasia. It operates the Avis brand, that offers vehicle rental and other mobility solutions to the premium commercial and leisure segments of the travel industry; and the Zipcar brand, a car sharing network, as well as the Budget brand, a supplier of vehicle rental and other mobility solutions focused primarily on more value-conscious customers comprising Budget car rental, and Budget Truck, a local, and one-way truck and cargo van rental businesses with a fleet of approximately 19,000 vehicles, which are rented through a network of dealer-operated and company-operated locations that serve the light commercial and consumer sectors in the continental United States.

Featured Stories

Before you consider Avis Budget Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avis Budget Group wasn't on the list.

While Avis Budget Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.