Algert Global LLC increased its holdings in Avista Co. (NYSE:AVA - Free Report) by 202.2% in the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 57,617 shares of the utilities provider's stock after purchasing an additional 38,550 shares during the period. Algert Global LLC owned approximately 0.07% of Avista worth $2,233,000 as of its most recent SEC filing.

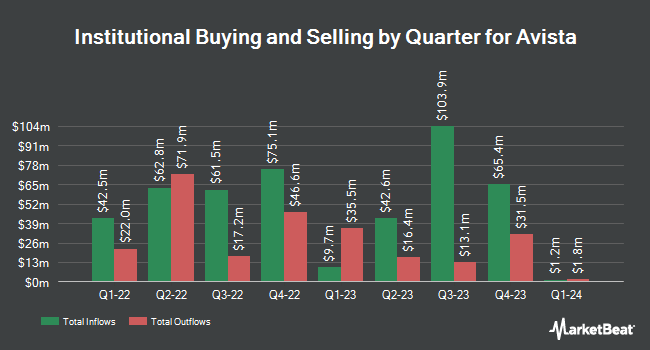

Other institutional investors also recently made changes to their positions in the company. Public Sector Pension Investment Board increased its stake in Avista by 0.4% during the 2nd quarter. Public Sector Pension Investment Board now owns 3,551,460 shares of the utilities provider's stock valued at $122,916,000 after purchasing an additional 13,445 shares in the last quarter. Dimensional Fund Advisors LP boosted its stake in Avista by 4.2% during the second quarter. Dimensional Fund Advisors LP now owns 1,534,341 shares of the utilities provider's stock worth $53,103,000 after buying an additional 61,466 shares during the period. Charles Schwab Investment Management Inc. boosted its stake in shares of Avista by 2.2% during the third quarter. Charles Schwab Investment Management Inc. now owns 1,228,299 shares of the utilities provider's stock valued at $47,597,000 after purchasing an additional 26,706 shares during the period. Tortoise Capital Advisors L.L.C. lifted its stake in Avista by 13.6% in the second quarter. Tortoise Capital Advisors L.L.C. now owns 692,944 shares of the utilities provider's stock worth $23,983,000 after acquiring an additional 83,127 shares during the period. Finally, Principal Financial Group Inc. raised its holdings in Avista by 9.0% in the third quarter. Principal Financial Group Inc. now owns 420,527 shares of the utilities provider's stock worth $16,295,000 after purchasing an additional 34,829 shares in the last quarter. Hedge funds and other institutional investors own 85.24% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Bank of America initiated coverage on Avista in a research report on Thursday, September 12th. They issued an "underperform" rating and a $37.00 target price on the stock.

Check Out Our Latest Research Report on Avista

Avista Trading Up 1.0 %

Avista stock traded up $0.40 during midday trading on Wednesday, reaching $38.94. 71,505 shares of the stock traded hands, compared to its average volume of 515,382. The company has a 50-day simple moving average of $37.99 and a two-hundred day simple moving average of $37.33. Avista Co. has a 12-month low of $31.91 and a 12-month high of $39.99. The firm has a market cap of $3.08 billion, a PE ratio of 15.35, a price-to-earnings-growth ratio of 4.30 and a beta of 0.47. The company has a current ratio of 0.75, a quick ratio of 0.48 and a debt-to-equity ratio of 1.05.

Avista (NYSE:AVA - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The utilities provider reported $0.23 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.13 by $0.10. Avista had a return on equity of 7.83% and a net margin of 10.24%. The business had revenue of $383.70 million during the quarter, compared to analysts' expectations of $389.29 million. During the same quarter last year, the business posted $0.19 EPS. The business's quarterly revenue was up 3.8% compared to the same quarter last year. Research analysts expect that Avista Co. will post 2.36 earnings per share for the current fiscal year.

Avista Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, December 13th. Shareholders of record on Tuesday, November 26th will be given a dividend of $0.475 per share. This represents a $1.90 annualized dividend and a yield of 4.88%. The ex-dividend date is Tuesday, November 26th. Avista's dividend payout ratio (DPR) is 75.70%.

Avista Profile

(

Free Report)

Avista Corporation, together with its subsidiaries, operates as an electric and natural gas utility company. It operates in two segments, Avista Utilities and AEL&P. The Avista Utilities segment provides electric distribution and transmission, and natural gas distribution services in parts of eastern Washington and northern Idaho; and natural gas distribution services in parts of northeastern and southwestern Oregon, as well as generates electricity in Washington, Idaho, Oregon, and Montana.

Read More

Before you consider Avista, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avista wasn't on the list.

While Avista currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.