Algert Global LLC reduced its position in CleanSpark, Inc. (NASDAQ:CLSK - Free Report) by 45.8% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 51,776 shares of the company's stock after selling 43,700 shares during the period. Algert Global LLC's holdings in CleanSpark were worth $484,000 as of its most recent SEC filing.

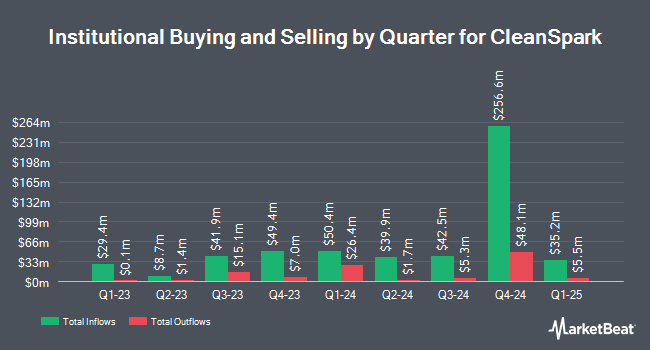

Several other hedge funds and other institutional investors have also recently bought and sold shares of CLSK. Charles Schwab Investment Management Inc. raised its holdings in CleanSpark by 10.5% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 2,194,835 shares of the company's stock valued at $20,500,000 after acquiring an additional 208,862 shares during the last quarter. Van ECK Associates Corp increased its stake in CleanSpark by 64.0% in the third quarter. Van ECK Associates Corp now owns 1,590,688 shares of the company's stock valued at $14,857,000 after purchasing an additional 620,792 shares during the last quarter. Millennium Management LLC increased its stake in CleanSpark by 74.6% in the second quarter. Millennium Management LLC now owns 1,251,278 shares of the company's stock valued at $19,958,000 after purchasing an additional 534,825 shares during the last quarter. Marshall Wace LLP purchased a new position in CleanSpark during the second quarter worth about $18,074,000. Finally, Bank of New York Mellon Corp boosted its stake in CleanSpark by 32.8% in the 2nd quarter. Bank of New York Mellon Corp now owns 871,793 shares of the company's stock worth $13,905,000 after buying an additional 215,124 shares during the last quarter. 43.12% of the stock is owned by institutional investors and hedge funds.

Insider Transactions at CleanSpark

In other CleanSpark news, Director Thomas Leigh Wood sold 22,222 shares of the firm's stock in a transaction on Thursday, September 12th. The stock was sold at an average price of $9.24, for a total value of $205,331.28. Following the sale, the director now directly owns 137,050 shares in the company, valued at approximately $1,266,342. This trade represents a 13.95 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. In the last quarter, insiders sold 26,272 shares of company stock worth $254,836. 2.99% of the stock is currently owned by corporate insiders.

CleanSpark Stock Up 3.5 %

NASDAQ:CLSK traded up $0.49 during mid-day trading on Friday, reaching $14.35. The stock had a trading volume of 28,952,510 shares, compared to its average volume of 36,905,532. The stock's 50 day simple moving average is $11.86 and its two-hundred day simple moving average is $13.57. CleanSpark, Inc. has a 1-year low of $5.73 and a 1-year high of $24.72.

Wall Street Analysts Forecast Growth

Several research analysts have recently weighed in on the stock. JPMorgan Chase & Co. cut their price objective on shares of CleanSpark from $12.50 to $10.50 and set a "neutral" rating on the stock in a report on Friday, August 23rd. Cantor Fitzgerald reaffirmed an "overweight" rating and set a $23.00 price target on shares of CleanSpark in a research note on Thursday, October 3rd. Macquarie started coverage on shares of CleanSpark in a report on Wednesday, September 25th. They issued an "outperform" rating and a $20.00 price target on the stock. Finally, HC Wainwright restated a "buy" rating and set a $27.00 price objective on shares of CleanSpark in a report on Wednesday, September 25th. One investment analyst has rated the stock with a hold rating and five have assigned a buy rating to the company's stock. Based on data from MarketBeat, CleanSpark has an average rating of "Moderate Buy" and a consensus target price of $21.42.

Check Out Our Latest Stock Analysis on CleanSpark

CleanSpark Company Profile

(

Free Report)

CleanSpark, Inc operates as a bitcoin miner in the Americas. It owns and operates data centers that primarily run on low-carbon power. Its infrastructure supports Bitcoin, a digital commodity and a tool for financial independence and inclusion. The company was formerly known as Stratean Inc and changed its name to CleanSpark, Inc in November 2016.

Featured Articles

Before you consider CleanSpark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CleanSpark wasn't on the list.

While CleanSpark currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.