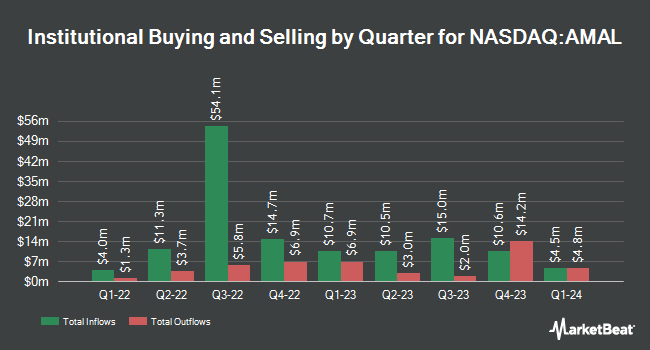

Algert Global LLC lowered its position in Amalgamated Financial Corp. (NASDAQ:AMAL - Free Report) by 36.4% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 49,046 shares of the company's stock after selling 28,083 shares during the period. Algert Global LLC owned approximately 0.16% of Amalgamated Financial worth $1,539,000 as of its most recent SEC filing.

Several other large investors have also recently modified their holdings of AMAL. Charles Schwab Investment Management Inc. boosted its holdings in Amalgamated Financial by 219.7% in the third quarter. Charles Schwab Investment Management Inc. now owns 162,047 shares of the company's stock worth $5,083,000 after acquiring an additional 111,357 shares in the last quarter. Connor Clark & Lunn Investment Management Ltd. boosted its stake in Amalgamated Financial by 125.5% in the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 41,089 shares of the company's stock worth $1,289,000 after purchasing an additional 22,865 shares in the last quarter. Segall Bryant & Hamill LLC purchased a new stake in Amalgamated Financial during the 3rd quarter worth approximately $1,612,000. Quest Partners LLC increased its stake in Amalgamated Financial by 18.7% during the 3rd quarter. Quest Partners LLC now owns 11,905 shares of the company's stock valued at $373,000 after purchasing an additional 1,877 shares in the last quarter. Finally, Thrivent Financial for Lutherans raised its stake in Amalgamated Financial by 14.5% in the 3rd quarter. Thrivent Financial for Lutherans now owns 46,420 shares of the company's stock worth $1,456,000 after acquiring an additional 5,885 shares during the last quarter. Institutional investors own 75.93% of the company's stock.

Insider Activity at Amalgamated Financial

In other news, CFO Jason Darby sold 4,000 shares of the stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $36.59, for a total value of $146,360.00. Following the completion of the sale, the chief financial officer now owns 50,208 shares of the company's stock, valued at $1,837,110.72. This represents a 7.38 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Also, major shareholder United Canada Council Workers sold 82,464 shares of the company's stock in a transaction that occurred on Monday, September 9th. The shares were sold at an average price of $31.05, for a total value of $2,560,507.20. Following the completion of the transaction, the insider now owns 440,401 shares in the company, valued at $13,674,451.05. This represents a 15.77 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 718,890 shares of company stock worth $24,995,731 in the last 90 days. Corporate insiders own 0.90% of the company's stock.

Amalgamated Financial Stock Performance

AMAL traded down $0.47 during midday trading on Friday, hitting $35.63. 97,216 shares of the company were exchanged, compared to its average volume of 152,776. The firm has a market capitalization of $1.09 billion, a price-to-earnings ratio of 10.62 and a beta of 0.91. Amalgamated Financial Corp. has a 1-year low of $20.61 and a 1-year high of $38.19. The company's 50 day simple moving average is $33.77 and its 200 day simple moving average is $30.23. The company has a current ratio of 0.63, a quick ratio of 0.63 and a debt-to-equity ratio of 0.10.

Amalgamated Financial (NASDAQ:AMAL - Get Free Report) last announced its quarterly earnings results on Thursday, October 24th. The company reported $0.91 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.83 by $0.08. Amalgamated Financial had a net margin of 24.19% and a return on equity of 16.00%. The firm had revenue of $111.76 million for the quarter, compared to the consensus estimate of $79.50 million. During the same period in the prior year, the firm posted $0.76 earnings per share. As a group, sell-side analysts predict that Amalgamated Financial Corp. will post 3.46 earnings per share for the current year.

Amalgamated Financial Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Thursday, November 21st. Stockholders of record on Tuesday, November 5th were given a dividend of $0.12 per share. This represents a $0.48 dividend on an annualized basis and a dividend yield of 1.35%. The ex-dividend date was Tuesday, November 5th. Amalgamated Financial's dividend payout ratio (DPR) is presently 14.12%.

Amalgamated Financial Company Profile

(

Free Report)

Amalgamated Financial Corp. operates as the bank holding company for Amalgamated Bank that provides commercial and retail banking, investment management, and trust and custody services for commercial and retail customers in the United States. The company accepts various deposit products, including non-interest bearing accounts, interest-bearing demand products, savings accounts, money market accounts, NOW accounts, and certificates of deposit.

Recommended Stories

Before you consider Amalgamated Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amalgamated Financial wasn't on the list.

While Amalgamated Financial currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.