Algert Global LLC boosted its holdings in shares of Owens & Minor, Inc. (NYSE:OMI - Free Report) by 189.4% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 276,438 shares of the company's stock after purchasing an additional 180,922 shares during the period. Algert Global LLC owned 0.36% of Owens & Minor worth $4,337,000 as of its most recent SEC filing.

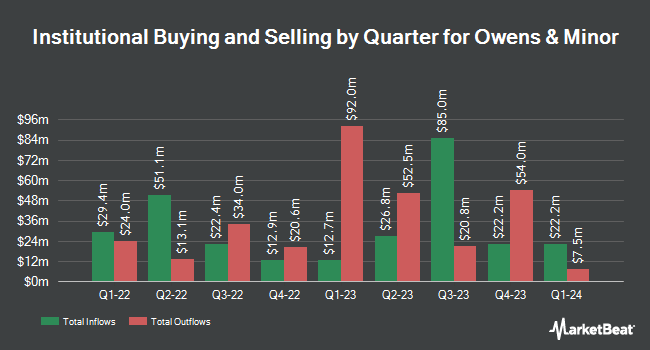

Several other institutional investors have also recently bought and sold shares of the business. State Board of Administration of Florida Retirement System raised its holdings in shares of Owens & Minor by 20.3% in the first quarter. State Board of Administration of Florida Retirement System now owns 25,501 shares of the company's stock valued at $707,000 after buying an additional 4,300 shares during the last quarter. Vanguard Group Inc. lifted its position in shares of Owens & Minor by 1.9% during the first quarter. Vanguard Group Inc. now owns 8,749,866 shares of the company's stock worth $242,459,000 after purchasing an additional 162,182 shares in the last quarter. Price T Rowe Associates Inc. MD grew its stake in shares of Owens & Minor by 5.9% during the first quarter. Price T Rowe Associates Inc. MD now owns 48,286 shares of the company's stock valued at $1,339,000 after purchasing an additional 2,671 shares during the last quarter. Public Employees Retirement System of Ohio acquired a new stake in shares of Owens & Minor in the first quarter valued at approximately $120,000. Finally, Burney Co. bought a new position in Owens & Minor in the 1st quarter worth approximately $271,000. Institutional investors own 98.04% of the company's stock.

Insider Buying and Selling at Owens & Minor

In other Owens & Minor news, CFO Jonathan A. Leon sold 5,282 shares of Owens & Minor stock in a transaction dated Thursday, November 21st. The stock was sold at an average price of $11.82, for a total value of $62,433.24. Following the sale, the chief financial officer now owns 130,822 shares of the company's stock, valued at $1,546,316.04. This trade represents a 3.88 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Insiders own 2.62% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently commented on OMI shares. JPMorgan Chase & Co. lowered their target price on Owens & Minor from $22.00 to $18.00 and set an "underweight" rating for the company in a research note on Wednesday, August 21st. Barclays cut their target price on shares of Owens & Minor from $18.00 to $14.00 and set an "equal weight" rating on the stock in a research report on Tuesday, November 5th. Robert W. Baird lowered their price target on shares of Owens & Minor from $19.00 to $14.00 and set a "neutral" rating for the company in a research report on Tuesday, November 5th. StockNews.com lowered shares of Owens & Minor from a "buy" rating to a "hold" rating in a report on Monday, August 26th. Finally, Citigroup lowered their target price on shares of Owens & Minor from $21.00 to $18.50 and set a "buy" rating for the company in a report on Tuesday, November 5th. Two research analysts have rated the stock with a sell rating, five have given a hold rating and two have issued a buy rating to the company's stock. Based on data from MarketBeat.com, Owens & Minor currently has an average rating of "Hold" and an average target price of $18.50.

Check Out Our Latest Report on OMI

Owens & Minor Trading Up 10.6 %

Shares of OMI stock traded up $1.31 on Monday, hitting $13.66. The stock had a trading volume of 1,029,804 shares, compared to its average volume of 825,727. The firm has a market cap of $1.05 billion, a P/E ratio of -21.02, a PEG ratio of 0.43 and a beta of 0.41. Owens & Minor, Inc. has a twelve month low of $11.42 and a twelve month high of $28.35. The company has a current ratio of 1.09, a quick ratio of 0.45 and a debt-to-equity ratio of 2.11. The company has a fifty day moving average price of $13.71 and a two-hundred day moving average price of $15.13.

Owens & Minor (NYSE:OMI - Get Free Report) last announced its quarterly earnings results on Monday, November 4th. The company reported $0.42 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.41 by $0.01. Owens & Minor had a positive return on equity of 14.60% and a negative net margin of 0.46%. The company had revenue of $2.72 billion during the quarter, compared to the consensus estimate of $2.68 billion. During the same period in the prior year, the company earned $0.44 earnings per share. The company's revenue for the quarter was up 5.0% compared to the same quarter last year. As a group, analysts forecast that Owens & Minor, Inc. will post 1.49 earnings per share for the current fiscal year.

Owens & Minor Profile

(

Free Report)

Owens & Minor, Inc, together with its subsidiaries, operates as a healthcare solutions company worldwide. It operates through Products & Healthcare Services and Patient Direct segments. The Products & Healthcare Services segment offers a portfolio of products and services to healthcare providers and manufacturers.

Featured Articles

Before you consider Owens & Minor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Owens & Minor wasn't on the list.

While Owens & Minor currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.