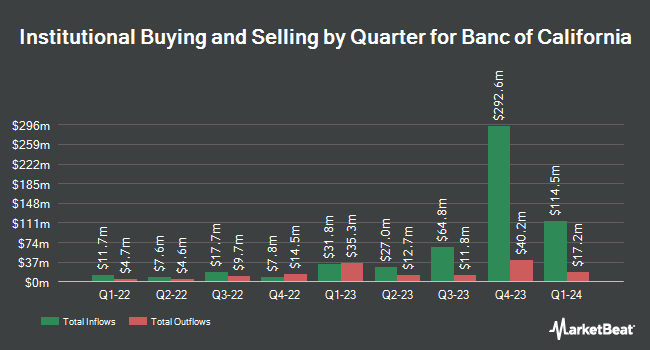

Algert Global LLC grew its position in Banc of California, Inc. (NYSE:BANC - Free Report) by 735.1% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 118,800 shares of the bank's stock after purchasing an additional 104,575 shares during the quarter. Algert Global LLC owned about 0.07% of Banc of California worth $1,750,000 at the end of the most recent reporting period.

A number of other large investors have also made changes to their positions in BANC. Future Financial Wealth Managment LLC acquired a new position in shares of Banc of California in the 3rd quarter valued at $29,000. Fifth Third Bancorp increased its holdings in shares of Banc of California by 146.3% in the second quarter. Fifth Third Bancorp now owns 2,143 shares of the bank's stock valued at $27,000 after purchasing an additional 1,273 shares during the period. GAMMA Investing LLC raised its stake in shares of Banc of California by 32.3% in the third quarter. GAMMA Investing LLC now owns 3,005 shares of the bank's stock worth $44,000 after purchasing an additional 734 shares during the last quarter. Mendon Capital Advisors Corp acquired a new stake in shares of Banc of California during the second quarter worth about $102,000. Finally, Simplicity Wealth LLC purchased a new stake in Banc of California in the second quarter valued at approximately $132,000. 86.88% of the stock is owned by institutional investors and hedge funds.

Insider Activity at Banc of California

In related news, Director Richard J. Lashley sold 75,000 shares of Banc of California stock in a transaction that occurred on Wednesday, September 4th. The shares were sold at an average price of $14.00, for a total value of $1,050,000.00. Following the completion of the sale, the director now owns 719,826 shares in the company, valued at approximately $10,077,564. This trade represents a 9.44 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 2.80% of the stock is owned by insiders.

Wall Street Analyst Weigh In

BANC has been the topic of a number of recent research reports. Stephens upped their target price on Banc of California from $15.00 to $16.00 and gave the stock an "equal weight" rating in a research note on Thursday, October 24th. Wells Fargo & Company raised their price objective on shares of Banc of California from $16.00 to $17.00 and gave the stock an "equal weight" rating in a research note on Wednesday, October 23rd. Barclays raised shares of Banc of California from an "equal weight" rating to an "overweight" rating and increased their price target for the stock from $17.00 to $18.00 in a report on Thursday, October 31st. Raymond James boosted their price target on Banc of California from $16.00 to $17.00 and gave the stock an "outperform" rating in a research report on Wednesday, October 23rd. Finally, Wedbush lifted their target price on shares of Banc of California from $18.00 to $19.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 23rd. One analyst has rated the stock with a sell rating, four have assigned a hold rating and six have given a buy rating to the company. According to MarketBeat, Banc of California has a consensus rating of "Hold" and a consensus price target of $17.30.

Check Out Our Latest Stock Report on Banc of California

Banc of California Trading Down 0.9 %

BANC stock traded down $0.15 during trading on Thursday, reaching $17.30. 1,629,060 shares of the stock were exchanged, compared to its average volume of 2,357,018. The business has a 50 day moving average price of $15.41 and a 200-day moving average price of $14.22. Banc of California, Inc. has a 1 year low of $11.36 and a 1 year high of $18.08. The company has a current ratio of 0.89, a quick ratio of 0.89 and a debt-to-equity ratio of 0.31. The firm has a market capitalization of $2.75 billion, a price-to-earnings ratio of -4.05 and a beta of 1.13.

Banc of California (NYSE:BANC - Get Free Report) last released its quarterly earnings results on Tuesday, October 22nd. The bank reported $0.25 EPS for the quarter, beating the consensus estimate of $0.14 by $0.11. The firm had revenue of $431.44 million for the quarter, compared to analyst estimates of $229.46 million. Banc of California had a negative net margin of 20.75% and a positive return on equity of 2.93%. During the same quarter in the previous year, the company earned $0.30 EPS. On average, research analysts predict that Banc of California, Inc. will post 0.7 earnings per share for the current year.

Banc of California Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, January 2nd. Investors of record on Monday, December 16th will be given a dividend of $0.10 per share. This represents a $0.40 dividend on an annualized basis and a dividend yield of 2.31%. The ex-dividend date of this dividend is Monday, December 16th. Banc of California's payout ratio is -9.37%.

About Banc of California

(

Free Report)

Banc of California, Inc operates as the bank holding company for Banc of California that provides various banking products and services in California. The company offers deposit products, such as checking, savings, money market, demand, and time deposits; certificates of deposit; retirement accounts; and safe deposit boxes.

Featured Stories

Before you consider Banc of California, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Banc of California wasn't on the list.

While Banc of California currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.