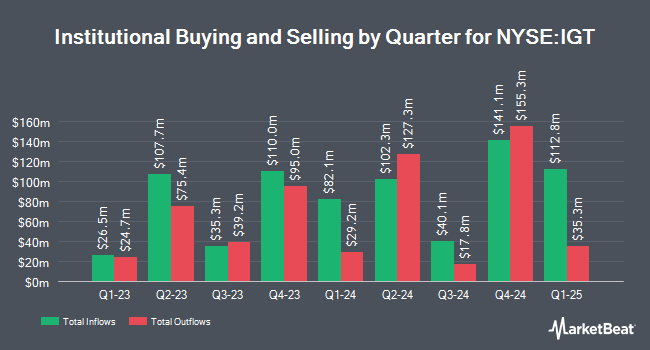

Algert Global LLC trimmed its holdings in International Game Technology PLC (NYSE:IGT - Free Report) by 45.5% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 83,750 shares of the company's stock after selling 69,942 shares during the quarter. Algert Global LLC's holdings in International Game Technology were worth $1,784,000 as of its most recent filing with the Securities and Exchange Commission.

Other institutional investors and hedge funds have also bought and sold shares of the company. Segall Bryant & Hamill LLC acquired a new position in shares of International Game Technology in the third quarter valued at $1,209,000. Massachusetts Financial Services Co. MA increased its stake in International Game Technology by 0.6% in the third quarter. Massachusetts Financial Services Co. MA now owns 7,790,889 shares of the company's stock valued at $165,946,000 after acquiring an additional 47,442 shares during the period. M&G Plc acquired a new position in International Game Technology in the second quarter worth about $8,850,000. Solel Partners LP bought a new position in International Game Technology during the second quarter worth about $43,478,000. Finally, Seven Eight Capital LP acquired a new stake in International Game Technology during the second quarter valued at approximately $1,182,000. Institutional investors own 44.33% of the company's stock.

Wall Street Analyst Weigh In

Several brokerages recently commented on IGT. StockNews.com raised International Game Technology from a "hold" rating to a "buy" rating in a research note on Friday, November 8th. Stifel Nicolaus raised their price objective on shares of International Game Technology from $26.00 to $30.00 and gave the stock a "buy" rating in a report on Wednesday, July 31st. Two equities research analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $28.67.

Read Our Latest Research Report on IGT

International Game Technology Price Performance

Shares of International Game Technology stock traded up $0.11 during midday trading on Thursday, reaching $19.33. The company had a trading volume of 736,824 shares, compared to its average volume of 1,115,069. The stock has a fifty day simple moving average of $20.54 and a 200 day simple moving average of $20.87. International Game Technology PLC has a 1-year low of $18.56 and a 1-year high of $28.82. The company has a current ratio of 2.36, a quick ratio of 2.31 and a debt-to-equity ratio of 2.85. The company has a market capitalization of $3.85 billion, a price-to-earnings ratio of 32.22 and a beta of 1.96.

International Game Technology (NYSE:IGT - Get Free Report) last issued its quarterly earnings results on Tuesday, November 12th. The company reported ($0.02) earnings per share (EPS) for the quarter, missing the consensus estimate of $0.22 by ($0.24). The firm had revenue of $587.00 million for the quarter, compared to analyst estimates of $591.50 million. International Game Technology had a net margin of 4.17% and a return on equity of 16.17%. The company's revenue was down 2.3% compared to the same quarter last year. During the same period last year, the company earned $0.52 EPS. As a group, equities research analysts forecast that International Game Technology PLC will post 1 earnings per share for the current year.

International Game Technology Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 10th. Investors of record on Tuesday, November 26th will be issued a $0.20 dividend. The ex-dividend date of this dividend is Tuesday, November 26th. This represents a $0.80 annualized dividend and a yield of 4.14%. International Game Technology's dividend payout ratio is currently 133.34%.

International Game Technology Company Profile

(

Free Report)

International Game Technology PLC operates and provides gaming technology products and services in the United States, Canada, Italy, The United Kingdom, rest of Europe, and internationally. It operates through three segments: Global Lottery, Global Gaming, and PlayDigital. The company designs, sells, operates, and leases a suite of point-of-sale machines that reconciles lottery funds between the retailer and lottery authority; provides online lottery transaction processing systems; produces instant ticket games; and offers printing services, such as instant ticket marketing plans and graphic design, programming, packaging, shipping, and delivery services, as well as iLottery solutions and services.

See Also

Before you consider International Game Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Game Technology wasn't on the list.

While International Game Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.