Algert Global LLC grew its position in shares of Balchem Co. (NASDAQ:BCPC - Free Report) by 88.7% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 17,781 shares of the basic materials company's stock after purchasing an additional 8,360 shares during the quarter. Algert Global LLC owned approximately 0.05% of Balchem worth $3,129,000 as of its most recent SEC filing.

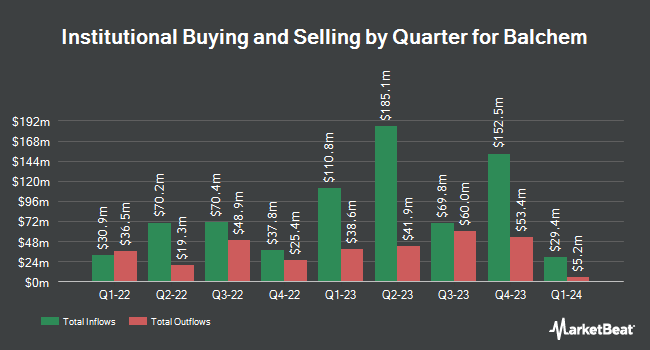

Other institutional investors have also recently modified their holdings of the company. O Shaughnessy Asset Management LLC bought a new position in Balchem during the 1st quarter worth approximately $321,000. Bessemer Group Inc. grew its position in shares of Balchem by 568.9% in the 1st quarter. Bessemer Group Inc. now owns 301 shares of the basic materials company's stock worth $47,000 after buying an additional 256 shares during the last quarter. Price T Rowe Associates Inc. MD grew its position in shares of Balchem by 32.2% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 193,146 shares of the basic materials company's stock worth $29,929,000 after buying an additional 47,036 shares during the last quarter. Janus Henderson Group PLC grew its position in shares of Balchem by 21.3% in the 1st quarter. Janus Henderson Group PLC now owns 18,059 shares of the basic materials company's stock worth $2,795,000 after buying an additional 3,176 shares during the last quarter. Finally, Tidal Investments LLC bought a new stake in shares of Balchem in the 1st quarter worth approximately $265,000. 87.91% of the stock is currently owned by institutional investors.

Balchem Stock Down 0.2 %

Shares of NASDAQ BCPC traded down $0.37 during mid-day trading on Tuesday, hitting $182.32. 96,924 shares of the stock traded hands, compared to its average volume of 110,144. The company has a debt-to-equity ratio of 0.21, a quick ratio of 1.90 and a current ratio of 2.98. The stock has a fifty day moving average price of $174.05 and a 200-day moving average price of $166.90. Balchem Co. has a 52 week low of $120.87 and a 52 week high of $186.03. The company has a market cap of $5.93 billion, a price-to-earnings ratio of 48.74, a PEG ratio of 5.45 and a beta of 0.65.

Analyst Upgrades and Downgrades

A number of brokerages have recently weighed in on BCPC. StockNews.com upgraded Balchem from a "hold" rating to a "buy" rating in a research report on Monday, October 28th. HC Wainwright raised their target price on Balchem from $185.00 to $190.00 and gave the company a "buy" rating in a research note on Monday, November 4th.

View Our Latest Stock Analysis on BCPC

About Balchem

(

Free Report)

Balchem Corporation develops, manufactures, and markets specialty performance ingredients and products for the nutritional, food, pharmaceutical, animal health, medical device sterilization, plant nutrition, and industrial markets worldwide. It operates through three segments: Human Nutrition and Health, Animal Nutrition and Health, and Specialty Products.

Featured Stories

Before you consider Balchem, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Balchem wasn't on the list.

While Balchem currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.