Algert Global LLC boosted its holdings in Tennant (NYSE:TNC - Free Report) by 16.3% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund owned 43,391 shares of the industrial products company's stock after buying an additional 6,085 shares during the quarter. Algert Global LLC owned 0.23% of Tennant worth $4,167,000 as of its most recent SEC filing.

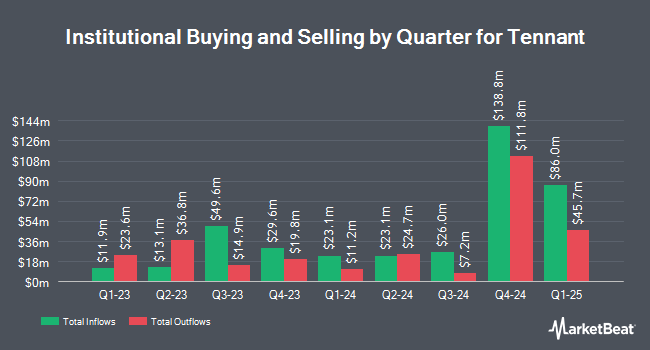

Several other institutional investors also recently modified their holdings of the stock. Arizona State Retirement System raised its position in shares of Tennant by 3.6% during the second quarter. Arizona State Retirement System now owns 5,053 shares of the industrial products company's stock worth $497,000 after purchasing an additional 176 shares during the period. Price T Rowe Associates Inc. MD lifted its position in shares of Tennant by 1.4% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 13,960 shares of the industrial products company's stock valued at $1,698,000 after acquiring an additional 186 shares in the last quarter. Tidal Investments LLC boosted its stake in Tennant by 10.0% in the 1st quarter. Tidal Investments LLC now owns 2,379 shares of the industrial products company's stock worth $289,000 after purchasing an additional 216 shares during the period. Dorsey & Whitney Trust CO LLC raised its stake in Tennant by 0.5% during the 2nd quarter. Dorsey & Whitney Trust CO LLC now owns 49,251 shares of the industrial products company's stock valued at $4,848,000 after purchasing an additional 239 shares during the period. Finally, DekaBank Deutsche Girozentrale lifted its holdings in shares of Tennant by 37.1% in the second quarter. DekaBank Deutsche Girozentrale now owns 972 shares of the industrial products company's stock valued at $95,000 after purchasing an additional 263 shares in the last quarter. Institutional investors own 93.33% of the company's stock.

Tennant Stock Up 1.7 %

TNC traded up $1.55 on Monday, reaching $91.24. 127,610 shares of the company traded hands, compared to its average volume of 119,201. The company has a market cap of $1.72 billion, a price-to-earnings ratio of 15.82 and a beta of 1.00. The company has a debt-to-equity ratio of 0.32, a current ratio of 2.17 and a quick ratio of 1.43. The stock's 50 day moving average price is $91.17 and its 200-day moving average price is $96.47. Tennant has a 52-week low of $82.54 and a 52-week high of $124.11.

Tennant (NYSE:TNC - Get Free Report) last posted its quarterly earnings results on Thursday, October 31st. The industrial products company reported $1.39 earnings per share for the quarter, missing analysts' consensus estimates of $1.44 by ($0.05). The company had revenue of $315.80 million during the quarter, compared to analyst estimates of $319.40 million. Tennant had a return on equity of 21.50% and a net margin of 8.52%. The company's revenue was up 3.6% compared to the same quarter last year. During the same period last year, the company posted $1.34 earnings per share. On average, sell-side analysts expect that Tennant will post 6.43 EPS for the current fiscal year.

Tennant Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Friday, November 29th will be paid a dividend of $0.295 per share. This is a positive change from Tennant's previous quarterly dividend of $0.28. The ex-dividend date of this dividend is Friday, November 29th. This represents a $1.18 annualized dividend and a dividend yield of 1.29%. Tennant's dividend payout ratio is 19.75%.

Analysts Set New Price Targets

Separately, StockNews.com lowered Tennant from a "strong-buy" rating to a "buy" rating in a research report on Friday, November 1st.

Get Our Latest Report on Tennant

Tennant Company Profile

(

Free Report)

Tennant Company, together with its subsidiaries, designs, manufactures, and markets floor cleaning equipment in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers a suite of products, including floor maintenance and cleaning equipment, detergent-free and other sustainable cleaning technologies, aftermarket parts and consumables, equipment maintenance and repair services, and asset management solutions.

Read More

Before you consider Tennant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tennant wasn't on the list.

While Tennant currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.