Algert Global LLC lifted its holdings in Alkami Technology, Inc. (NASDAQ:ALKT - Free Report) by 102.6% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 202,947 shares of the company's stock after purchasing an additional 102,799 shares during the quarter. Algert Global LLC owned 0.20% of Alkami Technology worth $6,401,000 as of its most recent SEC filing.

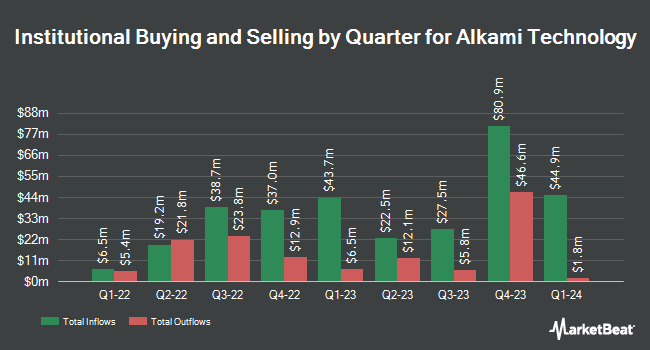

Other large investors have also added to or reduced their stakes in the company. Vanguard Group Inc. boosted its stake in shares of Alkami Technology by 1.9% during the 1st quarter. Vanguard Group Inc. now owns 4,650,560 shares of the company's stock worth $114,264,000 after buying an additional 88,390 shares during the last quarter. Massachusetts Financial Services Co. MA raised its holdings in Alkami Technology by 13.0% during the second quarter. Massachusetts Financial Services Co. MA now owns 1,570,179 shares of the company's stock worth $44,719,000 after acquiring an additional 181,194 shares in the last quarter. Driehaus Capital Management LLC boosted its position in Alkami Technology by 56.2% during the second quarter. Driehaus Capital Management LLC now owns 1,091,276 shares of the company's stock valued at $31,080,000 after purchasing an additional 392,483 shares during the last quarter. Dimensional Fund Advisors LP grew its stake in Alkami Technology by 12.9% in the second quarter. Dimensional Fund Advisors LP now owns 1,053,567 shares of the company's stock valued at $30,002,000 after purchasing an additional 120,468 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. increased its position in shares of Alkami Technology by 29.2% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 534,375 shares of the company's stock worth $16,854,000 after purchasing an additional 120,845 shares during the last quarter. Institutional investors and hedge funds own 54.97% of the company's stock.

Insider Buying and Selling

In related news, CFO W Bryan Hill sold 110,250 shares of the business's stock in a transaction dated Thursday, November 21st. The stock was sold at an average price of $38.62, for a total value of $4,257,855.00. Following the completion of the transaction, the chief financial officer now owns 471,403 shares of the company's stock, valued at $18,205,583.86. The trade was a 18.95 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, insider Douglas A. Linebarger sold 43,336 shares of the company's stock in a transaction dated Thursday, November 21st. The stock was sold at an average price of $38.50, for a total transaction of $1,668,436.00. Following the sale, the insider now directly owns 248,585 shares of the company's stock, valued at $9,570,522.50. This represents a 14.85 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 3,366,077 shares of company stock valued at $125,011,332. 38.00% of the stock is owned by company insiders.

Alkami Technology Stock Performance

ALKT traded up $1.95 during trading on Friday, hitting $40.69. The stock had a trading volume of 1,226,685 shares, compared to its average volume of 1,063,774. The company has a 50 day moving average price of $35.10 and a 200-day moving average price of $31.59. The firm has a market cap of $4.09 billion, a price-to-earnings ratio of -86.57 and a beta of 0.43. Alkami Technology, Inc. has a one year low of $21.19 and a one year high of $41.36. The company has a debt-to-equity ratio of 0.05, a current ratio of 3.52 and a quick ratio of 3.52.

Analysts Set New Price Targets

Several equities analysts recently weighed in on ALKT shares. Lake Street Capital raised their target price on shares of Alkami Technology from $30.00 to $36.00 and gave the company a "buy" rating in a research note on Thursday, August 1st. Barclays increased their price target on shares of Alkami Technology from $35.00 to $41.00 and gave the company an "equal weight" rating in a research note on Thursday, October 31st. The Goldman Sachs Group boosted their price objective on shares of Alkami Technology from $34.00 to $39.00 and gave the stock a "neutral" rating in a research note on Friday, November 1st. Craig Hallum raised their target price on shares of Alkami Technology from $38.00 to $45.00 and gave the company a "buy" rating in a research note on Thursday, October 31st. Finally, Needham & Company LLC boosted their price target on Alkami Technology from $43.00 to $54.00 and gave the stock a "buy" rating in a research report on Thursday, October 31st. Three research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company's stock. According to data from MarketBeat, Alkami Technology presently has a consensus rating of "Moderate Buy" and a consensus price target of $37.44.

Read Our Latest Stock Report on Alkami Technology

About Alkami Technology

(

Free Report)

Alkami Technology, Inc offers cloud-based digital banking solutions in the United States. The company's Alkami Platform allows financial institutions to onboard and engage new users, accelerate revenues, and enhance operational efficiency, with the support of a proprietary, cloud-based, and multi-tenant architecture.

Featured Articles

Before you consider Alkami Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alkami Technology wasn't on the list.

While Alkami Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.