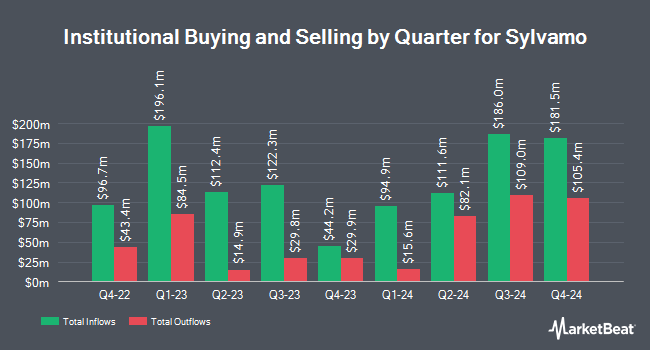

Algert Global LLC raised its holdings in shares of Sylvamo Co. (NYSE:SLVM - Free Report) by 190.2% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 10,290 shares of the company's stock after purchasing an additional 6,744 shares during the period. Algert Global LLC's holdings in Sylvamo were worth $883,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors and hedge funds also recently modified their holdings of SLVM. Independence Bank of Kentucky increased its stake in shares of Sylvamo by 6,733.3% in the 2nd quarter. Independence Bank of Kentucky now owns 410 shares of the company's stock valued at $28,000 after acquiring an additional 404 shares during the last quarter. CWM LLC increased its stake in shares of Sylvamo by 62.5% in the 2nd quarter. CWM LLC now owns 408 shares of the company's stock valued at $28,000 after acquiring an additional 157 shares during the last quarter. Fifth Third Bancorp increased its stake in shares of Sylvamo by 149.3% in the 2nd quarter. Fifth Third Bancorp now owns 506 shares of the company's stock valued at $35,000 after acquiring an additional 303 shares during the last quarter. Fortitude Family Office LLC increased its stake in Sylvamo by 116.6% during the 3rd quarter. Fortitude Family Office LLC now owns 444 shares of the company's stock worth $38,000 after purchasing an additional 239 shares in the last quarter. Finally, GAMMA Investing LLC increased its stake in Sylvamo by 59.0% during the 3rd quarter. GAMMA Investing LLC now owns 461 shares of the company's stock worth $40,000 after purchasing an additional 171 shares in the last quarter. 91.16% of the stock is owned by institutional investors.

Sylvamo Stock Up 1.1 %

SLVM traded up $1.03 on Friday, hitting $92.29. 120,587 shares of the company were exchanged, compared to its average volume of 312,926. Sylvamo Co. has a 12 month low of $44.94 and a 12 month high of $98.02. The company has a market cap of $3.78 billion, a PE ratio of 14.35 and a beta of 1.08. The company has a debt-to-equity ratio of 0.94, a quick ratio of 1.13 and a current ratio of 1.72. The stock's fifty day moving average is $86.44 and its 200-day moving average is $77.25.

Sylvamo (NYSE:SLVM - Get Free Report) last announced its quarterly earnings results on Tuesday, November 12th. The company reported $2.44 earnings per share for the quarter, topping analysts' consensus estimates of $2.18 by $0.26. The firm had revenue of $965.00 million for the quarter, compared to the consensus estimate of $960.47 million. Sylvamo had a return on equity of 30.60% and a net margin of 7.13%. The business's revenue was up 7.6% compared to the same quarter last year. During the same quarter in the previous year, the business earned $1.70 earnings per share. Equities research analysts predict that Sylvamo Co. will post 7.07 EPS for the current fiscal year.

Sylvamo Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Thursday, October 17th. Shareholders of record on Thursday, October 3rd were given a dividend of $0.45 per share. This represents a $1.80 dividend on an annualized basis and a yield of 1.95%. The ex-dividend date was Thursday, October 3rd. Sylvamo's dividend payout ratio (DPR) is presently 27.99%.

Analyst Upgrades and Downgrades

SLVM has been the subject of a number of research reports. Sidoti initiated coverage on Sylvamo in a research note on Tuesday, October 15th. They set a "buy" rating and a $100.00 target price for the company. Bank of America increased their target price on Sylvamo from $82.00 to $88.00 and gave the stock a "neutral" rating in a research note on Monday, September 23rd. Finally, Royal Bank of Canada lifted their price objective on shares of Sylvamo from $63.00 to $71.00 and gave the company a "sector perform" rating in a report on Monday, August 12th.

Read Our Latest Report on Sylvamo

Sylvamo Company Profile

(

Free Report)

Sylvamo Corporation produces and markets uncoated freesheet for cutsize, offset paper, and pulp in Latin America, Europe, and North America. The company operates through Europe, Latin America, and North America segments. The Europe segment offers copy, tinted, and colored laser printing paper under REY Adagio and Pro-Design brands; and graphic and high-speed inkjet printing papers under the brand Jetstar; as well as produces uncoated freesheet papers.

Read More

Before you consider Sylvamo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sylvamo wasn't on the list.

While Sylvamo currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.