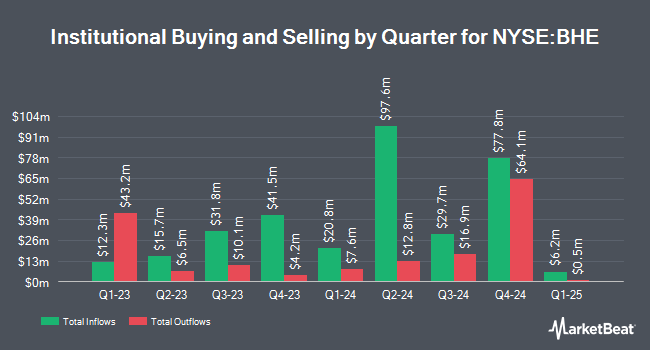

Algert Global LLC grew its position in shares of Benchmark Electronics, Inc. (NYSE:BHE - Free Report) by 428.1% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 32,887 shares of the technology company's stock after purchasing an additional 26,660 shares during the period. Algert Global LLC owned approximately 0.09% of Benchmark Electronics worth $1,458,000 at the end of the most recent quarter.

Other institutional investors have also recently made changes to their positions in the company. UMB Bank n.a. grew its position in Benchmark Electronics by 65.7% in the second quarter. UMB Bank n.a. now owns 686 shares of the technology company's stock worth $27,000 after acquiring an additional 272 shares in the last quarter. Quest Partners LLC purchased a new position in shares of Benchmark Electronics in the 2nd quarter worth about $41,000. CWM LLC increased its position in shares of Benchmark Electronics by 81.9% during the 2nd quarter. CWM LLC now owns 1,106 shares of the technology company's stock valued at $44,000 after purchasing an additional 498 shares during the last quarter. Quarry LP raised its holdings in shares of Benchmark Electronics by 172.5% during the 2nd quarter. Quarry LP now owns 1,379 shares of the technology company's stock valued at $54,000 after buying an additional 873 shares in the last quarter. Finally, Innealta Capital LLC bought a new stake in Benchmark Electronics in the 2nd quarter worth approximately $61,000. Institutional investors own 92.29% of the company's stock.

Benchmark Electronics Trading Up 1.0 %

Shares of NYSE:BHE traded up $0.50 during trading on Friday, reaching $48.55. 97,216 shares of the company traded hands, compared to its average volume of 305,117. The company has a current ratio of 2.36, a quick ratio of 1.45 and a debt-to-equity ratio of 0.25. Benchmark Electronics, Inc. has a 52-week low of $24.75 and a 52-week high of $52.57. The business's fifty day moving average is $45.80 and its 200-day moving average is $42.90. The firm has a market capitalization of $1.75 billion, a price-to-earnings ratio of 28.23 and a beta of 0.97.

Benchmark Electronics (NYSE:BHE - Get Free Report) last announced its quarterly earnings results on Wednesday, October 30th. The technology company reported $0.57 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.54 by $0.03. The business had revenue of $658.00 million for the quarter, compared to analyst estimates of $650.00 million. Benchmark Electronics had a net margin of 2.32% and a return on equity of 6.81%. The company's revenue was down 8.6% on a year-over-year basis. During the same quarter last year, the firm earned $0.57 EPS.

Benchmark Electronics Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Friday, October 11th. Stockholders of record on Monday, September 30th were given a $0.17 dividend. This is a positive change from Benchmark Electronics's previous quarterly dividend of $0.17. This represents a $0.68 dividend on an annualized basis and a dividend yield of 1.40%. The ex-dividend date was Monday, September 30th. Benchmark Electronics's dividend payout ratio (DPR) is currently 39.53%.

Insider Activity at Benchmark Electronics

In other Benchmark Electronics news, SVP Rhonda R. Turner sold 6,000 shares of Benchmark Electronics stock in a transaction that occurred on Tuesday, November 19th. The stock was sold at an average price of $46.98, for a total transaction of $281,880.00. Following the sale, the senior vice president now directly owns 47,991 shares of the company's stock, valued at approximately $2,254,617.18. The trade was a 11.11 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CEO Jeff Benck sold 24,000 shares of the stock in a transaction that occurred on Tuesday, November 5th. The stock was sold at an average price of $45.90, for a total value of $1,101,600.00. Following the completion of the transaction, the chief executive officer now directly owns 424,173 shares of the company's stock, valued at $19,469,540.70. This represents a 5.36 % decrease in their position. The disclosure for this sale can be found here. 2.10% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

BHE has been the topic of a number of recent research reports. Needham & Company LLC increased their price target on shares of Benchmark Electronics from $45.00 to $48.00 and gave the company a "buy" rating in a research report on Friday, November 1st. StockNews.com raised shares of Benchmark Electronics from a "hold" rating to a "buy" rating in a report on Tuesday. Two research analysts have rated the stock with a hold rating and three have given a buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $42.33.

Read Our Latest Stock Report on BHE

Benchmark Electronics Company Profile

(

Free Report)

Benchmark Electronics, Inc, together with its subsidiaries, offers product design, engineering services, technology solutions, and manufacturing services in the Americas, Asia, and Europe. The company provides engineering services and technology solutions, including new product design, prototype, testing, and related engineering services; and custom testing and technology solutions, as well as automation equipment design and build services.

Featured Articles

Before you consider Benchmark Electronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Benchmark Electronics wasn't on the list.

While Benchmark Electronics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.