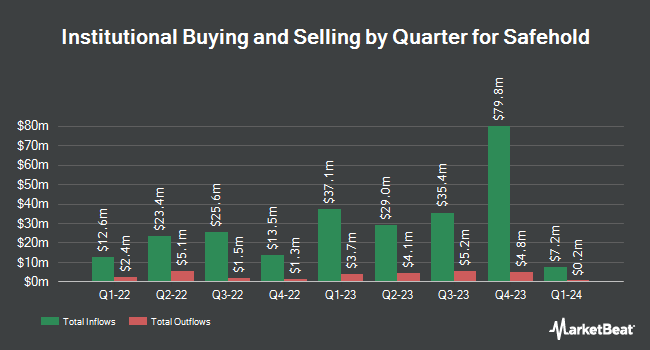

Algert Global LLC cut its position in Safehold Inc. (NYSE:SAFE - Free Report) by 60.0% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 27,243 shares of the company's stock after selling 40,833 shares during the quarter. Algert Global LLC's holdings in Safehold were worth $715,000 as of its most recent SEC filing.

A number of other large investors have also added to or reduced their stakes in the business. GAMMA Investing LLC increased its position in Safehold by 108.7% in the 3rd quarter. GAMMA Investing LLC now owns 1,766 shares of the company's stock valued at $46,000 after acquiring an additional 920 shares during the period. Mirae Asset Global Investments Co. Ltd. grew its stake in shares of Safehold by 35.4% in the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 1,802 shares of the company's stock worth $47,000 after purchasing an additional 471 shares during the last quarter. KBC Group NV increased its holdings in Safehold by 79.3% in the third quarter. KBC Group NV now owns 2,883 shares of the company's stock valued at $76,000 after purchasing an additional 1,275 shares during the period. First Trust Direct Indexing L.P. bought a new position in Safehold during the 3rd quarter worth $234,000. Finally, abrdn plc acquired a new position in Safehold during the 3rd quarter worth about $271,000. Institutional investors own 70.38% of the company's stock.

Analysts Set New Price Targets

SAFE has been the subject of several recent research reports. Mizuho increased their price target on Safehold from $20.00 to $25.00 and gave the company a "neutral" rating in a research note on Thursday, October 31st. Wedbush reissued a "neutral" rating and set a $23.00 target price (down previously from $25.00) on shares of Safehold in a research report on Monday, November 4th. Raymond James upgraded shares of Safehold from a "market perform" rating to an "outperform" rating and set a $34.00 price target on the stock in a research report on Thursday, September 19th. JMP Securities reiterated a "market outperform" rating and set a $35.00 price objective on shares of Safehold in a research report on Tuesday, October 29th. Finally, The Goldman Sachs Group dropped their target price on shares of Safehold from $38.00 to $30.00 and set a "buy" rating on the stock in a report on Friday, November 1st. Four investment analysts have rated the stock with a hold rating and five have given a buy rating to the company. According to data from MarketBeat.com, Safehold has a consensus rating of "Moderate Buy" and an average price target of $28.22.

View Our Latest Research Report on Safehold

Safehold Stock Up 0.2 %

SAFE traded up $0.04 during midday trading on Friday, hitting $21.36. The company had a trading volume of 228,516 shares, compared to its average volume of 348,552. The stock's 50 day moving average price is $23.00 and its 200 day moving average price is $22.21. Safehold Inc. has a 52 week low of $17.91 and a 52 week high of $28.80. The company has a market capitalization of $1.53 billion, a price-to-earnings ratio of 12.56 and a beta of 1.68. The company has a quick ratio of 37.83, a current ratio of 37.83 and a debt-to-equity ratio of 1.85.

Safehold (NYSE:SAFE - Get Free Report) last posted its quarterly earnings results on Monday, October 28th. The company reported $0.37 earnings per share for the quarter, hitting analysts' consensus estimates of $0.37. Safehold had a return on equity of 4.79% and a net margin of 32.08%. The business had revenue of $90.70 million for the quarter, compared to the consensus estimate of $89.45 million. During the same period in the prior year, the business earned $0.33 EPS. The firm's revenue for the quarter was up 6.0% on a year-over-year basis. On average, research analysts anticipate that Safehold Inc. will post 1.56 earnings per share for the current fiscal year.

Safehold Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Tuesday, October 15th. Investors of record on Monday, September 30th were issued a $0.177 dividend. This represents a $0.71 dividend on an annualized basis and a dividend yield of 3.31%. The ex-dividend date of this dividend was Monday, September 30th. Safehold's dividend payout ratio is currently 41.18%.

About Safehold

(

Free Report)

Safehold Inc NYSE: SAFE is revolutionizing real estate ownership by providing a new and better way for owners to unlock the value of the land beneath their buildings. Having created the modern ground lease industry in 2017, Safehold continues to help owners of high quality multifamily, office, industrial, hospitality, student housing, life science and mixed-use properties generate higher returns with less risk.

Featured Stories

Before you consider Safehold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Safehold wasn't on the list.

While Safehold currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.