Algert Global LLC purchased a new position in shares of Despegar.com, Corp. (NYSE:DESP - Free Report) during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 70,800 shares of the company's stock, valued at approximately $878,000. Algert Global LLC owned approximately 0.11% of Despegar.com at the end of the most recent reporting period.

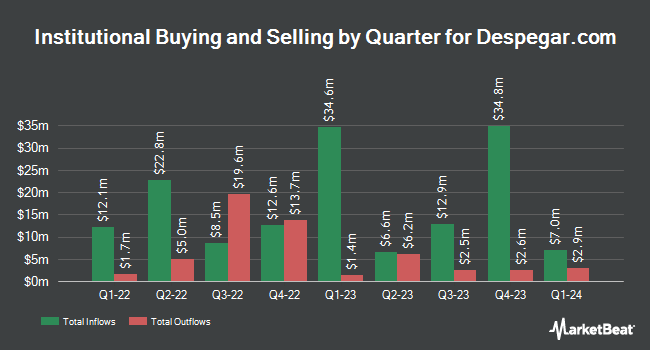

A number of other large investors have also added to or reduced their stakes in the stock. Amalgamated Bank bought a new stake in Despegar.com during the second quarter worth $28,000. LRI Investments LLC bought a new position in shares of Despegar.com in the 2nd quarter valued at $87,000. Sanctuary Advisors LLC acquired a new stake in Despegar.com in the second quarter valued at $128,000. Bayesian Capital Management LP acquired a new stake in Despegar.com in the first quarter valued at $132,000. Finally, MQS Management LLC acquired a new stake in Despegar.com in the second quarter valued at $136,000. Institutional investors and hedge funds own 67.93% of the company's stock.

Despegar.com Stock Performance

Despegar.com stock traded up $0.16 during trading hours on Friday, reaching $17.89. 631,776 shares of the company's stock were exchanged, compared to its average volume of 936,903. The firm's 50 day simple moving average is $14.70 and its 200 day simple moving average is $13.43. Despegar.com, Corp. has a twelve month low of $7.83 and a twelve month high of $19.00.

Wall Street Analysts Forecast Growth

A number of analysts recently weighed in on DESP shares. Cantor Fitzgerald restated an "overweight" rating and issued a $17.00 price objective on shares of Despegar.com in a report on Friday, August 16th. TD Cowen downgraded Despegar.com from a "buy" rating to a "sell" rating and increased their price objective for the company from $12.00 to $14.00 in a report on Monday, November 25th. Finally, Morgan Stanley increased their price target on Despegar.com from $17.00 to $21.00 and gave the stock an "overweight" rating in a report on Friday. One research analyst has rated the stock with a sell rating, one has issued a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat.com, Despegar.com currently has an average rating of "Hold" and an average target price of $17.20.

Read Our Latest Analysis on Despegar.com

Despegar.com Profile

(

Free Report)

Despegar.com, Corp., an online travel company, provides a range of travel and travel-related products to leisure and corporate travelers through its websites and mobile applications in Latin America and the United States. The company operates in two segments, Travel Business and Financial Services Business.

Read More

Before you consider Despegar.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Despegar.com wasn't on the list.

While Despegar.com currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.